South Korea Aerospace and Defense Market Size, Share, and COVID-19 Impact Analysis, Product (Aluminum, Composites, Titanium, Others), By Application (Aerostructure, Propulsion System), By Aircraft Type (Commercial, Military), and South Korea Aerospace & Defense Market Insights Forecasts 2023 – 2033

Industry: Aerospace & DefenseSouth Korea Aerospace & Defense Market Insights Forecasts to 2033

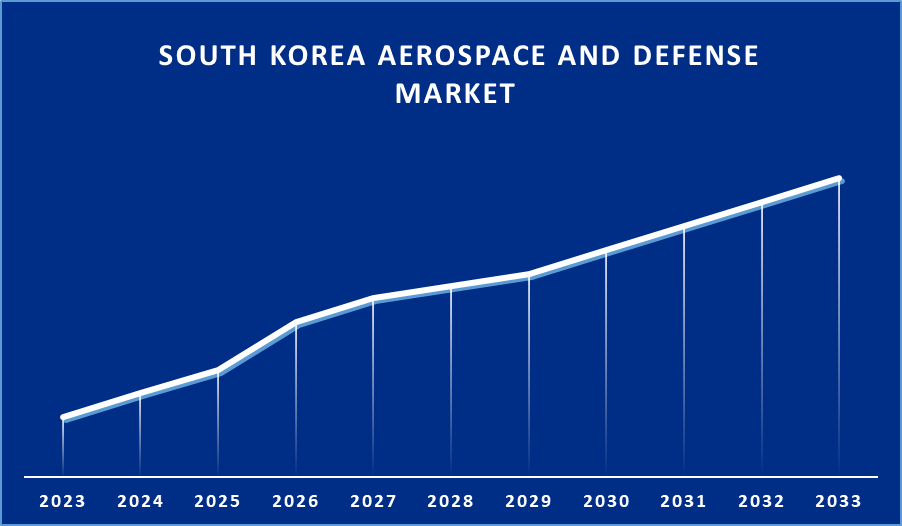

- The Market Size is Growing at a CAGR of 6.89% from 2023 to 2033.

- The South Korea Aerospace and Defense Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The South Korea Aerospace and Defense Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 6.89% during the forecast period 2023 to 2033.

Market Overview

The aerospace and defense market in South Korea refers to the industry in South Korea that develops, manufactures, and distributes aerospace and defense-related products and services. Included are military aircraft, satellites, defense electronics, communication systems, radar systems, and other products. R&D activities aimed at improving South Korea's capabilities in the aerospace and defense domains are also included in the market. The aerospace and defense industry in South Korea has established itself as a major player in the global aerospace and defense industry. Due to a rich history of technological advancements and a strong commitment to innovation, South Korea has positioned itself as a key market for aerospace and defense products and services. South Korea's aerospace and defense sector has expanded significantly in recent years as a result of increased defense spending, technological advancements, and collaborations with international players.

Report Coverage

This research report categorizes the market for South Korea aerospace & defense market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea aerospace & defense market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea aerospace & defense market.

South Korea Aerospace and Defense Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.89% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Aircraft Type |

| Companies covered:: | Hanwha Group, Daewoo Shipbuilding & Marine Engineering Co. Ltd, Korean Air Lines Co. Ltd, Korea Aerospace Research Institute, Lockheed Martin Corporation, The Boeing Company, Korea Aerospace Industries Ltd, VICTEK Co. Ltd, DS Navcours, Hyundai Motor Group, Korea Shipbuilding & Offshore Engineering, LIG Nex1 Co. Ltd, SNT Holdings Co. Ltd and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean aerospace and defense market is being propelled by several key drivers. The country's geopolitical situation and regional security concerns, first and foremost, have resulted in increased defense spending. Furthermore, South Korean’s emphasis on developing advanced aerospace technologies, as well as its expanding space industry, helps to drive market growth. The increasing preference for lightweight and high-strength materials can be attributed to the growth. Lightweight materials with high strength-to-weight ratios, such as carbon fiber composites, titanium alloys, and advanced polymers, are increasingly sought after by the aerospace and defense industries. These materials improve structural integrity, fuel efficiency, and operational costs while also reducing aircraft weight. Furthermore, the aerospace industry is adopting lightweight materials to reduce carbon emissions and meet stringent environmental regulations. This is consistent with the trend toward environmentally responsible solutions, which ensures a positive image of the environment.

Restraining Factors

Despite the market's growth potential, it faces some significant challenges. Budgetary constraints and the high costs of R&D efforts can stymie market growth. Furthermore, due to South Korea's complex regulatory framework and strict export controls, industry participants may face challenges.

Market Segment

- In 2023, the titanium segment accounted for the largest revenue share over the forecast period.

Based on the product, the South Korea aerospace & defense market is segmented into aluminum, composites, titanium, and others. Among these, the titanium segment has the largest revenue share over the forecast period. Titanium is lightweight, high-strength, and excellent corrosion resistance properties are expected to boost demand for critical aircraft components. Copper alloys, such as Beryllium copper and Nickel-Aluminum-Bronze, are widely used in aerospace engineering for the fabrication of critical aircraft components requiring high strength, corrosion resistance, and ductility. These are mostly used in abrasive wear, heavy loads, and corrosion-prone applications, such as strut bearings, landing gear components, and main pistons.

- The aerostructure segment is witnessing significant CAGR growth over the forecast period.

Based on application, the South Korea aerospace & defense market is segmented into aerostructure and propulsion systems. Among these, the aerostructure segment is witnessing significant CAGR growth over the forecast period. Aluminum and composites are widely used in structures because of their lightweight properties as well as improved rigidity. Bearings, fasteners, bushings, and fueling and refueling systems are examples of aircraft components that contribute to the core functions of an aircraft. The growing use of composites in aerostructures is expected to boost demand for titanium used in the production of these components. Because of its superior corrosion resistance, titanium and its alloys are widely preferred over aluminum.

In 2023, the military segment accounted for a significant revenue share over the forecast period.

Based on the aircraft type, the South Korea aerospace & defense market is segmented into commercial, and military. Among these, the military segment has a significant revenue share over the forecast period. Demand for innovative fighter planes is expected to boost product demand shortly. Unmanned vehicles and spacecraft, for example, require advanced, robust, and temperature-resistant materials with high resilience. Composite materials, such as carbon fiber-reinforced polymers, are widely used in the production of drones. Titanium alloys and thermal protective tiles are used to fortify the outer structure and provide resistance to extreme temperatures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea aerospace & defense market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanwha Group

- Daewoo Shipbuilding & Marine Engineering Co. Ltd

- Korean Air Lines Co. Ltd

- Korea Aerospace Research Institute

- Lockheed Martin Corporation

- The Boeing Company

- Korea Aerospace Industries Ltd

- VICTEK Co. Ltd

- DS Navcours

- Hyundai Motor Group

- Korea Shipbuilding & Offshore Engineering

- LIG Nex1 Co. Ltd

- SNT Holdings Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2021, Atem X, a smart, slim, bionic air purifier, was introduced by IQAir, a Swiss air quality technology expert. It is the most recent addition to IQAir's line of high-performance air purifiers.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea Aerospace and defense Market based on the below-mentioned segments:

South Korea Aerospace & Defense Market, By Product

- Aluminum

- Composites

- Titanium

- Others

South Korea Aerospace & Defense Market, By Application

- Aerostructure

- Propulsion System

South Korea Aerospace & Defense Market, By Aircraft Type

- Commercial

- Military

Need help to buy this report?