South Africa Third-Party Logistics Market Size, Share, and COVID-19 Impact Analysis, By Services (Warehousing, International Transportation, Domestic Transportation, Inventory Management, and Others) By Transport Outlook (Roadways, Railways, Waterways, and Airways), and South Africa Third-Party Logistics Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationSouth Africa Third-Party Logistics Market Insights Forecasts to 2033

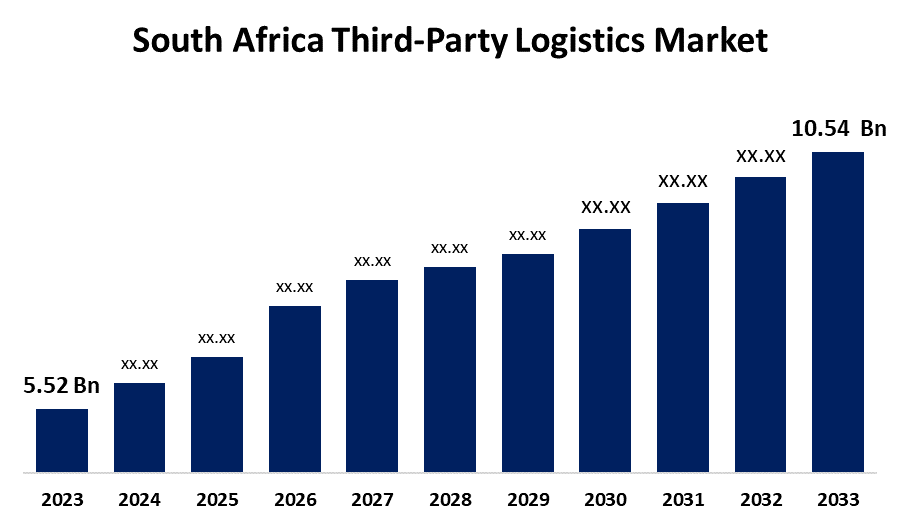

- The South Africa Third-Party Logistics Market Size was valued at USD 5.52 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.68% from 2023 to 2033.

- The South Africa Third-Party Logistics Market Size is Expected to Reach USD 10.54 Billion by 2033.

Get more details on this report -

The South Africa Third-Party Logistics Market Size is Anticipated to Reach USD 10.54 Billion by 2033, Growing at a CAGR of 6.68% from 2023 to 2033.

Market Overview

Outsourcing the supply chain management and logistics activities to a third-party company is termed third-party logistics. Suppliers encompass distribution, order fulfillment, inventory management, warehousing, and transportation. Businesses can focus on their core competencies and improve operational efficiency while cutting costs through outsourcing to a specialized third-party logistics supplier. Within a given time frame, third-party logistics assists producers in making their products available and generating higher demand prospects through the management of demand fluctuations. The service providers help manufacturers maintain better warehouse management and assist the manufacturers in maintaining inventory supplies when a company lacks infrastructural facilities and acts as a warehouse. The growth of South Africa third-party logistics market is boosted by high growth in seaborne trade, growth in the manufacturing industry, and increasing trading activities.

Report Coverage

This research report categorizes the market for South Africa third-party logistics based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa third-party logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa third-party logistics market.

South Africa Third-Party Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 5.52 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.68% |

| 2033 Value Projection: | USD 10.54 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 155 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Services, By Transport Outlook |

| Companies covered:: | FedEx Corporation, Maersk, Nippon Express, Union Pacific Railroad, Barloworld Logistics, Imperial Logistics, Bidvest Panalpina Logistic, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Manufacturing industries are those that deal with turning materials or items into new products. The growth rate of the manufacturing sector is an indication of the strength of the nation’s economy. To satisfy the rising demand for quick and effective delivery services as more and more customers shop online, companies are forced to reduce their supply chains. As e-commerce expands rapidly, and demand for scalable, adaptable, and sustainable logistics solutions continues to rise, the third-party logistics market is likely to experience further growth.

Restraining Factors

To boost competitiveness efficient supply chains, infrastructure, and trade facilitation are prioritized by third-party logistics. The third-party logistics market can be more expensive due to a lack of these factors, including transportation inefficiencies, inadequate storage facilities, and slow technology adoption.

Market Segmentation

The South Africa third-party logistics market share is classified into services and transport outlook.

- The domestic transportation segment is expected to hold the largest market share through the forecast period.

The South Africa third-party logistics market is segmented by services into warehousing, international transportation, domestic transportation, inventory management, and others. Among these, the domestic transportation segment is expected to hold the largest market share through the forecast period. This is attributed to the increase in commerce movement from unloading docks to warehouses, rising carrier rates, escalating fuel surcharges, and an increase in cross-docking services.

- The roadways segment is expected to dominate the South Africa third-party logistics market during the forecast period.

Based on the transport outlook, the South Africa third-party logistics market is divided into roadways, railways, waterways, and airways. Among these, the roadways segment is expected to dominate the South Africa third-party logistics market during the forecast period. This is due to the growing public-private partnership model and increased emphasis on logistics infrastructure. Additionally, several government programs are supporting the expansion of the road transportation market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa third-party logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FedEx Corporation

- Maersk

- Nippon Express

- Union Pacific Railroad

- Barloworld Logistics

- Imperial Logistics

- Bidvest Panalpina Logistic

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Sequence Logistics, a top supplier of temperature-controlled warehousing and distribution services, was purchased by African Infrastructure Investment Managers (AIIM). This acquisition is a component of AIIM's plan to improve its service offerings and grow its cold chain logistics platform.

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa third-party logistics market based on the below-mentioned segments:

South Africa Third-Party Logistics Market, By Services

- Warehousing

- International Transportation

- Domestic Transportation

- Inventory Management

- Others

South Africa Third-Party Logistics Market, By Transport Outlook

- Roadways

- Railways

- Waterways

- Airways

Need help to buy this report?