South Korea Diabetes Care Devices Market Size, Share, and COVID-19 Impact Analysis, by Monitoring Devices (Self-Monitoring Blood Glucose Devices and Continuous Glucose Monitoring Devices), By Management Devices (Insulin Pumps, Insulin Disposable Pens, Insulin Syringes, Cartridges in Reusable Pens, and Jet Injectors), and South Korea Diabetes Care Devices Market Insights Forecasts 2022 - 2032

Industry: HealthcareSouth Korea Diabetes Care Devices Market Insights Forecasts to 2032

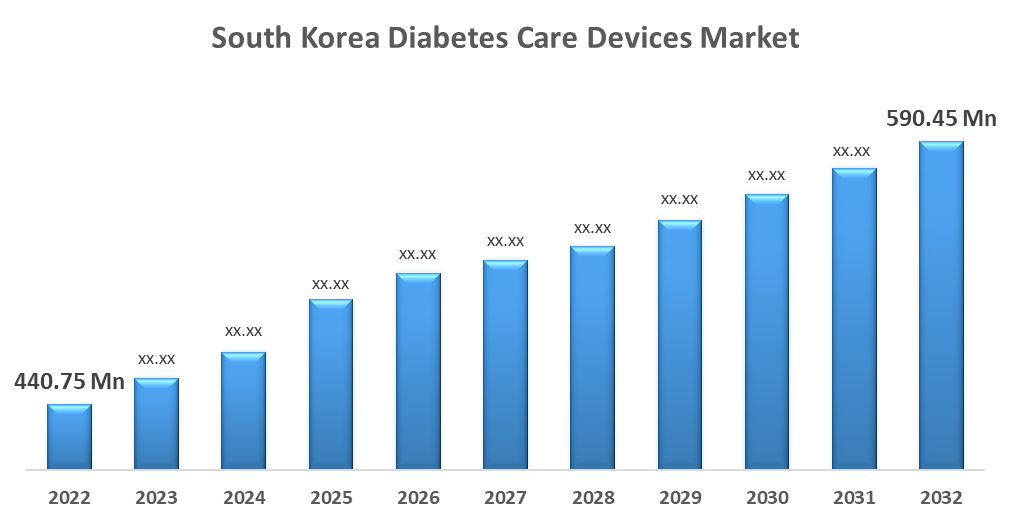

- The South Korean Diabetes Care Devices Market Size was valued at USD 440.75 Million in 2022.

- The Market Size is Growing at a CAGR of 2.9% from 2022 to 2032.

- The South Korean Diabetes Care Devices Market Size is Expected to reach USD 590.45 Million by 2032.

Get more details on this report -

The South Korea Diabetes Care Devices Market Size is expected to reach USD 590.45 Million by 2032, at a CAGR of 2.9 % during the forecast period 2022 to 2032.

The report includes various segments as well as an analysis of the trends and factors influencing the market.

Market Overview

Diabetes mellitus, also known as diabetes, is a group of metabolic disorders characterized by a persistently high blood sugar level. Common symptoms include frequent urination, increased thirst, and increased appetite. Diabetes, if untreated, can cause a slew of health problems. Acute complications include diabetic ketoacidosis, hyperosmolar hyperglycemia, and death. Long-term consequences include cardiovascular disease, stroke, chronic renal disease, foot ulcers, nerve damage, eye damage, and cognitive impairment. Diabetes is classified into three types: type 1 diabetes, type 2 diabetes, and gestational diabetes. Diabetes devices or diabetes care devices are thus the devices used to monitor patients' diabetic conditions. The market is primarily driven by factors such as an increase in the prevalence of obesity and technological advancements. Furthermore, rising diabetes prevalence and increased use of insulin-delivery devices are driving market growth.

Report Coverage

This research report categorizes the market for South Korean diabetes care devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean diabetes care devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korean diabetes care devices market.

South Korea Diabetes Care Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 440.75 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 2.9% |

| 2032 Value Projection: | USD 590.45 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Monitoring Devices, By Management Devices |

| Companies covered:: | Abbott Diabetes Care, Eli Lilly and Company, Dexcom, Medtronic, Novo Nordisk A/S, Sanofi, Arkray and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The use of diabetic devices is expected to increase as governments and charitable organizations increase their efforts to raise diabetes awareness. A large geriatric population, affordable healthcare facilities, cost-effective labor, and less stringent regulatory policies are just a few of the factors driving diabetic device manufacturers to expand their operations. Manufacturers are now focusing on capitalizing on opportunities in developing economies to increase market share.

Restraining Factors

Diabetes devices such as insulin pens and insulin pumps have some drawbacks. As such, before a product can be commercialized, regulatory organizations in various areas must identify potential hazards. Insulin pumps are mostly used to treat type 1 diabetes, but they can cause complications such as pump failure, insulin stability issues, and infusion site problems.

Market Segment

- In 2022, the self-monitoring blood glucose devices segment accounted for the largest revenue share over the forecast period.

Based on the monitoring devices, the South Korean diabetes care devices market is segmented into self-monitoring blood glucose devices and continuous glucose monitoring devices. Among these, the self-monitoring blood glucose devices segment has the largest revenue share over the forecast period. Diabetes is a serious health issue and one of the most difficult challenges confronting South Korean healthcare systems. The frequency with which glucose levels are monitored is determined by the type of diabetes, which varies from patient to patient. Type 1 diabetics must check their blood glucose levels at regular intervals, monitor them, and adjust their insulin doses accordingly.

- In 2022, the cartridges in reusable pens segment accounted for the largest revenue share over the forecast period.

Based on the management devices, the South Korean Diabetes Care Devices market is segmented into insulin pumps, insulin disposable pens, insulin syringes, cartridges in reusable pens, and jet injectors. Among these, the cartridges in the reusable pens segment have the largest revenue share over the forecast period. Insulin cartridges in reusable pens are a more advanced form of insulin vials. Most insulins are available in the form of cartridges, making them easily accessible. These devices have all of the functional benefits of reusable pens and are more cost-effective in the long run because these cartridges are less expensive than disposable insulin pens. These insulin cartridges are thought to be more user-friendly because they are smaller and less visible than the traditional vial and syringe. Additionally, these devices are more portable for consumers. Open cartridges do not need to be refrigerated, making storage very convenient for consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korean diabetes care devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Diabetes Care

- Eli Lilly and Company

- Dexcom

- Medtronic

- Novo Nordisk A/S

- Sanofi

- Arkray

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, in light of continuous increases in raw materials and inflation, Delta (Korea's Online Selling Website for Abbott Free Style Libre) announced that the freestyle Libre selling price will be raised by 10% in Korea.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korean Diabetes Care Devices Market based on the below-mentioned segments:

South Korean Diabetes Care Devices Market, By Monitoring Devices

- Self-Monitoring Blood Glucose Devices

- Continuous Glucose Monitoring Devices

South Korea Diabetes Care Devices Market, By Management Devices

- Insulin Pumps

- Insulin Disposable Pens

- Insulin Syringes

- Cartridges in Reusable Pens

- Jet Injectors

Need help to buy this report?