South Africa Supply Chain Finance Market Size, Share, and COVID-19 Impact Analysis, By Offering (Export & Import Bills, Letter of Credit, Performance Bonds, and Shipping Guarantees), By Provider (Banks and Trade Finance Houses), By End-Use (Large Enterprises and Small & Medium-Sized Enterprises (SMEs)) and South Africa Supply Chain Finance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialSouth Africa Supply Chain Finance Market Insights Forecasts to 2033

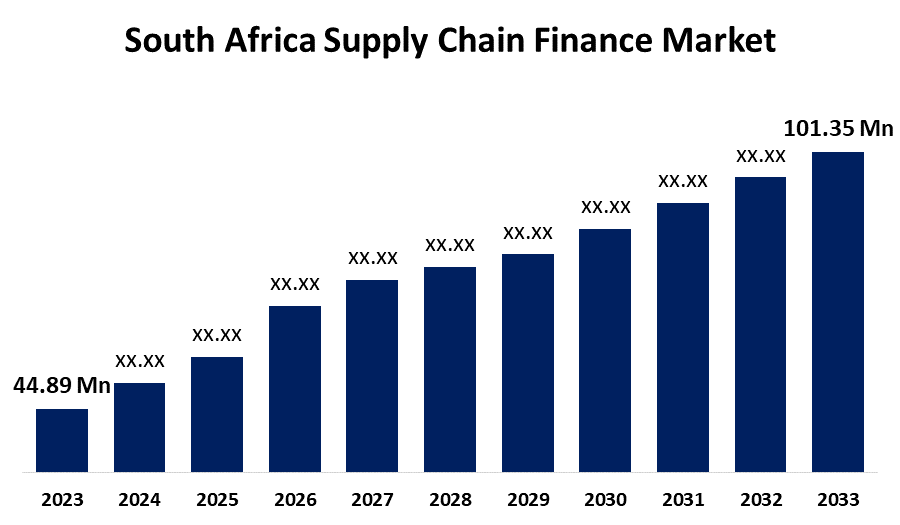

- The South Africa Supply Chain Finance Market Size was valued at USD 44.89 Million in 2023.

- The Market Size is Growing at a CAGR of 8.48% from 2023 to 2033

- The South Africa Supply Chain Finance Market Size is Expected to Reach USD 101.35 Million by 2033

Get more details on this report -

The South Africa Supply Chain Finance Market Size is Anticipated to Reach USD 101.35 Million by 2033, growing at a CAGR of 8.48% from 2023 to 2033.

Market Overview

A finance solution in which the suppliers are allowed to get paid earlier for their invoices is known as supply chain finance. It lowers the risk of supply chain disruption and increases the working capital for both supplier and buyer. Business can manage their cash flows, and enhance overall supply chain efficiency with the help of various financial solutions and technologies, including digital platforms and fintech innovations. Supplier finance, invoice financing, and various trade finance instruments are the key components of the South Africa supply chain finance market. The key factors for the expansion of the supply chain finance market in South Africa are rising e-commerce, increasing demand for end-to-end supply chain visibility, and growing adoption of supply chain finance.

Report Coverage

This research report categorizes the market for the South Africa supply chain finance based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa supply chain finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa supply chain finance market.

South Africa Supply Chain Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 44.89 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.48% |

| 2033 Value Projection: | USD 101.35 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Offering, By Provider, By End-Use |

| Companies covered:: | Standard Bank, Absa, Nedbank, FirstRand, Rand Merchant Bank, ABN AMRO, Finbond, Nigel Frank, Supply Chain Finance Hub, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The primary driving factor for the supply chain finance market in South Africa is the growing demand for supply chain finance by small and medium-sized enterprises (SMEs). Maximizing work capital, guaranteeing a more seamless supply chain operations, and improving liquidity management are some of the benefits of supply chain finance which are increasingly recognized by SMEs. For instance, in the recent strategic alliance between supply chain financing company, Fiducia and SME financing in Africa, the African Export-Import Bank, and Afreximbank signed a Memorandum of Understanding (MoU) aiming at the addressing of supply chain gap in Africa. Growing demand for real-time visibility of the entire supply chain is a reason why the South African supply chain finance market continues to grow significantly. Various companies in different industries have learned to appreciate the openness and continuous monitoring of their supply chains.

Restraining Factors

The expansion of the supply chain finance market in South Africa is hampered by the lack of knowledge about supply chain finance in businesses. Various small and medium-sized enterprises (SMEs) are unaware of the opportunities and benefits of supply chain finance. Due to their ignorance of supply chain finance, they are unable to take benefits of financial tools to increase working capital, cash flow, and supply chain efficiency.

Market Segmentation

The South Africa supply chain finance market share is classified into offerings, providers, and end-users.

- The export & import bills segment is expected to hold the largest market share through the forecast period.

The South Africa supply chain finance market is segmented by offering into export & import bills, letters of credit, performance bonds, and shipping guarantees. Among these, the export & import bills segment is expected to hold the largest market share through the forecast period. It is attributed to the significant international trade and wide range of economic activities. These sectors are vital to the nation’s economy and require working capital optimization and risk reduction.

- The bank segment is expected to dominate the South Africa supply chain finance market during the forecast period.

Based on the provider, the South Africa supply chain finance market is divided into banks and trade finance houses. Among these, the bank segment is expected to dominate the South Africa supply chain finance market during the forecast period. This is attributed to its extensive networks and well-established financial infrastructure. Companies rely on banks for safe and effective methods to handle working capital and lower financial risks involved in supply chain operations.

- The small & medium-sized enterprises (SMEs) segment is expected to hold the largest market share through the forecast period.

The South Africa supply chain finance market is segmented by end-use into large enterprises and small & medium-sized enterprises (SMEs). Among these, the small & medium-sized enterprises (SMEs) segment is expected to hold the largest market share through the forecast period. Small & medium-sized enterprises (SMEs) play a crucial role in Soth Africa’s economy. These companies often have trouble with working capital, and supply chain finance solutions give them a lifeline to maximize cash flows.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa supply chain finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Standard Bank

- Absa

- Nedbank

- FirstRand

- Rand Merchant Bank

- ABN AMRO

- Finbond

- Nigel Frank

- Supply Chain Finance Hub

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, DP World Trade Finance and South Africa’s Nedbank CIB have teamed up to extend working capital solutions to businesses facing liquidity challenges across Sub-Saharan Africa. Under the agreement, DP World Trade Finance has launched a supply chain finance solution on its platform, with Nedbank as the financier, which allows DP World’s suppliers in the region to access receivables financing.

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa supply chain finance market based on the below-mentioned segments:

South Africa Supply Chain Finance Market, By Offerings

- Export & Import Bills

- Letter of Credit

- Performance Bonds

- Shipping Guarantees

South Africa Supply Chain Finance Market, By Provider

- Banks

- Trade Finance Houses

South Africa Supply Chain Finance Market, By End-Use

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

Need help to buy this report?