South Africa Water Purifier Market Size, Share, and COVID-19 Impact Analysis, By Technology (Ultraviolet (UV), Reverse Osmosis (RO), and Gravity-Based), By Portability (Portable and Non-Portable), By End-Users (Commercial and Residential) and South Africa Water Purifier Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsSouth Africa Water Purifier Market Insights Forecasts to 2033

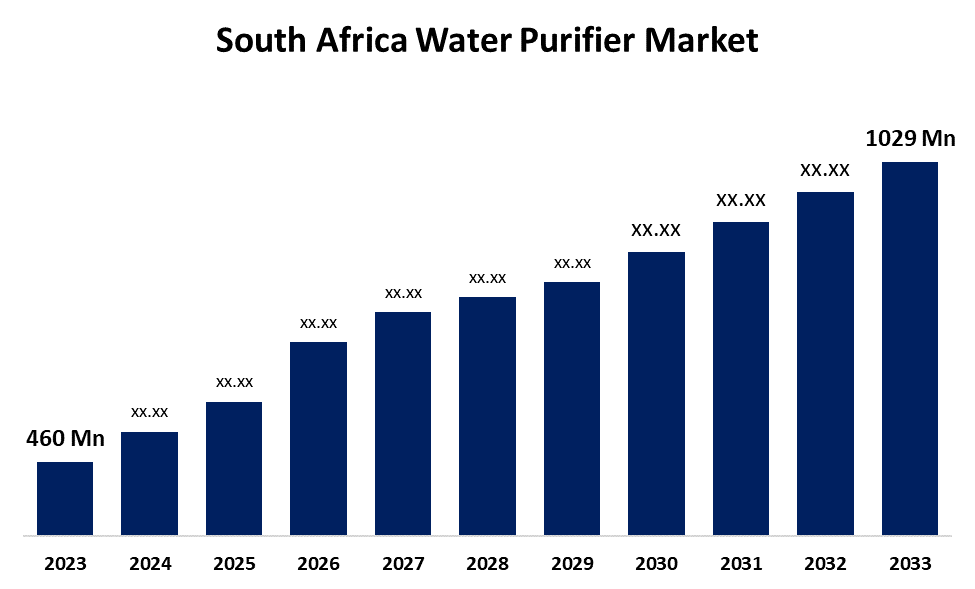

- The South Africa Water Purifier Market Size was valued at USD 460 Million in 2023.

- The Market Size is Growing at a CAGR of 8.38% from 2023 to 2033

- The South Africa Water Purifier Market Size is Expected to Reach USD 1029 Million by 2033

Get more details on this report -

The South Africa Water Purifier Market Size is Anticipated to Reach USD 1029 Million by 2033, Growing at a CAGR of 8.38% from 2023 to 2033

Market Overview

A machine that evacuates impurities and pollutants from the water so that it is safe to drink and for other purposes is known as a water purifier. To eradicate dangerous materials including germs, viruses, chemicals, silt, and heavy metals various filtering techniques are used such as reverse osmosis, activated carbon filters, ultraviolet sterilization, and ion exchange. Water purifier improves overall quality by eliminating unwanted flavors, smells, and colors. To meet the various requirements and offer a dependable supply of water, they are available in a variety of forms, including portable, under-sink, faucet-mounted, and countertop units, for usage in homes, workplaces, and outdoor settings. Factors such as growing water pollution and shortages, increased awareness of the value of clean drinking water, urbanization, improving living standards, and government programs that support access to safe and clean water help to expand the South Africa water purifier market. For instance, the South African National Water Resources Infrastructure Agency SOC Ltd. Bill, which was approved by President Cyril Ramaphosa, creates a new organization that is in charge of creating and overseeing the country's water infrastructure.

Report Coverage

This research report categorizes the market for the South Africa water purifier based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa water purifier market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa water purifier market.

South Africa Water Purifier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 460 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.38% |

| 2033 Value Projection: | USD 1029 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Portability, By End-Users |

| Companies covered:: | H2O International, Aquazania, Pure Water Technology, Brita, Eureka Forbes, Unilever (Pureit), PurePro, Amway, LG Electronics, Pentair, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

As drinking water heads the list of the country's priorities, a strong demand for safe drinking water acts as a prime motivator for the increase in the water purifier market. With more and more awareness regarding waterborne sickness and the demand for reliable water filtering technologies, consumers are actively searching for workable and effective ways to ensure the safety of drinking water consumers. As it meets the urgent need for clean, purified water throughout the country, the South Africa water purifier market is therefore expected to increase significantly.

Restraining Factors

Outdated infrastructure, poor sanitation, and restricted access to potable water are the primary restraining factors of the South Africa water purifier market. Limited access to clean water sources, especially in rural areas hampers the need for purifiers. Unstable power supply and inadequate maintenance services also escalate the problem and throw off potential customers.

Market Segmentation

The South Africa water purifier market share is classified into technology, portability, and end-user.

- The reverse osmosis segment is expected to hold the largest market share through the forecast period.

The South Africa water purifier market is segmented by technology into ultraviolet (UV), reverse osmosis (RO), and gravity-based. Among these, the reverse osmosis segment is expected to hold the largest market share through the forecast period. Reverse osmosis water purifiers have a semipermeable solvent that removes particles and contaminants and provides pure drinkable water The reason for the widespread use of reverse osmosis systems is that they have high purity efficiency and can remove various contaminants. However, the RO market has grown rapidly due to increasing water quality issues and demand for safe drinking water in South Africa.

- The non-portable segment is expected to dominate the South Africa water purifier market during the forecast period.

Based on the portability, the South Africa water purifier market is divided into portable and non-portable. Among these, the non-portable segment is expected to dominate the South Africa water purifier market during the forecast period. Non-portable water purifiers are those intended for stationary installation meant for homes, offices, and commercial premises. The need to satisfy a large number of users is served by such large purifying machines with high-purity capabilities.

- The residential segment is expected to hold the largest market share through the forecast period.

The South Africa water purifier market is segmented by end-users into commercial and residential. Among these, the residential segment is expected to hold the largest market share through the forecast period. This is attributed to increased knowledge of waterborne diseases in the region. The demand for water in residential buildings is also increasing due to factors such as increasing population, urbanization, and lack of access to safe drinking water.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa water purifier market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- H2O International

- Aquazania

- Pure Water Technology

- Brita

- Eureka Forbes

- Unilever (Pureit)

- PurePro

- Amway

- LG Electronics

- Pentair

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa water purifier market based on the below-mentioned segments:

South Africa Water Purifier Market, By Technology

- Ultraviolet (UV)

- Reverse Osmosis (RO)

- Gravity-based

South Africa Water Purifier Market, By Portability

- Portable

- Non-portable

South Africa Water Purifier Market, By End-User

- Commercial

- Residential

Need help to buy this report?