South Africa Zirconium Market Size, Share, and COVID-19 Impact Analysis, By Occurrence Type (Zircon, Zirconia, and Others), By Application (Zircon Flour/Milled Sand, Zircon Opacifier, Refractories, Zircon Chemicals, and Zircon Metal), and South Africa Zirconium Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsSouth Africa Zirconium Market Insights Forecasts to 2033

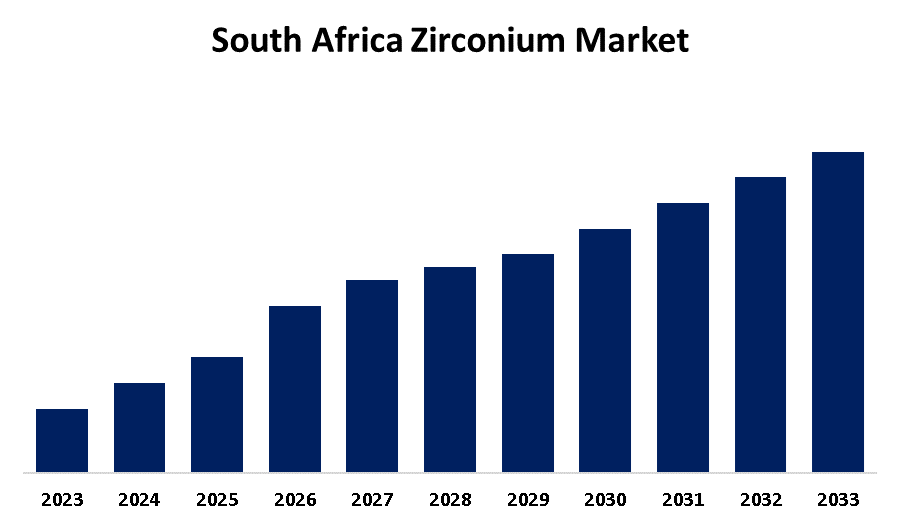

- The South Africa Zirconium Market is Growing at a CAGR of 7.2% from 2023 to 2033

- The South Africa Zirconium Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The South Africa Zirconium Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 7.2% from 2023 to 2033

Market Overview

The manufacture, use, and commerce of zirconium, a metallic element mostly derived from zircon, a mineral found in heavy mineral sands, constitutes the zirconium industry in South Africa. Zirconium is used in various sectors, including refractories, ceramics, and the manufacturing of nuclear-grade zirconium for use in nuclear reactors. Particularly in the vicinity of Richards Bay, South Africa is a major producer of zirconium worldwide due to the abundance of mineral sands along its shore. The ceramics and foundry industries, which use zirconium because of its exceptional heat and corrosion resistance, have a high demand. Another factor driving the market is the growing demand for zirconium-based goods in advanced applications such as the nuclear, automotive, and aerospace industries worldwide. Zirconium is used in the production of tiles and sanitaryware, which increases demand for the material due to the growing construction industry. An important factor in supporting the zirconium industry is government policy. Mineral beneficiation is promoted by the South African government through its industrial development programs to boost domestic value-added manufacturing. Incentives are being offered to miners and downstream firms to boost the export value of refined zirconium products. Long-term market stability is also influenced by investments in infrastructure development and legislation that support sustainable mining. This creates an environment that is favorable for the growth and diversification of South Africa's zirconium sector.

Report Coverage

This research report categorizes the market for the South Africa zirconium market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa zirconium market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa zirconium market.

South Africa Zirconium Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Occurrence Type, By Application |

| Companies covered:: | Richards Bay Minerals (RBM), Tronox Limited, E7.2aro Resources, Kenmare Resources, Mineral Commodities Ltd (MRC), Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The growing applications of zirconium from sectors including nuclear power, foundries, and ceramics dominate the South African market. Zirconium's increased use in luxury sectors like aerospace and auto manufacturing, which benefit from its exceptional corrosion and heat resistance, is another factor driving market expansion. Zirconium is in greater demand for the production of tile, sanitary ware, and other ceramics due to the growing global construction industry. Nuclear-grade zirconium is used to build nuclear reactors, therefore the growth of nuclear power projects around the world also increases demand for this material.

Restraining Factors

The production capacity of zirconium in South Africa is threatened by unstable prices, supply chain disruptions, mining regulations, and environmental concerns. High extraction and processing costs, especially for small-scale mining enterprises, also pose a challenge. Additionally, demand for zirconium may decline due to competition from substitute materials, such as synthetic substitutes in the ceramics sector.

Market Segmentation

The South Africa zirconium market share is classified into occurrence type and application.

- The zircon segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The South Africa zirconium market is segmented by occurrence type into zircon, zirconia, and others. Among these, the zircon segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The primary mineral used to extract zirconium is zircon, and South Africa is one of the world's largest producers of zircon. The primary raw material for the manufacturing of products based on zirconium, zircon is extracted from heavy mineral sands along the shore. In comparison to zirconia and other market sectors, zircon's dominant position is further cemented by the enormous demand for the mineral in ceramics, foundries, and other industrial processes.

- The zircon flour/milled sand segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the South Africa zirconium market is divided into zircon flour/milled sand, zircon opacifier, refractories, zircon chemicals, and zircon metal. Among these, the zircon flour/milled sand segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Zircon flour, a finely ground product, is widely used in the ceramics sector due to its heat resistance and ability to create opacity in tiles, sanitary ware, and tableware. Its high demand in local and foreign markets drives its dominance. Zircon flour also finds use in foundries and casting operations, solidifying its position in other markets like zircon opacifier, refractories, chemicals, and metal.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa zirconium market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Richards Bay Minerals (RBM)

- Tronox Limited

- E7.2aro Resources

- Kenmare Resources

- Mineral Commodities Ltd (MRC)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa zirconium market based on the below-mentioned segments:

South Africa Zirconium Market, By Occurrence Type

- Zircon

- Zirconia

- Others

South Africa Zirconium Market, By Application

- Zircon Flour/Milled Sand

- Zircon Opacifier

- Refractories

- Zircon Chemicals

- Zircon Metal

Need help to buy this report?