South Africa Port Infrastructure Market Size, Share, and COVID-19 Impact Analysis, By Port Type (Sea Port and Inland Port), By Construction Type (Terminal, Equipment, and Others), By Cargo Type (Container Ports, Bulk Cargo Ports, Liquid Bulk Ports, and Others) and South Africa Port Infrastructure Market Insights, Industry Trend, Forecasts to 2033.

Industry: Construction & ManufacturingSouth Africa Port Infrastructure Market Insights Forecasts to 2033

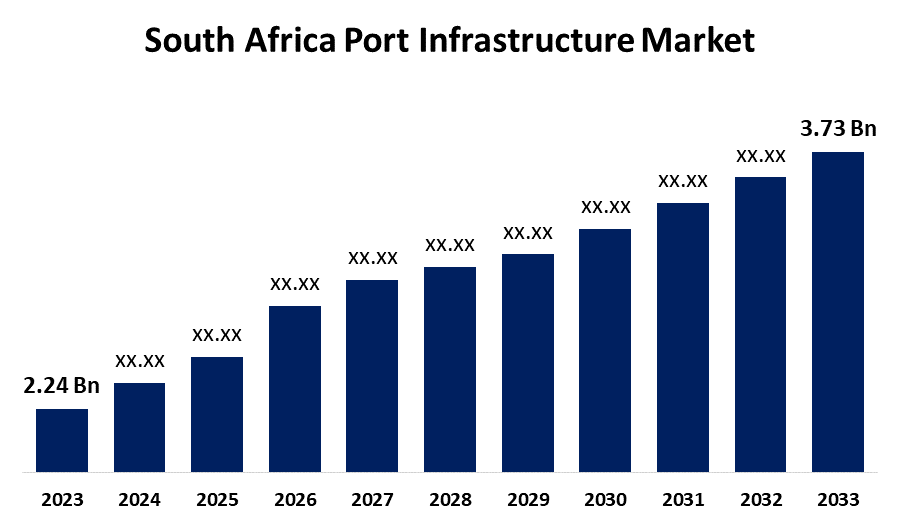

- The South Africa Port Infrastructure Market Size was valued at USD 2.24 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.42% from 2023 to 2033

- The South Africa Port Infrastructure Market Size is Expected to Reach USD 3.73 Billion by 2033

Get more details on this report -

The South Africa Port Infrastructure Market Size is Anticipated to Reach USD 3.73 Billion by 2033, growing at a CAGR of 5.42% from 2023 to 2033.

Market Overview

Port infrastructure is the services required to facilitate the functioning of ships which includes passenger berths, unloading facilities, and handling facilities with easy access to relevant supplies. High-capital investment facilities like piers, stacking, basins or storage spaces, warehouses, and machinery like cranes have to be included at the port location. As South Africa is surrounded by the Atlantic Ocean and the Indian Ocean, it has a significant impact on the port infrastructure market because of the nation's access to international trade routes. South Africa provides an advantageous location for an international trade route, it is anticipated to expand the South Africa port infrastructure market.

Report Coverage

This research report categorizes the market for the South Africa port infrastructure based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa port infrastructure market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa port infrastructure market.

South Africa Port Infrastructure Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.24 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.42% |

| 2033 Value Projection: | USD 3.73 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Port Type, By Construction Type, and By Cargo Type |

| Companies covered:: | Transnet SOC Ltd, Durban Container Terminal (DCT), APM Terminals, DP World, Maersk Line, TPT (Transnet Port Terminals), TNPA (Transnet National Ports Authority), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

To ensure safe and efficient economic activities an increase in government investments in port infrastructure is expected to drive the South Africa port infrastructure market. The development and need for shipment of liquified natural gas by sea route is expected to drive the port infrastructure market. To improve the efficiency of the port market in South Africa, many major private industry players are significantly expanding their investments.

Restraining Factors

The primary restraining factor includes maintaining the construction of the modern port infrastructure requires significant financial investments which include building new terminals, integrating cutting-edge technologies, and collecting harbors to accommodate larger ships. The demand for sustainability and environmental issues should be dealt with by the port while expanding its capacity.

Market Segmentation

The South Africa port infrastructure market share is classified into port type, construction type, and cargo type.

- The seaport segment is expected to hold the largest market share through the forecast period.

The South Africa port infrastructure market is segmented by port type into seaports and inland ports. Among these, the seaport segment is expected to hold the largest market share through the forecast period. The growth of this segment is attributed to the expansion of international trade. Waterway transportation is considered the cheapest way for heavy-load transportation due to fuel efficiency.

- The terminal segment is expected to dominate the South Africa port infrastructure market during the forecast period.

Based on the construction type, the South Africa port infrastructure market is divided into terminals, equipment, and others. Among these, the terminal segment is expected to dominate the South Africa port infrastructure market during the forecast period. Private companies are investing in them as they are essential to the handling of heavy loads. In addition to the increase in profitability, the adoption of information technology in the port industry drives the expansion of the market through improved port productivity safety, and security.

- The bulk cargo ports segment is expected to hold the largest market share through the forecast period.

The South Africa port infrastructure market is segmented by cargo type into container ports, bulk cargo ports, liquid bulk ports, and others. Among these, the bulk cargo ports segment is expected to hold the largest market share through the forecast period. The large-scale transportation of goods has a direct relation with the increase in the economy of a developed country as bulk goods have to be transported in bulk. High exports of precious metals like rhodium, palladium, and platinum encourage an additional demand in South Africa for bulk container ports.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa port infrastructure market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Transnet SOC Ltd

- Durban Container Terminal (DCT)

- APM Terminals

- DP World

- Maersk Line

- TPT (Transnet Port Terminals)

- TNPA (Transnet National Ports Authority)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa port infrastructure market based on the below-mentioned segments:

South Africa Port Infrastructure Market, By Port Type

- Seaports

- Inland Ports

South Africa Port Infrastructure Market, By Construction Type

- Terminals

- Equipment

- Others

South Africa Port Infrastructure Market, By Cargo Type

- Container Ports

- Bulk Cargo Ports

- Liquid Bulk Ports

- Others

Need help to buy this report?