South Africa Seeds Market Size, Share, and COVID-19 Impact Analysis, By Type (Genetically Modified Seeds and Conventional Seeds), By Crop (Grain and Cereal, Pulse, Vegetable, and Oilseed), and South Africa Seeds Market Insights, Industry Trend, Forecasts to 2033

Industry: AgricultureSouth Africa Seeds Market Insights Forecasts to 2033

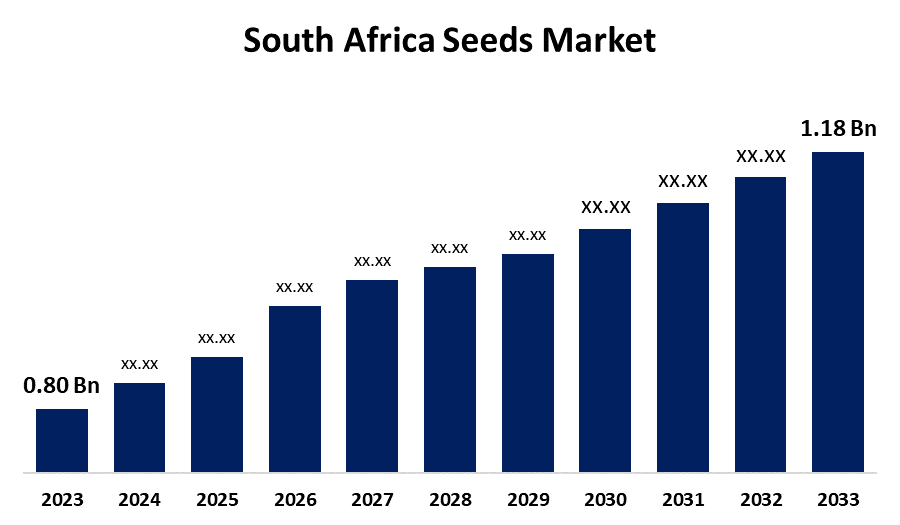

- The South Africa Seeds Market Size was valued at USD 0.80 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.96% from 2023 to 2033

- The South Africa Seeds Market Size is Expected to Reach USD 1.18 Billion by 2033

Get more details on this report -

The South Africa Seeds Market Size is Anticipated to Reach USD 1.18 Billion by 2033, Growing at a CAGR of 3.96% from 2023 to 2033.

Market Overview

The growing need for this world's population translates into a huge amount of food to feed and support it, meaning that high-quality seed varieties must be developed to increase crop production and productivity. Thus, in this market, demand is rising for high-quality seeds with such characteristics as disease resistance, increased yields, and higher nutritional value. Technological development, along with genetic engineering, has played its role in bringing forth genetically modified seeds. This has yielded huge benefits but has raised concerns about environmental and human health impacts. These include multinational firms, small-scale seed producers, and public research organizations. Altogether, their work focuses on responding to the changing demands of farmers and consumers and sustainable agriculture practices while ensuring the changing techniques of agriculture, tastes of consumers, and issues facing the environment that allow for drawing prominently into the definition of the future of global food production. For instance, the South African Diabetes Alliance hosted the Diabetes Summit in collaboration with the University of Pretoria Diabetes Research Centre. Stakeholders gathered at the summit to identify problems and suggest fixes for enhancing diabetes care.

Report Coverage

This research report categorizes the South Africa seeds market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa seeds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa seeds market.

South Africa Seeds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 0.80 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.96% |

| 2033 Value Projection: | USD 1.18 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Crop |

| Companies covered:: | Monsanto South Africa, Corteva agriscience, Capstone seeds, Syngenta Seed, Pannar Seed (Pty) Ltd, Agricol (Pty) Ltd, Bayer AG, Sensako (Pty) Ltd, Rijk Zwaan, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Increased demand for biofuels drives the growth of this market. Seed market for agricultural products includes soybean meal and oilseed pulses, grains, pulses, and plant-based proteins. This seed is used for many reasons in animal feeds, oil production, and human consumption. Food and Agriculture Organization asserts that wheat is a crop mainly grown on dry land and used for agricultural food production. Better regulation of coated and circular seeding has led to an increased use of fine seeds in modern agriculture. Stress tolerant and increased nutrient requirements of seeds in recent cropping seasons, in a bid by farmers to cut the losses and increase yield. Modern agriculture features better regulations on seeding and rounding, leading to an increased use of fine seeds.

Restraining Factors

As seed prices increase, it could limit the market growth of a range of crop products including soybean and oilseed meal, cereals, pulses, and sources of plant-based proteins. Premium seeds are already in use in modern farming to support the demand for tolerance to stresses and nutritious types due to several regulatory backings that support seed coating and pelleting.

Market Segmentation

The South Africa seeds market share is classified into type and crop.

- The genetically modified seeds segment is expected to hold the largest market share through the forecast period.

Based on type, South Africa seed is divided into genetically modified seeds (GEM) and conventional seeds. Among these genetically modified seeds are expected to hold the largest market share. Genetically modified seeds, engineered with distinct qualities such as resistance to pests, tolerance to herbicides, or content of nutrients, have completely transformed the technology of farming. Several benefits have been reaped through the introduction of genetically modified seeds, thereby significantly increasing agricultural productivity. Among them are a host of benefits that cut across higher crop yields, less use of chemical pesticides, and greater stamina in the face of environmental challenges.

- The cereals segment is expected to dominate the South Africa seeds market during the forecast period.

Based on the crop, the South Africa seeds market is divided into grain and cereal, pulse, vegetable, and oilseed. Among these, the cereals segment is expected to dominate the South Africa seeds market during the forecast period. Maize is the main staple food crop grown in the most varied agroecological zones and farming systems of South Africa and consumed by people with different food preferences and socio-economic backgrounds. After maize, the second most important cereal is sorghum, followed by millets (pearl and finger).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa seeds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Monsanto South Africa

- Corteva agriscience

- Capstone seeds

- Syngenta Seed

- Pannar Seed (Pty) Ltd

- Agricol (Pty) Ltd

- Bayer AG

- Sensako (Pty) Ltd

- Rijk Zwaan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, The South African Cultivar and Technology Agency (Sacta) promoted new cultivar development in the seed sector through breeding and technology levies, which encourage innovations and growth along the value chain. The main goal is to promote the breeding of grains and oil seeds by collecting levies at the point of first sale or delivery and then transferring this money to seed firms and plant breeder rights holders.

Market Segment

This study forecasts South Africa, regional and country revenue from 2020 to 2033. Spherical Insights has segmented the South Africa seeds market based on the below-mentioned segments:

South Africa Seeds Market, By Type

- Genetically modified seeds

- Conventional Seeds

South Africa Seeds Market, By Crop

- Grain and cereal

- Pulse

- Vegetable

- Oilseed

Need help to buy this report?