South Africa Property and Casualty Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Motor Insurance, Homeowner Insurance, Home-Content Insurance, and Others), By Distribution Channel (Agents, Brokers, Banks, Online Mode, and Others), and South Africa Property and Casualty Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialSouth Africa Property and Casualty Insurance Market Insights Forecasts to 2033

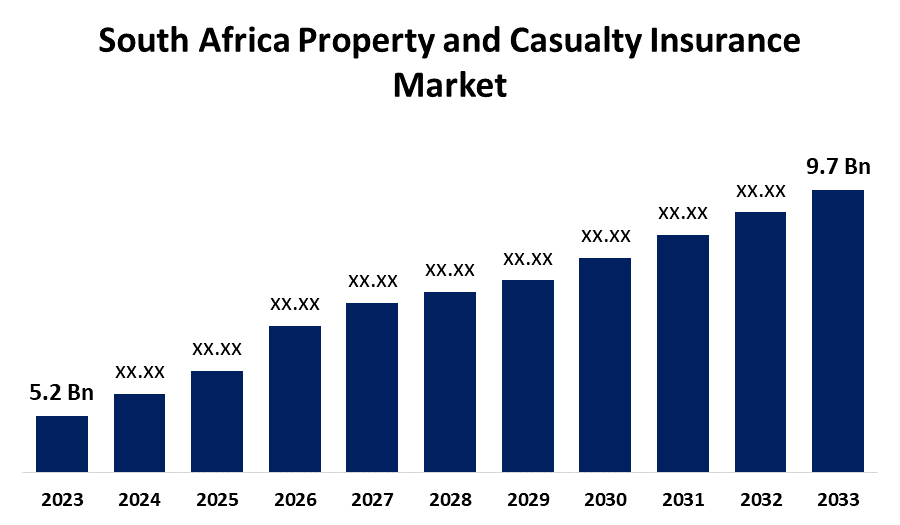

- The South Africa Property and Casualty Insurance Market Size was valued at USD 5.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.43% from 2023 to 2033

- The South Africa Property and Casualty Insurance Market Size is Expected to Reach USD 9.7 Billion by 2033

Get more details on this report -

The South Africa Property and Casualty Insurance Market Size is Anticipated to Reach USD 9.7 Billion by 2033, growing at a CAGR of 6.43% from 2023 to 2033.

Market Overview

Insurance that covers both liability for harm done to third parties and damage or loss to property is known as property and casualty insurance. Insurance that guards against loss or damage to the policyholder’s assets, including home or vehicle, as a result of natural disasters, theft, or fire is called property insurance. Inversely, casualty insurance is responsible for property damage or bodily injury brought on by the policyholders or their employees. To reduce financial risk in the event of an unforeseen loss or accident, and to safeguard their possessions, people and businesses usually purchase this kind of insurance. South Africa property and casualty insurance market is strongly propelled by the strong emphasis on innovations and customer-centric solutions, infrastructure developments, and increased demand for insurance products.

Report Coverage

This research report categorizes the market for South Africa property and casualty insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa property and casualty insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa property and casualty insurance market.

South Africa Property and Casualty Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.43% |

| 2033 Value Projection: | USD 9.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Distribution |

| Companies covered:: | Santam Ltd., Hollard Insurance Company Ltd., Zurich Insurance Company South Africa Ltd., Old Mutual Insure Ltd., Bryte Insurance Company Ltd., Discovery Insure Ltd., Renasa Insurance Company Ltd, Constantia Insurance Company Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The major factor propelling the market expansion is the insurance industry’s digitalization. Substantial changes are observed in the insurance sector. Individualized, effective, and convenient services are offered by their customers. Modern technologies are used by Insurtech businesses to provide clients with personalized, innovative insurance products and services. Quickly comparison between insurance plans and selecting the one that best meets their needs can be done by the customers. The primary factor that propels the South Africa property and casualty insurance market is the rising awareness of the importance of insurance coverage among consumers and businesses. Moreover, the increasing government initiatives to advance foreign investment and upgrade infrastructure will drive the property and casualty insurance market in South Africa.

Restraining Factors

South Africa and casualty insurance market faces numerous challenges, hindering its growth potential due to the high levels of crime, an unstable economy, competition, lack of innovation, and premium rates. Adjusting these difficulties, embracing new technologies, and upholding strict risk management procedures must be adjusted by the insurers.

Market Segmentation

The South Africa property and casualty insurance market share is classified into type and distribution channel.

- The motor insurance segment is expected to hold the largest market share through the forecast period.

The South Africa property and casualty insurance market is segmented by type into motor insurance, homeowner insurance, home-content insurance, and others. Among these, the motor insurance segment is expected to hold the largest market share through the forecast period. This is attributed to the safety improvements brought about by automation and smart technology, as well as related claims, the share of motor insurance. Motor insurance is historically a lower-risk and high-volume core section of property and casualty.

- The online segment is expected to dominate the South Africa property and casualty insurance market during the forecast period.

Based on the distribution channel, the South Africa property and casualty insurance market is divided into agents, brokers, banks, online mode, and others. Among these, the online segment is expected to dominate the South Africa property and casualty insurance market during the forecast period. This is due to the intermediary serving between policyholders and insurers, which significantly boosts economic growth. Working closely with their clients to meet their insurance needs increases the demand for this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa property and casualty insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Santam Ltd.

- Hollard Insurance Company Ltd.

- Zurich Insurance Company South Africa Ltd.

- Old Mutual Insure Ltd.

- Bryte Insurance Company Ltd.

- Discovery Insure Ltd.

- Renasa Insurance Company Ltd

- Constantia Insurance Company Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Outsurance, a South African insurance company, started a soft launch of its Irish home and auto insurance product before the local branch's scheduled official opening.

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa property and casualty insurance market based on the below-mentioned segments:

South Africa Property and Casualty Insurance Market, By Type

- Motor Insurance

- Homeowner Insurance

- Home-Content Insurance

- Others

South Africa Property and Casualty Insurance Market, By Distribution Channel

- Agents

- Brokers

- Banks

- Online Mode

- Others

Need help to buy this report?