South Korea Engineering Plastics Market Size, Share, and COVID-19 Impact Analysis, By Type (Thermoplastic Polyester, Polycarbonate (PC), Polyamide (PA), Acrylonitrile Butadiene Styrene (ABS), and Others), By End-User (Automotive & Transportation, Electrical & Electronics, Industrial & Machinery, Packaging, and Others), and South Korea Engineering Plastics Market Insights Forecasts 2023 – 2033

Industry: Chemicals & MaterialsSouth Korea Engineering Plastics Market Insights Forecasts to 2033

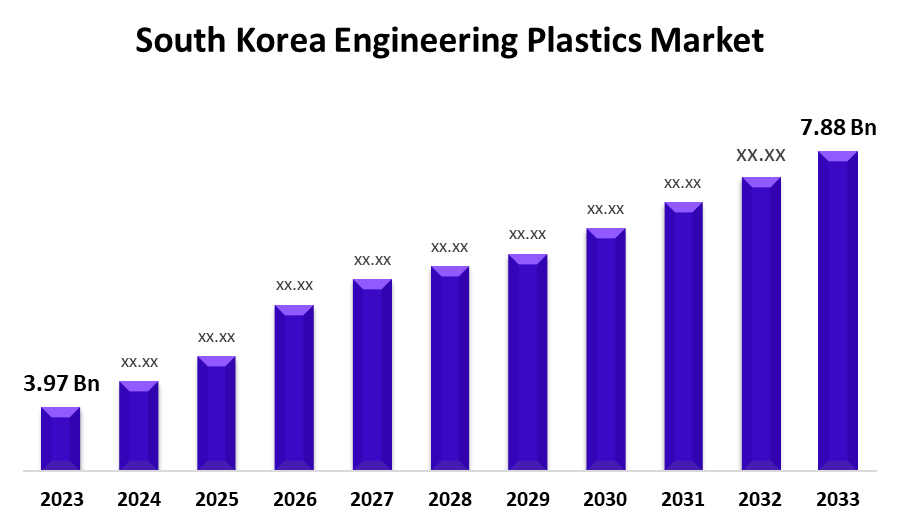

- The South Korea Engineering Plastics Market Size was valued at USD 3.97 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.10% from 2023 to 2033.

- The South Korea Engineering Plastics Market Size is Expected to Reach USD 7.88 Billion by 2033.

Get more details on this report -

The South Korea Engineering Plastics Market Size is Expected to Reach USD 7.88 Billion by 2033, at a CAGR of 7.10% during the forecast period 2023 to 2033.

Market Overview

Engineering plastics are high-quality polymers that are used to improve the mechanical and thermal properties of plastics in order to meet higher demands. Traditional engineering materials such as wood and metals have already been replaced by engineering plastics. It's also used in applications where chemical resistance, wear resistance, structural stability, and dimensional stability are required. Engineering plastics are used in a variety of industries, including electronics, transportation, automotive, food, and manufacturing. Although engineering plastics are more expensive than conventional plastics, they are manufactured in smaller quantities and used for smaller items or low-volume applications (such as mechanical parts) rather than bulk and high-volume applications (such as containers and packaging). Engineering plastics are less difficult to manufacture, especially in intricate shapes, and they match or exceed them in weight/strength and other properties. Each engineering plastic has a unique set of characteristics that may make it an excellent choice for a specific application. Polycarbonates, for instance, are extremely impact resistant, whereas polyamides are extremely abrasion resistant.

Report Coverage

This research report categorizes the market for South Korea engineering plastics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea engineering plastics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea engineering plastics market.

South Korea Engineering Plastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.97 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.10% |

| 2033 Value Projection: | USD 7.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-User |

| Companies covered:: | BASF SE, Daikin Industries, Ltd., INEOS, Kolon BASF innoPOM, Inc., Kolon Industries, Inc., Korea Engineering Plastics Co., Ltd., Kumho Petrochemical, LG Chem, Lotte Chemical, LX MMA, Mitsubishi Chemical Corporation, Saehan Industries Inc, Samyang Corporation, SK chemicals., Trinseo and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korean market for engineering plastics is expanding rapidly due to increased demand from end-use industries, particularly automotive and transportation, and electrical and electronics. These end-users are expected to drive the market in the coming years. Engineering plastics are also in high demand in the electrical and electronics industries, owing to an increase in appliance sales ranging from televisions to iron boxes to refrigerators. These plastics are used in the production of consumer appliances.

Restraining Factors

Engineering plastics face stiff competition from other polymers, particularly in lower-end engineering resins. Acrylonitrile butadiene styrene (ABS), for example, is being challenged by commodity polymers such as polypropylene. Polypropylene is a flexible and tough material that performs well when copolymerized with ethylene. Other polymers pose a greater threat in cost-competitive markets such as consumer goods and appliances.

Market Segment

- In 2023, the thermoplastic polyester segment accounted for the largest revenue share over the forecast period.

Based on the type, the South Korea engineering plastics market is segmented into thermoplastic polyester, polycarbonate (PC), polyamide (PA), acrylonitrile butadiene styrene (ABS), and others. Among these, the thermoplastic polyester segment has the largest revenue share over the forecast period. Thermoplastic Polyester has excellent mechanical, thermal, chemical, and electrical properties and is resistant to high temperatures, chemicals, and abrasion. It is solvent-resistant and has strong electrical properties, making it ideal for use in electrical applications.

- The industrial & machinery segment is witnessing significant CAGR growth over the forecast period.

Based on end-user, the South Korea engineering plastics market is segmented into automotive & transportation, electrical & electronics, industrial & machinery, packaging, and others. Among these, the industrial & machinery segment is witnessing significant CAGR growth over the forecast period. The rapid development of these industries should help the engineering plastics market grow. due to the superior properties of engineering plastics, the growing emphasis on reducing vehicle weight and improving fuel efficiency is expected to propel it to the top of the end-use industry list.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea engineering plastics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Daikin Industries, Ltd.

- INEOS

- Kolon BASF innoPOM, Inc.

- Kolon Industries, Inc.

- Korea Engineering Plastics Co., Ltd.

- Kumho Petrochemical

- LG Chem

- Lotte Chemical

- LX MMA

- Mitsubishi Chemical Corporation

- Saehan Industries Inc

- Samyang Corporation

- SK chemicals.

- Trinseo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, BASF SE introduced two new sustainable POM products, Ultraform LowPCF (Low Product Carbon Footprint) and Ultraform BMB (Biomass Balance), to reduce the carbon footprint, save fossil resources, and help with greenhouse gas (GHG) emissions reduction.

- In August 2022, INEOS announced the expansion of its high-performance Novodur line of specialty ABS products. The new Novodur E3TZ extrusion grade is ideal for a wide range of applications such as food trays, sanitary applications, and suitcases.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea Engineering Plastics Market based on the below-mentioned segments:

South Korea Engineering Plastics Market, By Type

- Thermoplastic Polyester

- Polycarbonate (PC)

- Polyamide (PA)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

South Korea Engineering Plastics Market, By End-User

- Automotive & Transportation

- Electrical & Electronics

- Industrial & Machinery

- Packaging

- Others

Need help to buy this report?