South Korea Nanochip Market Size, Share, and COVID-19 Impact Analysis, By End-User (Healthcare & Life Sciences, Electronics & Semiconductors, IT & Telecommunications, Aerospace & Defense, Energy & Utilities, and Others), By Sales Channel (Direct Sales, Distributors, and Online Channels), and South Korea Nanochip Market Insights Forecasts to 2033

Industry: Semiconductors & ElectronicsSouth Korea Nanochip Market Insights Forecasts to 2033

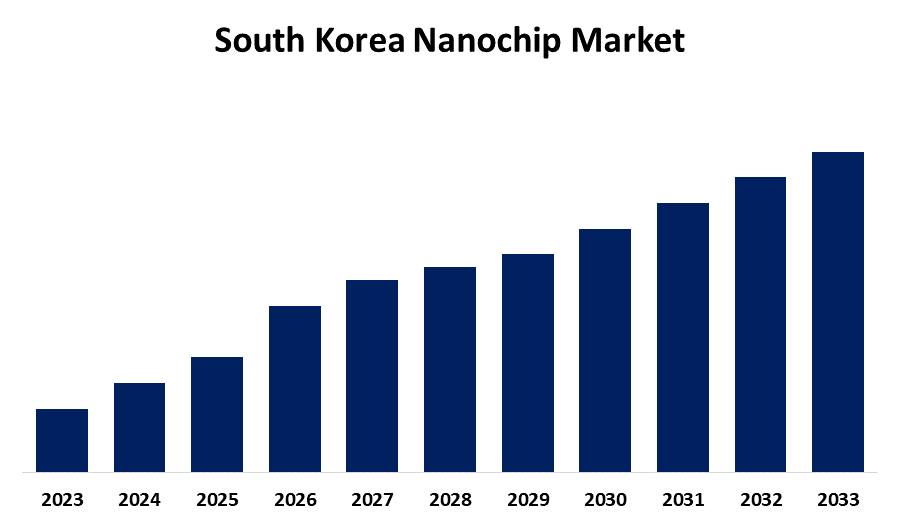

- The Market is growing at a CAGR of 8.9% from 2023 to 2033

- The South Korea Nanochip Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The South Korea Nanochip Market is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 8.9% from 2023 to 2033.

Market Overview

A nanochip refers to a semiconductor chip or IC that integrates nanoscale components, features, or manufacturing processes. The term "nano" within a nanochip refers to the order of nanometers in the size of the design, features, or component of the chip, ranging from several nanometers to tens or hundreds of nanometers. Nanochips will have more processing power and can fit into an assumed physical volume with less energy requirement to run at a faster pace. However, the benefit of the nanochip technology is that its storage chips do not depend on the limits of lithography. The application of nanochips can also be extended to consumer electronics products, such as cell phones, digital cameras, PDAs, laptops, and computers. Nanochips played an important role in various technologies in the form of progress regarding microprocessors, memory chips, sensors, and many other electronic devices required for miniaturization to perform better. Steady innovations in nanotechnology promote the development of ever-simpler and more powerful semiconductor components by the market's leading manufacturers, research institutions, and technology firms. Continuous evolution provides the basis for the role the nanochip market will play in defining the future of electronics and related industries.

Report Coverage

This research report categorizes the market for South Korea nanochip market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea nanochip market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the South Korea nanochip market.

South Korea Nanochip Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By End-User, By Sales Channel |

| Companies covered:: | Samsung Electronics, Taiwan Semiconductor Manufacturing Company (TSMC), NVIDIA Corporation, Advanced Micro Devices (AMD), Qualcomm Incorporated, SK Hynix Inc., Micron Technology, Inc., Broadcom Inc., Texas Instruments Incorporated, Infineon Technologies AG, STMicroelectronics, ASML Holding N.V., Applied Materials, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The tremendous demand for miniaturized electronic devices with more efficiency, better performance, and superior functionality dramatically shapes the technology landscape. Fast-increasing adoption of the Industrial Internet of Things (IoT) also fosters a more compact and efficient electronic solution. Coupled with such characteristics is the capability of nanotechnology to take smaller, more efficient chips, hence innovation continues to rev up in the sector. Furthermore, increased investments in research and development in nanoelectronics serve as testimony to this interest in advancing this field. Moreover, increasing demand for wearable technology and smart devices indicates an essential need for electronic solutions from consumers, thus accelerating the drive further.

Restraining Factors

Production of nano chips is also associated with several challenges which include high costs associated with manufacturing complexity involved in the processes of fabricating nanoscale structures and health and environmental concerns about nanomaterials. Moreover, there is no standardized universal process for manufacturing that applies everywhere because inconsistencies in quality are factors holding back the widespread application of nanoelectronics.

Market Segment

The South Korea nanochip market share is classified into end-user and sales channels.

- The electronics & semiconductors segment is expected to hold the largest market share through the forecast period.

The South Korea nanochip market is segmented by end-users into healthcare & life sciences, electronics & semiconductors, it & telecommunications, aerospace & defense, energy & utilities, and others. Among these, the electronics & semiconductors segment is expected to hold the largest market share through the forecast period. Nanochips would essentially be semiconductor devices, which were usually an integral part of the manufacturing process in electronics and would encompass products such as microprocessors and memory chips, sensors, and other types of similar components that are integral to electronic devices. A major requirement for smaller yet powerful and energy-efficient semiconductors has stimulated huge investments and innovation in the electronics and semiconductors sector.

- The direct sales segment is expected to hold the largest market share through the forecast period.

The South Korea nanochip market is segmented by sales channel into direct sales, distributors, and online channels. Among these, the direct sales segment is expected to hold the largest market share through the forecast period. This is because customized solutions require close cooperation between manufacturers and clients. Further, direct sales would allow for greater communication and tailormade offerings, which goes well in the niche domain of nanoelectronics. Distributors and online channels would also prove significant, but in sectors like nanochips, direct sales usually win.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea nanochip market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Electronics

- Taiwan Semiconductor Manufacturing Company (TSMC)

- NVIDIA Corporation

- Advanced Micro Devices (AMD)

- Qualcomm Incorporated

- SK Hynix Inc.

- Micron Technology, Inc.

- Broadcom Inc.

- Texas Instruments Incorporated

- Infineon Technologies AG

- STMicroelectronics

- ASML Holding N.V.

- Applied Materials, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, Samsung Electronics has shown its plan for the mass production of 3-nanometer chips using an advanced ultra-micro fabrication process which it says could help beat Taiwan's TSMC to do this. It now spells a sharp competition with Taiwan's TSMC, which earlier reported plans also to mass-produce 1.4-nm chips.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea nanochip market based on the below-mentioned segments

South Korea Nanochip Market, By End-User

- Healthcare & Life Sciences

- Electronics & Semiconductors

- IT & Telecommunications

- Aerospace & Defense

- Energy & Utilities

- Others

South Korea Nanochip Market, By Sales Channel

- Direct Sales

- Distributors

- Online Channels

Need help to buy this report?