South Korea Adhesives And Sealants Market Size, Share, and COVID-19 Impact Analysis, By Product (Solvent-Based, Water-Based), By Resin Type (Silicone, Polyurethane, Plastisol, Emulsion, Polysulfide, Butyl), By Application (General Aviation, Commercial Aviation), and South Korea Adhesives And Sealants Market Insights Forecasts 2023 - 2033

Industry: Specialty & Fine ChemicalsSouth Korea Adhesives And Sealants Market Size Insights Forecasts to 2033

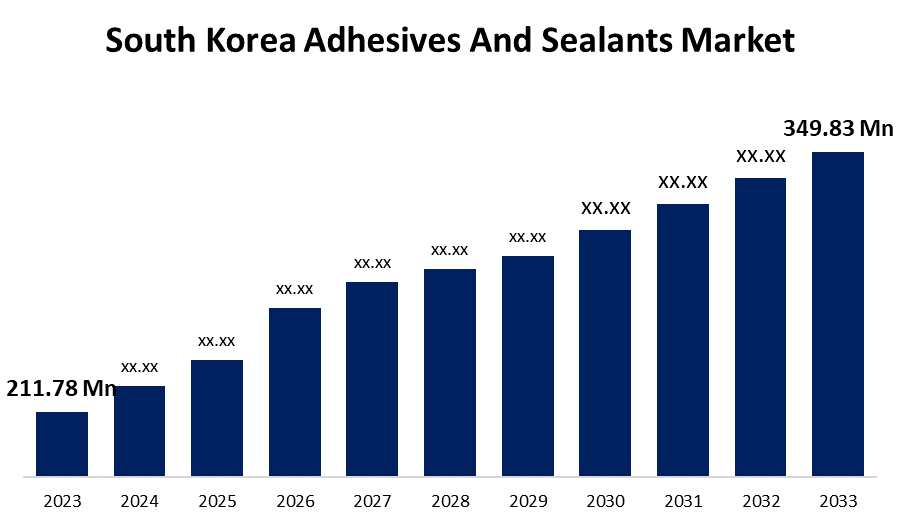

- The South Korea Adhesives And Sealants Market Size was valued at USD 211.78 Million in 2023.

- The Market Size is Growing at a CAGR of 5.15% from 2022 to 2033.

- The South Korea Adhesives And Sealants Market Size is Expected to reach USD 349.83 Million by 2033.

Get more details on this report -

The South Korea Adhesives And Sealants Market Size is expected to reach USD 349.83 Million by 2032, at a CAGR of 5.15% during the forecast period 2023 to 2033.

Market Overview

Adhesives are chemicals that are used to bond at least two surfaces permanently and securely. Sealants are materials that bond to at least two surfaces and fill the space between them to form a barrier or protective layer. Due to their exceptional bonding strength, adhesives, and sealants are adaptable solutions that are frequently used in industrial sectors ranging from flexible packaging and textile to structural applications. Adhesives and sealants, which are made using similar techniques and materials, have numerous applications. Sealants are semi-solid materials that are commonly used to stop fluid leaks. By filling gaps between substrates and sealing seams and components, they act as a barrier or protective covering. Adhesives and sealants are commonly used on metals, wood, glass, and plastics. Organic, inorganic, acrylic, polyurethane, and silicone are among the formulations used in these products. Adhesives and sealants are used in a variety of industries, including electronics, aerospace, automotive, food and beverage, and transportation.

Report Coverage

This research report categorizes the market for the South Korea adhesives and sealants market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea adhesives and sealants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea adhesives and sealants market.

South Korea Adhesives And Sealants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 211.78 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.15% |

| 2033 Value Projection: | USD 349.83 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Resin Type, By Application |

| Companies covered:: | 3M, Dow, GSMOA, Henkel AG & Co. KGaA, KCC SILICONE CORPORATION, OKONG Corp., Shin-Etsu Chemical Co., Ltd., Sika AG, Soudal Holding N.V., TOPSEAL, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Changes in material consumption patterns, such as the replacement of metal, aluminum, and paper with more durable materials, are expected to drive product demand in packaging segments. A consistent demand for food and beverage packaging items is expected to remain a key market growth driver in South Korea. Furthermore, the country's presence of discount retailers, combined with the high potential of the grocery retail sector, is projected to drive adhesive demand for packaging products. Rising consumer power, digitization, sustainability, consolidation, and a growing middle-class population are driving the rapid rate of change in the South Korean home appliance market. These developments emphasize investments and economies of scale, while also opening up significant opportunities in the appliance market.

Restraining Factors

Adhesives and sealants emit a large number of chemical gases, which are considered harmful and hazardous when inhaled. As a result, the restrictions on their use are becoming more stringent. Furthermore, rising consumer awareness about health and the environment has emerged as a major concern for manufacturers.

Market Segment

- In 2023, the water-based segment accounted for the largest revenue share over the forecast period.

Based on the product, the South Korea adhesives and sealants market is segmented into solvent-based, and water-based. Among these, the water-based segment has the largest revenue share over the forecast period. Water can evaporate or be absorbed by the substrate when used as a carrier or diluent. They also reduce VOC emissions and increased environmental awareness and stricter government regulations are expected to drive category growth. These substances are available as a ready-to-use solution or as dry powders that manufacturers and suppliers mix with water to give them adhesive properties. Since the polymer in water-based adhesives is water-soluble, the bond formed between them is more vulnerable to moisture and water. Water-based adhesives are used in a wide range of industries, including packaging, paper, plastic, and cloth because they are more adaptable, cost-effective, and widely available than other adhesives.

- In 2023, the polyurethane segment accounted for a significant revenue share over the forecast period.

Based on resin type, the South Korea adhesives and sealants market is segmented into silicone, polyurethane, plastisol, emulsion, polysulfide, and butyl. Among these, the polyurethane segment has a significant revenue share over the forecast period. Silicone and polyurethane sealants are both elastomeric materials used to fill gaps and keep water and air out. Despite their similarities, they differ in chemical properties, lifespan, and cost, and thus have different applications. Polyurethane sealant is used in industries such as building and construction and automotive because of its quick-drying and moisture resistance properties.

- In 2023, the commercial aviation segment accounted for the largest revenue share over the forecast period.

Based on the application, the South Korea adhesives and sealants market is segmented into general aviation and commercial aviation. Among these, the commercial aviation segment has the largest revenue share over the forecast period. Sealants and adhesives are commonly used in a variety of industrial assemblies because they provide processing flexibility and increase assembly lifespan. Polyurethane and acrylics are the two most common types of sealants used in industrial assembly. Silicone and polyurethane sealants are two types of elastomeric materials that are used to fill gaps and keep air and water out. Despite their similarities, they differ chemically, have different lifespans, are more expensive, and are used for different purposes. Polyurethane sealant is used in industries such as building and construction and automotive because of its properties such as quick drying and moisture resistance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea adhesives and sealants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Dow

- GSMOA

- Henkel AG & Co. KGaA

- KCC SILICONE CORPORATION

- OKONG Corp.

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Soudal Holding N.V.

- TOPSEAL

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2021, Momentive Performance Materials, an American subsidiary of KCC Corporation, acquired the silicone business. Momentive's divestment aims to achieve a balanced portfolio and responsible management.

Market Segment

This study forecasts revenue at regional, and country levels from 2023 to 2033. Spherical Insights has segmented the South Korea Adhesives And Sealants Market based on the below-mentioned segments:

South Korea Adhesives And Sealants Market, By Product

- Solvent Based

- Water-Based

South Korea Adhesives And Sealants Market, By Resin Type

- Silicone

- Polyurethane

- Plastisol

- Emulsion

- Polysulfide

- Butyl

South Korea Adhesives And Sealants Market, By Application

- General Aviation

- Commercial Aviation

Need help to buy this report?