South Korea Integrated Circuit Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Logic, Memory, Micro, and Analog), By Application (Standard PCs, Cellphones/Tablets, Automotive, Internet of Things (IoT), Servers, TVs/Set Top Box, Gaming Consoles, and Others), and South Korea Integrated Circuit Market Insights Forecasts to 2033

Industry: Semiconductors & ElectronicsSouth Korea Integrated Circuit Market Insights Forecasts to 2033

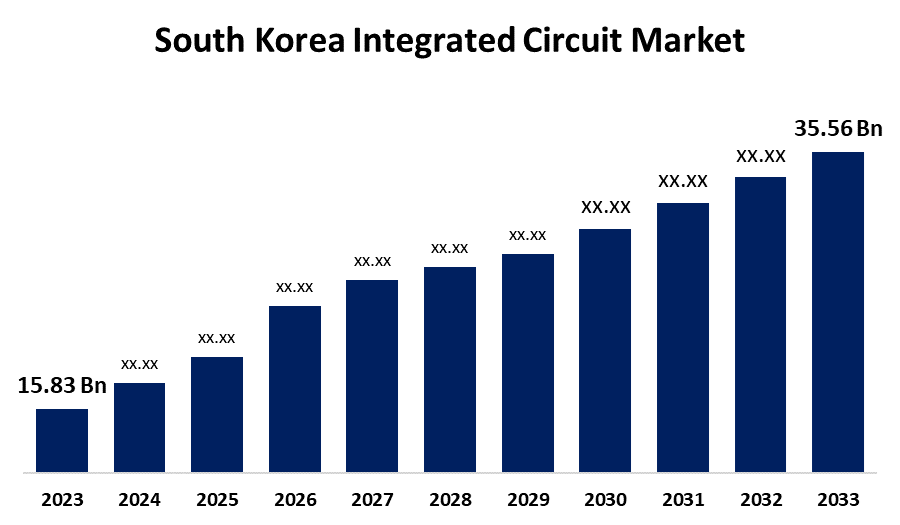

- The South Korea Integrated Circuit Market Size was valued at USD 15.83 Billion in 2023

- The Market Size is Growing at a CAGR of 8.43% from 2023 to 2033.

- The South Korea Integrated Circuit Market Size is Expected to Reach USD 35.56 Billion by 2033.

Get more details on this report -

The South Korea Integrated Circuit Market Size is Expected to reach USD 35.56 Billion by 2033, at a CAGR of 8.43% during the forecast period 2023 to 2033.

Market Overview

An integrated circuit (IC) is a set of electronic circuits formed on a small chip of semiconductor material, typically silicon, which can perform a variety of functions such as amplification, data processing, and signal conversion. ICs are the foundation of modern electronics, used in devices ranging from consumer electronics to industrial machinery, automotive systems, and telecommunications equipment. The South Korea integrated circuit market is driven by several key factors. The increasing demand for advanced consumer electronics, including smartphones, wearables, and smart home devices, is a primary contributor to market growth. Additionally, the rise of next-generation technologies such as 5G, artificial intelligence (AI), and the Internet of Things (IoT) requires more sophisticated ICs, fueling further market expansion. The country’s robust semiconductor manufacturing capabilities, coupled with its leadership in the production of memory chips, position South Korea as a global hub for IC production. Government initiatives also play a significant role in shaping the market. South Korea has implemented policies aimed at boosting its semiconductor industry, offering tax incentives, research funding, and support for innovation. Strategic investments in R&D and the development of cutting-edge fabrication facilities are also helping to advance the capabilities of ICs. These factors, combined with the strong presence of leading IC manufacturers, contribute to the sustained growth of the market in South Korea.

Report Coverage

This research report categorizes the market for South Korea's integrated circuit based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea integrated circuit market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea integrated circuit market.

South Korea Integrated Circuit Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 15.83 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.43% |

| 2033 Value Projection: | USD 35.56 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Samsung Electronics, SK hynix, LG Electronics, Hanwa Electronics, Nexell, Magnachip Semiconductor, DB HiTek, Silicon Works, Korea Semiconductor Industry Association (KSIA), Powertech Technology, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several factors are driving the South Korea integrated circuit market, including the rising demand for superior versions of advanced consumer electronics like smartphones, smart wearables, and IoT devices. All the technologies of the next generation, such as 5G, AI, and self-driving vehicles, increase the need for high-performance ICs. A good part of the global leadership position for South Korea is due to the great semiconductor manufacturing sector, especially in memory chips. In addition, an increased thrust of smart manufacturing and automation is being given across all sectors, which demands more advanced IC solutions. These factors along with innovation from the technological front and robust domestic production capabilities are fueling growth in the market.

Restraining Factors

The South Korea integrated circuit market faces stiff competition due to some challenges like high production costs, worldwide competition, and reliance on raw material imports. In the short run, it could also prove tough to maintain its competitiveness due to supply chain disruption and fast technological changes.

Market Segment

The South Korea integrated circuit market share is classified into product type and application.

- The memory segment is expected to hold the largest market share through the forecast period.

The South Korea integrated circuit market is segmented by product type into logic, memory, micro, and analog. Among these, the memory segment is expected to hold the largest market share through the forecast period. This is attributed to the South Korea is a global leader in producing memory chips, in particular DRAM and NAND flash memory, which are integral to nearly all applications: consumer electronics, data centers, and mobile devices. High demand for high-performance memory solutions driven by an upsurge of data-intensive technologies such as 5G, AI, and cloud computing further solidifies memory IC dominance in the market.

- The cellphones/tablets segment is expected to hold the largest market share through the forecast period.

The South Korea integrated circuit market is segmented by application into standard PCs, cellphones/tablets, automotive, internet of Things (IoT), servers, TVs/set-top boxes, gaming consoles, and others. Among these, the cellphones/tablets segment is expected to hold the largest market share through the forecast period. This is attributed to the demand for smartphones and tablets are growing rapidly, as these products rely heavily on advanced ICs for processing, memory, connectivity, and power management. South Korea is home to several key mobile manufacturers, including Samsung company in itself a player of global importance in the mobile device market. The adoption of 5G technology and subsequent advancements in mobile computing will help maintain demand for high-performance integrated circuits in these devices, keeping it an important grower.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea integrated circuit market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Electronics

- SK hynix

- LG Electronics

- Hanwa Electronics

- Nexell

- Magnachip Semiconductor

- DB HiTek

- Silicon Works

- Korea Semiconductor Industry Association (KSIA)

- Powertech Technology

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea integrated circuit market based on the below-mentioned segments

South Korea Integrated Circuit Market, By Product Type

- Logic

- Memory

- Micro

- Analog

South Korea Integrated Circuit Market, By Application

- Standard PCs

- Cellphones/Tablets

- Automotive

- Internet of Things (IoT

- Servers

- TVs/Set Top Box

- Gaming Consoles

- Others

Need help to buy this report?