South Africa Tire Market Size, Share, and COVID-19 Impact Analysis, By Demand (Original Equipment Manufacturer (OEM) and Replacement), By Type (Radial and Bias), and South Africa Tire Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationSouth Africa Tire Market Insights Forecasts to 2033

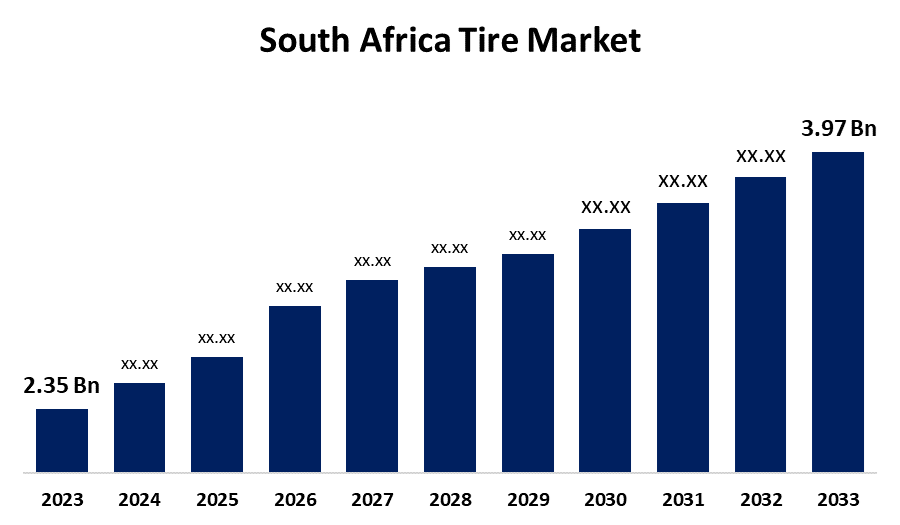

- The South Africa Tire Market Size was valued at USD 2.35 Billion in 2023.

- The Market is Growing at a CAGR of 5.38% from 2023 to 2033

- The South Africa Tire Market Size is Expected to Reach USD 3.97 Billion by 2033

Get more details on this report -

The South Africa Tire Market is Anticipated to Reach USD 3.97 Billion by 2033, growing at a CAGR of 5.38% from 2023 to 2033.

Market Overview

A ring-shaped component that surrounds the rim of a wheel, a tire transfers the weight of a vehicle from an axle via a wheel to the ground as well as provides friction in the surface the wheel moves on. To provide tractive force between the vehicle and the road surface while simultaneously protecting the wheel rim is the main purpose of the tire. Reduction in vibration and stress is absorbed due to the flexible cushion created by tires when they travel over uneven terrain. In tire manufacturing natural rubber has been used extensively. Inversely, modern tires are composed of steel wires, carbon black, synthetic rubber, and other materials. The contact patch or footprint that a tire creates is meant to balance the weight of the vehicle with the bearing strength of the surface it rolls over. Tires, therefore, apply a bearing pressure that does not allow the surface to deform too much. Rising demand for electric vehicles, increasing use of low-cost Chinese towers, the nation’s increasing industrialization, and the expanding automotive sector are the main factors that expand the South Africa tire market. For instance, definitive anti-dumping duties on tires imported from China for passenger cars, trucks, and buses have been approved by the Minister of Trade, Industry, and Competition after being recommended by the International Trade Administration Commission of South Africa (ITAC). The duties will be in effect until July 2028 and range from 7.18% to 43.60% ad valorem. The action is intended to preserve fair trade principles and safeguard the domestic tire industry.

Report Coverage

This research report categorizes the market for the South Africa tire market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa tire market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa tire market.

South Africa Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.35 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.38% |

| 2033 Value Projection: | USD 3.97 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Demand, By Type and COVID-19 Impact Analysis |

| Companies covered:: | Bridgestone Tyres, Sumitomo Rubber South Africa (PTY) Ltd., Continental Tires, Hangzhou Zhongce Rubber, Goodyear Tires, CEAT Tyres, Triangle Tyres, Michelin Tyres, Maxxis Tyres, Yokohama Rubber Company and Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The tire market is significantly influenced by the growth of South Africa's automotive sector. South Africa’s long-term strategy, the Automotive Production Development Programme (APDP) is essential to expanding the automobile sector. The South African Revenue Service (SARS) has published the revised Automotive Production Development Programme (APDP) regulations, which are as outlined in Schedule No. 3 of the Customs and Excise Act. The production incentive plan aims to create an environment that will allow registered South African light motor vehicle and component manufacturers to radically increase the volumes and value of production. Various industries such as construction, mining, agriculture, and logistics significantly require specialized machinery, which frequently has different kinds of tires and thus they play an important role in the economy of South Africa’s tire market.

Restraining Factors

Tires are necessary for vehicle performance and safety, when customers put their immediate financial needs first, affordability becomes a major issue. There is a substantial impact on tire wear and tear of road infrastructure in South Africa which is marked by potholes, uneven surface, and inadequate maintenance.

Market Segmentation

The South Africa tire market share is classified into demand and type.

- The original equipment manufacturer (OEM) segment is expected to hold the largest market share through the forecast period.

The South Africa tire market is segmented by demand into original equipment manufacturer (OEM) and replacement. Among these, the original equipment manufacturer (OEM) segment is expected to hold the largest market share through the forecast period. This is attributed to the reason that the manufacturers of vehicles are continuously upgrading the vehicles and increasing their sales, and it is driving the demand for original tires from associated OEMs.

- The radial segment is expected to dominate the South Africa tire market during the forecast period.

Based on the type, the South Africa tire market is divided into radial and bias. Among these, the radial segment is expected to dominate the South Africa tire market during the forecast period. Radial tires are likely to grow at a tremendous rate during the forecast period as they offer higher quality, which in turn makes them tougher and more durable. These radial tires offer a comfortable ride to the driver with passengers and absorb bumps and socks efficiently. It also tends to reduce the chances of vehicle damage and ground compaction.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa tire market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bridgestone Tyres

- Sumitomo Rubber South Africa (PTY) Ltd.

- Continental Tires

- Hangzhou Zhongce Rubber

- Goodyear Tires

- CEAT Tyres

- Triangle Tyres

- Michelin Tyres

- Maxxis Tyres

- Yokohama Rubber Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, the Magna M-STRADDLE tire, which has a 20% longer lifespan and a better load capacity, was introduced by Magna Tyres. The Magna M-STRADDLE was created for straddle carriers that operate in ports and terminals with high operational demands. The Magna M-STRADDLE has gained recognition for its unique crown design, high degree of damage resistance, substantial sidewalls, and superior traction since its first release.

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa tire market based on the below-mentioned segments:

South Africa Tire Market, By Demand

- OEM

- Replacement

South Africa Tire Market, By Type

- Radial

- Bias

Need help to buy this report?