South America Bike Sharing Market Size, Share, and COVID-19 Impact Analysis, By Bike Type (Traditional Bike, E-Bike), By Sharing System (Docked, Dock Less), By Sharing Duration (Short Term, Long Term), By Country (Brazil, Colombia, Argentina, Peru, Rest of South America), and South America Bike Sharing Market Insights Forecasts to 2033

Industry: Automotive & TransportationSouth America Bike Sharing Market Insights Forecasts to 2033

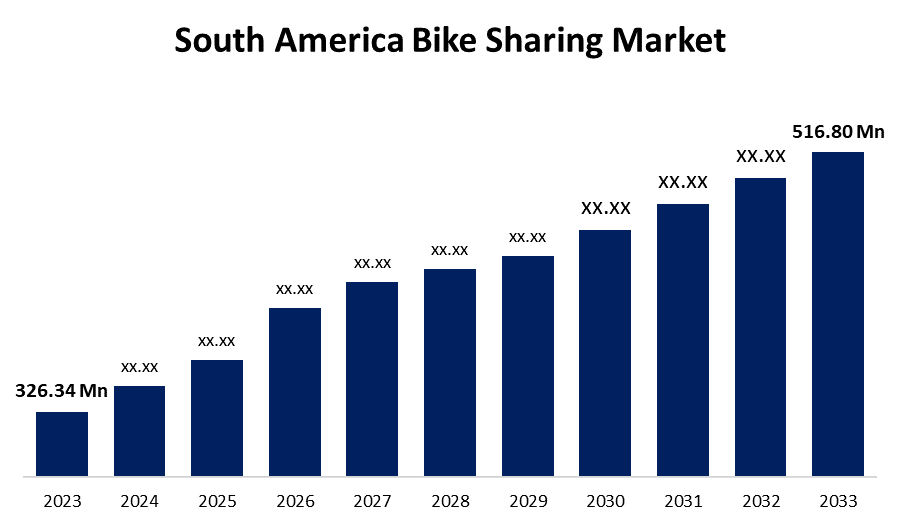

- The South America Bike Sharing Market Size was valued at USD 326.34 Million in 2023.

- The Market Size is Growing at a CAGR of 4.7% from 2023 to 2033.

- The South America Bike Sharing Market Size is Expected to Reach USD 516.80 Million by 2033.

Get more details on this report -

The South America Bike Sharing Market Size is Expected to Reach USD 516.80 Million by 2033, at a CAGR of 4.7% during the forecast period 2023 to 2033.

Market Overview

Bike sharing is a shared transportation service in which conventional or electric bikes are made available to individuals for short-term use for a fee or for free. Users can pick up bicycles throughout the city from various docked or dockless stations and return them to the same system. Docks are special bike racks that lock the bike and can only be released by computer control. Dock-less bike share does not require a docking station; bikes can be parked within a defined bike rack or along the sidewalk. Bike sharing provides both locals and tourists with an easy, low-cost, efficient mode of transportation around cities. Bike sharing systems are frequently facilitated by mobile applications or membership cards, which allow users to locate and unlock bikes, track usage, and make payments. The South America bike sharing market has experienced significant growth in recent years, owing to increased urbanization, a focus on sustainable transportation options, and the popularity of shared mobility services. The bike sharing market offers several benefits, including reduced traffic congestion, improved air quality, greater accessibility, and healthier lifestyles. It provides a cost-effective and environmentally friendly mode of transportation for short-distance trips, sightseeing, and leisure activities.

Report Coverage

This research report categorizes the market for South America bike sharing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South America bike sharing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the South America bike sharing market.

South America Bike Sharing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 326.34 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.7% |

| 2033 Value Projection: | USD 516.80 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Bike Type, By Sharing System, By Sharing Duration, By Country and COVID-19 Impact Analysis. |

| Companies covered:: | Ecobici, Bici Q, Encicla, Movete, BKT, Moventia, Tembici, Bike Santiago, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

South America bike sharing market share could supplement existing public transportation networks by providing first- and last-mile connections. Furthermore, technological advancements in bike sharing systems are expected to create profitable opportunities for South America bike sharing market growth during the forecast period. The significant increase in the preference for carpool and bike pool services among regular office commuters is the primary factor driving the growth of ride hailing and ride sharing companies. Furthermore, the expansion of the services offered by the leading market players, such as Uber and Ola, as well as the ability to select convenient pick-up and drop-off locations, is encouraging consumers to use ride hailing and ride sharing services, thereby increasing South America bike sharing market share. Furthermore, a significant increase in the number of ride-hailing and ride-sharing services, even for short distance travel, is fueling the growth of the South America bike sharing market.

Restraining Factors

The operation of app-based mobility services is not governed by any legal authority. As a result, the government does not define or regulate their operations. Taxi services must obtain separate licenses and registrations. This makes it difficult for app-based taxi services, as many of them do not own their vehicles.

Market Segment

- In 2023, the e-bike segment accounted for the largest revenue share over the forecast period.

Based on the bike type, the South America bike sharing market is segmented into traditional bike and e-bike. Among these, the e-bike segment has the largest revenue share over the forecast period. This is owing to their quick and flexible operations and zero carbon footprint. The growing consumer inclination toward using e-bikes as a cost-effective & eco-friendly transport solution is driving South America bike sharing market growth during the forecast period.

- In 2023, the dock less segment accounted for the largest revenue share over the forecast period.

Based on the sharing system, the South America bike sharing market is segmented into docked and dock less. Among these, the dock less segment has the largest revenue share over the forecast period. Major market players prefer the dockless bike sharing concept because it costs less than a docked sharing system and requires less capital to set up.

- In 2023, the long-term segment accounted for the largest revenue share over the forecast period.

Based on the sharing duration, the South America bike sharing market is segmented into short term and long term. Among these, the long-term segment has the largest revenue share over the forecast period. This is attributed to the increased flexibility, accessibility, and affordability. To reduce costs, service providers are increasingly deploying long-term cycles on roads.

- In 2023, the Brazil segment is expected to hold the substantial CAGR growth of the South America bike sharing market during the forecast period.

Based on the region, the Brazil is expected to dominate the South America bike sharing market growth over the forecast period. Brazil's ability to attract new investment and funding for bike-sharing initiatives is critical. This financial assistance allows for the expansion and development of more sophisticated and efficient bike-sharing systems across the country, giving it a competitive advantage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South America bike sharing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ecobici

- Bici Q

- Encicla

- Movete

- BKT

- Moventia

- Tembici

- Bike Santiago

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In April 2023, Uber Technologies Inc. announced a partnership with Brazilian bike-sharing company Tembici to make electric and standard bicycles available on its app in Latin America, as part of a push for greener initiatives. The agreement aimed to make it easier for people to travel short distances on bicycles rather than cars, while also assisting the company in meeting its goal of becoming a fully zero-emission platform by 2040.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the South America bike sharing market based on the below-mentioned segments:

South America Bike Sharing Market, By Bike Type

- Traditional Bike

- E-Bike

South America Bike Sharing Market, By Sharing System

- Docked

- Dock Less

South America Bike Sharing Market, By Sharing Duration

- Short Term

- Long Term

South America Air Compressor Market, By Country

- Brazil

- Colombia

- Argentina

- Peru

- Rest of South America

Need help to buy this report?