South Korea Microcontroller Socket Market Size, Share, and COVID-19 Impact Analysis, By Type (BGA, DIP, QFP, SOP, and SOIC), By Application (Automotive, Consumer Electronics, Industrial, Medical Devices, and Military & Defense), and South Korea Microcontroller Socket Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsSouth Korea Microcontroller Socket Market Insights Forecasts to 2033

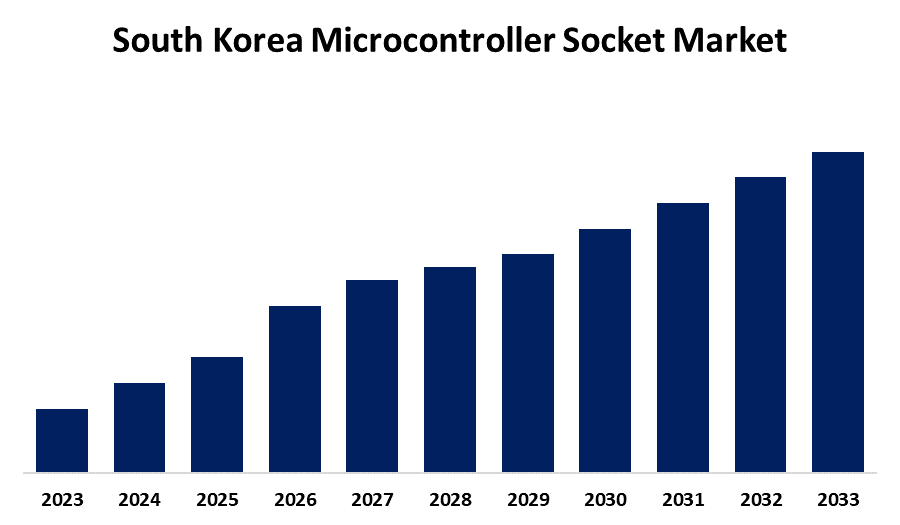

- The South Korea Microcontroller Socket Market Size is Growing at a CAGR of 5.8% from 2023 to 2033

- The South Korea Microcontroller Socket Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The South Korea Microcontroller Socket Market Size is anticipated to Hold a Significant Share by 2033, growing at a CAGR of 5.8% from 2023 to 2033.

Market Overview

The South Korea microcontroller socket market encompasses the production, distribution, and application of sockets designed for microcontrollers, which are integral components in electronic devices. These sockets facilitate secure connections, testing, and replacement of microcontrollers in various applications, including consumer electronics, automotive, industrial automation, and telecommunications. The market is driven by advancements in semiconductor technology and the growing demand for compact, high-performance electronic systems. The presence of a robust electronics manufacturing sector and technological innovation further support market expansion. The rising adoption of microcontrollers in smart devices, automotive electronics, and industrial automation serves as a key driver for market growth. The increasing penetration of the Internet of Things (IoT) and artificial intelligence (AI) in electronic systems enhances the demand for efficient microcontroller sockets. Additionally, the push for miniaturization and energy-efficient designs in consumer electronics fuels innovation in socket technology. Government initiatives promoting semiconductor research and development play a significant role in shaping the market. Policies supporting domestic semiconductor manufacturing and investment in advanced packaging technologies strengthen South Korea’s position in the global semiconductor supply chain. Incentives for research in high-performance computing and next-generation communication systems further contribute to market expansion and technological advancements.

Report Coverage

This research report categorizes the market for the South Korea microcontroller socket market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea microcontroller socket market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea microcontroller socket market.

South Korea Microcontroller Socket Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.8% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Aries Electronics, Amphenol Corporation, CnC Tech, LLC, FCI USA LLC, Hon Hai Precision Industry Co., Ltd. (Foxconn), Mill-Max Mfg. Corp., PRECI-DIP SA, Samtec, Silicon Laboratories, TE Connectivity, and Others |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korea microcontroller socket market is driven by the rapid expansion of the semiconductor and electronics industries, supported by advancements in microcontroller technology. The growing adoption of microcontrollers in smart devices, automotive electronics, and industrial automation fuels the demand for high-performance sockets. The increasing integration of the Internet of Things (IoT) and artificial intelligence (AI) in electronic systems further accelerates market growth. Additionally, the rising demand for compact and energy-efficient consumer electronics encourages innovation in socket design. Strong domestic semiconductor manufacturing capabilities and government support for research and development in advanced packaging technologies enhance market expansion and drive technological advancements.

Restraining Factors

The South Korea microcontroller socket market faces challenges due to high production costs, complexity in socket design for advanced microcontrollers, and fluctuating raw material prices. Additionally, rapid technological advancements necessitate frequent upgrades, increasing development costs and limiting adoption among small manufacturers.

Market segmentation

The South Korea microcontroller socket market share is classified into type and application.

- The BGA segment is expected to hold the largest market share through the forecast period.

The South Korea microcontroller socket market is segmented by type into BGA, DIP, QFP, SOP, and SOIC. Among these, the BGA segment is expected to hold the largest market share through the forecast period. BGA sockets are widely used in high-performance applications, including advanced computing, telecommunications, and automotive electronics, due to their superior electrical and thermal performance. The increasing demand for miniaturized and high-density electronic components further strengthens the dominance of this segment.

- The consumer electronics segment is expected to hold the largest market share through the forecast period.

The South Korea microcontroller socket market is segmented by application into automotive, consumer electronics, industrial, medical devices, and military & defense. Among these, the consumer electronics segment is expected to hold the largest market share through the forecast period. The country’s strong presence in the global electronics industry, coupled with rising demand for smartphones, tablets, smart home devices, and wearables, drives significant growth in this segment. Advancements in semiconductor technology, including miniaturization and high-performance computing, further enhance the adoption of microcontroller sockets in consumer devices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea microcontroller socket market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aries Electronics

- Amphenol Corporation

- CnC Tech, LLC

- FCI USA LLC

- Hon Hai Precision Industry Co., Ltd. (Foxconn)

- Mill-Max Mfg. Corp.

- PRECI-DIP SA

- Samtec

- Silicon Laboratories

- TE Connectivity

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Korea microcontroller socket market based on the below-mentioned segments:

South Korea Microcontroller Socket Market, By Type

- BGA

- DIP

- QFP

- SOP

- SOIC

South Korea Microcontroller Socket Market, By Application

- Automotive

- Consumer Electronics

- Industrial

- Medical Devices

- Military & Defense

Need help to buy this report?