South Korea LNG Bunkering Market Size, Share, and COVID-19 Impact Analysis, By End User (Tanker Fleet, Container Fleet, Bulk & General Cargo Fleet, Ferries & OSV, and Others), and South Korea LNG Bunkering Market Insights Forecasts to 2033

Industry: Energy & PowerSouth Korea LNG Bunkering Market Insights Forecasts to 2033

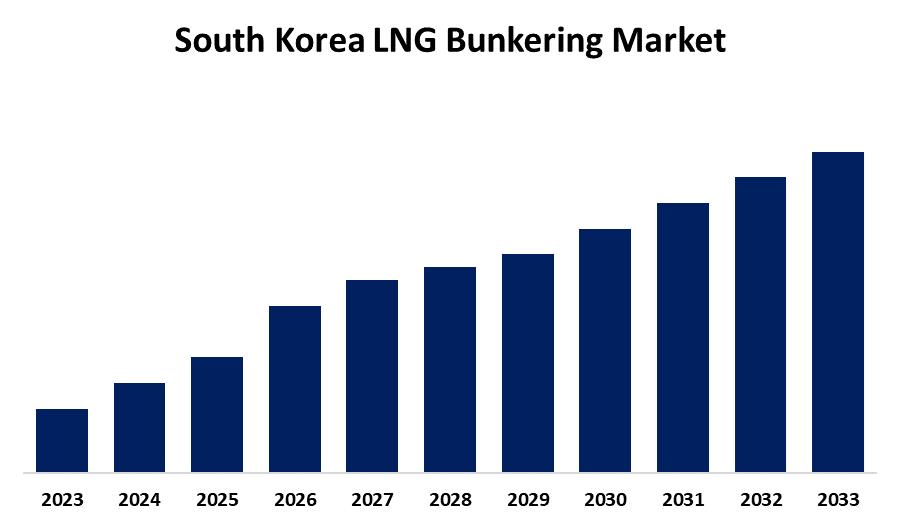

- The Market is Growing at a CAGR of 2.1% from 2023 to 2033

- The South Korea LNG Bunkering Market Size is Expected to Reach a significant share by 2033

Get more details on this report -

The South Korea LNG Bunkering Market Size is Anticipated to Exceed a significant share by 2033, Growing at a CAGR of 2.1% from 2023 to 2033.

Market Overview

LNG bunkering is defined as a service where liquid natural gas fuel is supplied to the ships for their main propulsion and auxiliary power usage. It can be executed through several types, such as truck-to-ship, ship-to-ship, and port-to-ship bunkering. There are some very important features that LNG bunkering presents, such as reduced sulfur oxide, superior energy density, and superior combustion efficiency. It is used in a variety of maritime applications, such as container vessels, ferries, cruise ships, and fishing boats, among others. The increase in demand is what mainly supports the growth of the market in LNG bunkering, in view of the stricter emission rules enforced in South Korea. This pushes the industry to opt for cleaner fuel alternatives, such as LNG. In addition, South Korea's positioning at busy shipping routes further enhances the hub appeal for LNG bunkering and consolidates the market growth.

Report Coverage

This research report categorizes the market for South Korea LNG bunkering market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea LNG bunkering market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea LNG bunkering market.

South Korea LNG Bunkering Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 194 |

| Tables, Charts & Figures: | 93 |

| Segments covered: | By End User and COVID-19 Impact Analysis. |

| Companies covered:: | Korea Line Corporation, Wartsila Oyj Abp, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid modernization of bunkering equipment and infrastructure easing the transition to LNG is fostering market growth. In addition, the encouraging policies by the government supporting LNG projects through subsidies and tax benefits are propelling market growth. In addition, the growth in domestic production of LNG that ensures stable supply and reduces dependency on imports is propelling the market growth.

Restraining Factors

South Korea's economy is slowing down principally because of the global economic slowdown because the country's economy relies on goods, machinery, and commodities exported from the country-for example, steel. This has not been good for the maritime trade in the country and would further stagnate the growth of the market.

Market Segment

The South Korea LNG bunkering market share is classified into end users.

- The tanker fleet segment is expected to hold the largest market share through the forecast period.

The South Korea LNG bunkering market is segmented by end-user into tanker fleets, container fleets, bulk & general cargo fleets, ferries & OSV, and others. Among these, the tanker fleet segment is expected to hold the largest market share through the forecast period. This is attributed to more and more fleets are looking for cleaner fueling options in maritime transport, while LNG increasingly gains ground as a fuel for bigger ships.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea LNG bunkering market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Korea Line Corporation

- Wartsila Oyj Abp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea LNG bunkering market based on the below-mentioned segments

South Korea LNG Bunkering Market, By End User

- Tanker Fleet

- Container Fleet

- Bulk & General Cargo Fleet

- Ferries & OSV

- Others

Need help to buy this report?