South Korea Aluminum Fluoride Market Size, Share, and COVID-19 Impact Analysis, By Type (Dry, Anhydrous, and Wet), By Purity (High, Standard, Low, and Others), By Application (Automotive, Construction, Pharmaceuticals, Aerospace, and Others), and South Korea Aluminum Fluoride Market Insights Forecasts 2023 - 2033

Industry: Chemicals & MaterialsSouth Korea Aluminum Fluoride Market Insights Forecasts to 2033

- The South Korea Aluminum Fluoride Market Size was Estimated at Remarkable Share in 2023

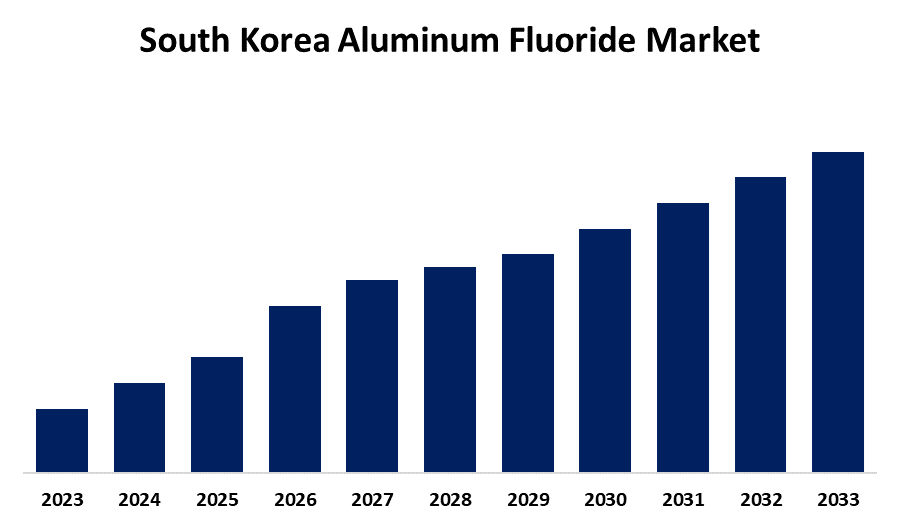

- The Market Size is Growing at 4.5% CAGR from 2023 to 2033.

- The South Korea Aluminum Fluoride Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The South Korea Aluminum Fluoride Market Size is expected to Reach a Significant Share by 2033, Growing at a 4.5% CAGR from 2023 to 2033.

Market Overview

The South Korea aluminum fluoride market includes the production, distribution, and consumption of this essential inorganic component. It is utilized as a fluxing agent in aluminum smelting, fluorinated chemicals, ceramics, glass, and lithium-ion batteries. South Korea, noted for its innovative manufacturing sector, strong aluminum industry, and fast-expanding battery technology, is a major player in the regional and worldwide aluminum fluoride supply chain. Furthermore, the country's emphasis on technological developments, sustainable manufacturing techniques, and energy-efficient materials is influencing the expansion of the aluminum fluoride business. With South Korea's increasing electric vehicle (EV) sector, robust aluminum processing facilities, and strong fluorochemical manufacturing capabilities, the aluminum fluoride market is expected to rise steadily in the coming years. Furthermore, the South Korea aluminum fluoride market offers high-purity semiconductors, lithium-ion batteries, and fluorinated compounds, fueled by advanced electronics and EV industries. The increase in aluminum smelting and sustainable manufacturing fuels demand for energy-efficient materials. Furthermore, R&D efforts in environmentally friendly production methods and fluoride recycling present new market potential opportunities.

Report Coverage

This research report categorizes the market for the South Korea aluminum fluoride market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea aluminum fluoride market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea aluminum fluoride market.

South Korea Aluminum Fluoride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Type, By Purity, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Do-Fluoride, Fluorsid, Jinyang Hi-Tech, Hunan Nonferrous, I.C.F, Rio Tinto Alcan, Gulf Fluor, Shandong Zhaohe, Hongyuan Chemical, Mexichem (Orbia), PhosAgro, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Aluminum fluoride contributes to the manufacturing of aluminum alloys, which are required for lightweight, durable, and corrosion-resistant buildings. The spike in urbanization has increased construction activity, ranging from residential housing to large-scale industrial complexes. As a result, the demand for aluminum fluoride has increased. Furthermore, the boom in government and private sector expenditures in renewable energy infrastructure, such as solar and wind power projects, is driving up demand for aluminum. Aluminum's advantageous qualities make it the favored material in these technologies, increasing the need for aluminum fluoride. All of these factors are projected to contribute to the growth of the South Korea aluminum fluoride market throughout the forecast period.

Restraining Factors

The scarcity of fluorspar poses a substantial barrier to the expansion of the aluminum fluoride business. Fluorspar, a critical raw material used in the manufacturing of aluminum fluoride, is experiencing supply limits due to a variety of issues including geological scarcity, mining restrictions, and environmental laws.

Market Segment

- The dry segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the South Korea aluminum fluoride market is divided into dry, anhydrous, and wet. Among these, the dry segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its broad use in aluminum smelting, excellent handling qualities, and great efficiency in industrial applications. Dry aluminum fluoride is chosen in the electrolytic reduction process because it efficiently reduces the melting point of alumina, resulting in lower energy consumption and increased aluminum production efficiency.

- The standard segment accounted for the majority of the share in 2023 and is estimated to grow at the significant CAGR during the projected timeframe.

Based on the purity, the South Korea aluminum fluoride market is divided into high, standard, low, and others. Among these, the standard segment accounted for the majority of the share in 2023 and is estimated to grow at the significant CAGR during the projected timeframe. Standard purity (98% to 99.9%) aluminum fluoride is the primary fluxing agent in electrolytic aluminum production, reducing energy consumption and improving process efficiency. With South Korea's thriving automotive, construction, and aerospace industries, demand for aluminum remains high, reinforcing the segment's dominance.

- The automotive segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the South Korea aluminum fluoride market is divided into automotive, construction, pharmaceuticals, aerospace, and others. Among these, the automotive segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the country's high aluminum demand for lightweight vehicle manufacture. Aluminum fluoride is required for electrolytic aluminum manufacturing, which is widely used in automobile components such as engine parts, body frames, and wheels due to its high strength-to-weight ratio and corrosion resistance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea aluminum fluoride market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Do-Fluoride

- Fluorsid

- Jinyang Hi-Tech

- Hunan Nonferrous

- I.C.F

- Rio Tinto Alcan

- Gulf Fluor

- Shandong Zhaohe

- Hongyuan Chemical

- Mexichem (Orbia)

- PhosAgro

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea Aluminum Fluoride Market based on the below-mentioned segments:

South Korea Aluminum Fluoride Market, By Type

- Dry

- Anhydrous

- Wet

South Korea Aluminum Fluoride Market, By Purity

- High

- Standard

- Low

- Others

South Korea Aluminum Fluoride Market, By Application

- Automotive

- Construction

- Pharmaceuticals

- Aerospace

- Others

Need help to buy this report?