South Korea B2C Payment Market Size, Share, and COVID-19 Impact Analysis, By Type (Cards, Digital Wallet, and Others), By Industry Vertical (BFSI, Healthcare, Hospitality and Tourism, Transportation and Logistics, Retail and E-commerce, Energy and Utilities, and Others), and South Korea B2C Payment Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialSouth Korea B2C Payment Market Insights Forecasts to 2033

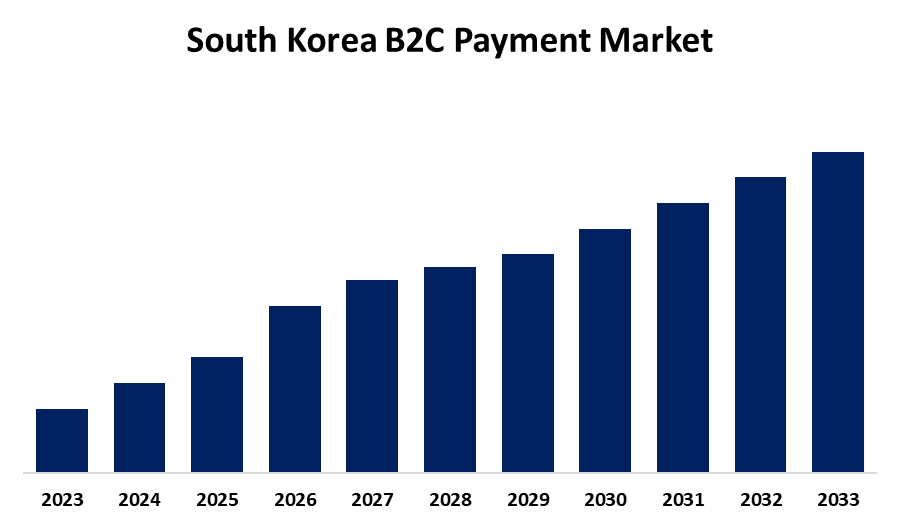

- The South Korea B2C Payment Market is Growing at a CAGR of 12.40% from 2023 to 2033

- The South Korea B2C Payment Market Size is Expected to Reach a Significant Share by 2033

Get more details on this report -

The South Korea B2C Payment Market is anticipated to reach a significant share by 2033, growing at a CAGR of 12.40% from 2023 to 2033

Market Overview

South Korea B2C payment market refers to the financial transactions that occur between businesses and consumers, where payments are made for goods or services through various digital and mobile platforms. This includes methods like credit and debit cards, mobile wallets, e-commerce platforms, and digital payment solutions such as Samsung Pay, Naver Pay, and KakaoPay. As one of the most advanced digital economies globally, South Korea has seen significant growth in B2C payments due to high smartphone penetration and widespread adoption of mobile and contactless payments. The South Korean government has introduced initiatives to regulate and support the digital payments landscape. Key measures include the introduction of regulatory frameworks for BNPL services, ensuring consumer protection and preventing over-indebtedness. The government is also promoting the development of fintech through favorable policies and technological infrastructure investments, fostering growth in digital payment services and embedding financial solutions within daily transactions.

Report Coverage

This research report categorizes the market for the South Korea B2C payment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea B2C payment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea B2C payment market.

South Korea B2C Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.40% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Industry Vertical and COVID-19 Impact Analysis |

| Companies covered:: | Capital One Financial Corporation., PayPal, American Express Company, BANK OF AMERICA CORPORATION, Due Inc., Apple Inc., Visa Inc., Payoneer Inc., Mastercard Incorporated., Stripe, and Others, key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rapid expansion of e-commerce is crucial factor, as consumers increasingly prefer to shop online, demanding seamless and secure payment methods. Furthermore, the government's proactive stance on promoting fintech innovation and providing regulatory support has created a favorable environment for the development of digital payment solutions.

Restraining Factors

There is the challenge of maintaining profitability in a highly competitive environment, with some smaller services facing difficulties in sustaining operations due to declining revenues or high operational costs.

Market Segmentation

The South Korea B2C payment market share is classified into type and industry vertical.

- The cards segment accounted for the highest revenue share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The South Korea B2C payment market is segmented by type into cards, digital wallet, and others. Among these, the cards segment accounted for the highest revenue share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The growth can be attributed to the continued rise in e-commerce transactions and the increasing integration of digital payment solutions with credit and debit card systems.

- The retail and e-commerce segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The South Korea B2C payment market is segmented by industry vertical into BFSI, healthcare, hospitality and tourism, transportation and logistics, retail and e-commerce, energy and utilities, and others. Among these, the retail and e-commerce segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growth in segment is driven by the rapid expansion of online shopping and digital transactions, with an increasing number of consumers opting for online purchasing due to convenience, variety, and competitive pricing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea B2C payment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Capital One Financial Corporation.

- PayPal, American Express Company

- BANK OF AMERICA CORPORATION

- Due Inc.

- Apple Inc.

- Visa Inc.

- Payoneer Inc.

- Mastercard Incorporated.

- Stripe

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, the Financial Services Commission amended the Electronic Financial Transactions Act, requiring BNPL providers to enhance transparency regarding fees and terms. Providers must also assess consumers' repayment abilities to prevent over-indebtedness, with potential licensing systems under consideration to standardize industry practices.

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Korea B2C payment market based on the below-mentioned segments:

South Korea B2C Payment Market, By Type

- Cards

- Digital Wallet

- Others

South Korea B2C Payment Market, By Industry Vertical

- BFSI

- Healthcare

- Hospitality and Tourism

- Transportation and Logistics

- Retail and E-commerce

- Energy and Utilities

- Others

Need help to buy this report?