South Korea Missile Guidance System Market Size, Share, and COVID-19 Impact Analysis, By Launch Platform (Air-to-air, Air-to-surface, Surface-to-air, Anti-ship, and Anti-tank), By Type (Command Guidance System, Beam Rider Guidance System, Homing Guidance System, and Inertial Guidance System), By End User (Submarines, UAVs, Ground Vehicles, Combat Aircrafts, and Ships), and South Korea Missile Guidance System Market Insights, Industry Trend, Forecasts to 2033.

Industry: Aerospace & DefenseSouth Korea Missile Guidance System Market Insights Forecasts to 2033

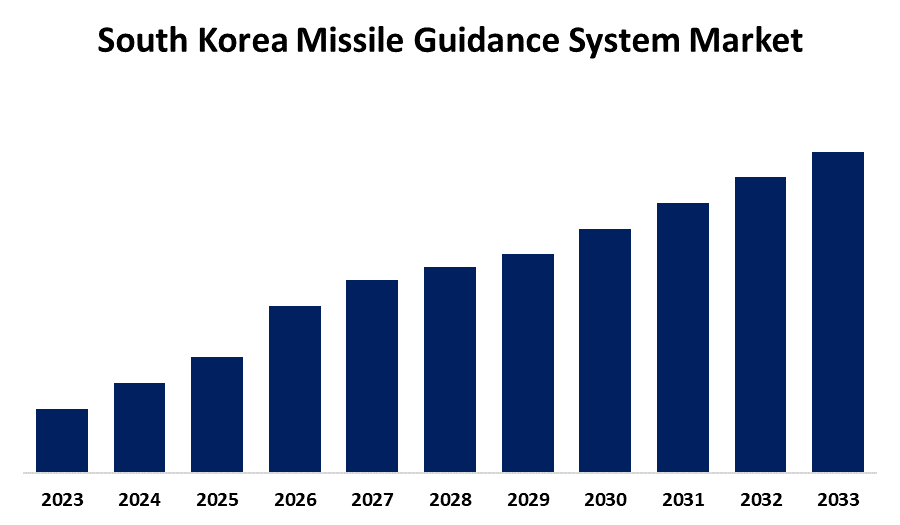

- The South Korea Missile Guidance System Market Size is Growing at a CAGR of 5.2% from 2023 to 2033

- The South Korea Missile Guidance System Market Size is Expected to Reach a Significant Share by 2033

Get more details on this report -

The South Korea Missile Guidance System Market Size is anticipated to reach a significant share by 2033, growing at a CAGR of 5.2% from 2023 to 2033

Market Overview

South Korea missile guidance system market includes various guidance methods such as inertial, GPS, radar, and infrared, which enhance missile accuracy and effectiveness. South Korea's missile defense capabilities are critical, given its geopolitical location and ongoing security concerns with neighboring countries. The government’s increased defense budget and focus on modernizing military technologies contribute to the market's growth. Additionally, South Korea is investing in advanced missile defense systems, like THAAD (Terminal High Altitude Area Defense) and Aegis, to strengthen its defense infrastructure. Additionally, South Korea’s strong industrial base and technological expertise, particularly in electronics and aerospace, further bolster opportunities for innovation in missile guidance systems. With increasing defense collaborations and partnerships with countries like the U.S., there are potential openings for market expansion, especially in the development of next-generation systems, including hypersonic missile guidance. Furthermore, as the global defense landscape shifts, the demand for advanced missile defense technologies is likely to grow, presenting long-term opportunities for companies operating in this space.

Report Coverage

This research report categorizes the market for the South Korea missile guidance system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea missile guidance system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea missile guidance system market.

South Korea Missile Guidance System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Launch Platform, By Type, By End User |

| Companies covered:: | Northrop Grumman Corporation, DRDO, General Dynamics Corporation, Saab AB, Raytheon Technologies Corporation, Elbit Systems Ltd., Safran S.A., The Boeing Company, Thales Group, BAE Systems plc, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

Country’s ongoing security concerns, particularly with neighboring North Korea, have spurred significant investments in advanced defense technologies. This has led to increased demand for precision-guided missile systems to enhance military capabilities. Additionally, South Korea’s substantial defense budget and its commitment to modernizing its military infrastructure further fuel market expansion. Technological advancements, including improvements in GPS, radar, and infrared guidance systems, also drive innovation within the sector.

Restraining Factors

International arms control regulations and export restrictions can create limitations on the global distribution of missile guidance systems, particularly for sensitive technologies.

Market Segmentation

The South Korea missile guidance system market share is classified into launch platform, type, and end user.

- The surface-to-air segment accounted for the largest revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The South Korea missile guidance system market is segmented by launch platform into air-to-air, air-to-surface, surface-to-air, anti-ship, and anti-tank. Among these, the surface-to-air segment accounted for the largest revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The segment growth is primarily driven by South Korea's focus on strengthening its air defense capabilities to protect against aerial threats, including those posed by neighboring North Korea. The government's investment in advanced missile defense systems like THAAD and Aegis further boosts the demand for surface-to-air guidance systems, as these platforms play a critical role in national security.

- The homing guidance system segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The South Korea missile guidance system market is segmented by type into command guidance system, beam rider guidance system, homing guidance system, and inertial guidance system. Among these, the homing guidance system segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The increasing demand for precision and accuracy in missile systems, along with advancements in sensor technologies such as infrared and radar homing, is driving the growth of this segment.

- The combat aircrafts segment accounted for a significant market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The South Korea missile guidance system market is segmented by end user into submarines, UAVs, ground vehicles, combat aircrafts, and ships. Among these, the combat aircrafts segment accounted for a significant market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segment growth can be attributed to the rise in defense spending, technological advancements in missile guidance, and the increasing emphasis on precision-strike capabilities in air combat. Additionally, South Korea’s strategic defense collaborations and its need to counter aerial threats further boost the demand for missile guidance systems in combat aircraft.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea missile guidance system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Northrop Grumman Corporation

- DRDO

- General Dynamics Corporation

- Saab AB

- Raytheon Technologies Corporation

- Elbit Systems Ltd.

- Safran S.A.

- The Boeing Company

- Thales Group

- BAE Systems plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2024, South Korea concluded the decade-long development of the Long-Range Surface-to-Air Missile (L-SAM). Designed to intercept incoming missiles at altitudes exceeding 40 kilometers, the L-SAM enhances the country's air defense by targeting threats during their terminal phase. Production is slated to begin in 2025, with operational deployment expected in the mid-to-late 2020s.

Market Segment

- This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Korea missile guidance system market based on the below-mentioned segments

South Korea Missile Guidance System Market, By Launch Platform

- Air-to-air

- Air-to-surface

- Surface-to-air

- Anti-ship

- Anti-tank

South Korea Missile Guidance System Market, By Type

- Command Guidance System

- Beam Rider Guidance System

- Homing Guidance System

- Inertial Guidance System

South Korea Missile Guidance System Market, By End User

- Submarines

- UAVs

- Ground Vehicles

- Combat Aircrafts

- Ships

Need help to buy this report?