South Korea Non-Volatile Memory Market Size, Share, and COVID-19 Impact Analysis, By Traditional Memory Type (EEPROM, SRAM, EPROM, and Others), By End Users (Healthcare, IT & Telecom, Automotive, Manufacturing, Consumer Electronics, and Others), and South Korea Non-Volatile Memory Market Insights Forecasts to 2033

Industry: Semiconductors & ElectronicsSouth Korea Non-Volatile Memory Market Insights Forecasts to 2033

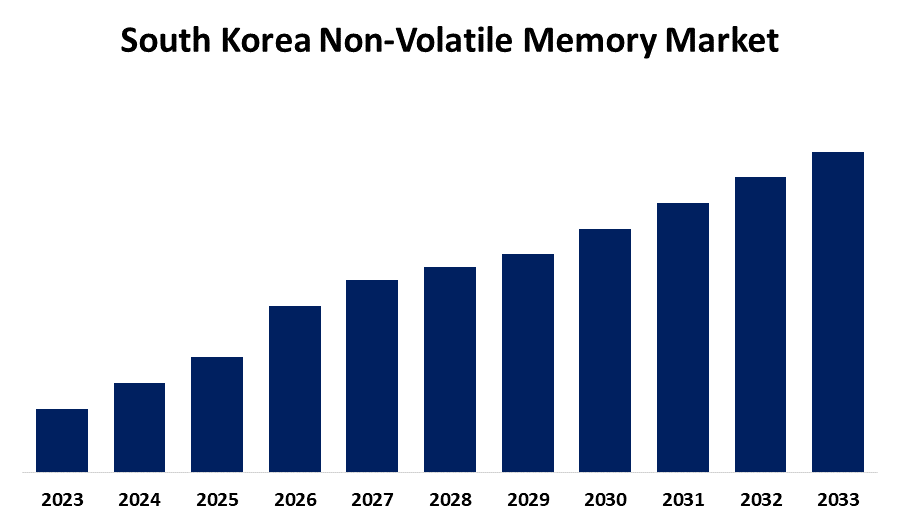

- The Market Size is growing at a CAGR of 8.7% from 2023 to 2033

- The South Korea Non-Volatile Memory Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The South Korea Non-Volatile Memory Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 8.7% from 2023 to 2033.

Market Overview

One of the most commonly used silicon-based semiconductor memories is non-volatile memory or non-volatile storage which allows permanent storage and backup to significant data. Furthermore, NVM devices are electrically programmable and erasable with the aim of storing changes in a specific location in the storage device and to retain that change even after power loss. Non-volatile memory NVM is applied in many consumers electronic devices like laptops, PCs, tablets, and even smartphones. Non-volatile memory keeps the data even when it is powered down. More persisted data is stored as compared to volatile memory such as random-access memory. With advanced digital technology, non-volatile memory will be developed and spread into numerous devices and applications. Besides, developing technologies like ADAS, driverless vehicles, and clinical automation in the automotive and healthcare sector are also anticipated to drive the South Korea non-volatile memory market.

Report Coverage

This research report categorizes the market for South Korea non-volatile memory market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea non-volatile memory market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea non-volatile memory market.

South Korea Non-Volatile Memory Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.7% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Traditional Memory Type, By End Users |

| Companies covered:: | Samsung Electronics, SK Hynix, LG Electronics, Micron Technology, Nexchip Semiconductor, Simmtech, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The South Korea non-volatile memory (NVM) market is driven by the growing demand for smart technologies and consumer electronics. High-capacity memory solutions with elevated data transfer rates are essential for connected devices, wearables, and portable gadgets, enhancing data storage capabilities. Flash memory's high-speed serial interface and optimized protocols significantly improve system performance while reducing power consumption, which is critical for mobile devices. These features enable the development of next-generation devices with faster operation and extended battery life, catering to diverse applications, including streaming media, smart speakers, and IoT devices, thereby propelling the market forward.

Restraining Factors

The South Korean non-volatile memory (NVM) market faces challenges due to high storage density demands, which correlate directly with performance and pricing, impacting overall market growth and accessibility.

Market Segment

The South Korea non-volatile memory market share is classified into traditional memory type and end users.

- The EEPROM segment is expected to hold the largest market share through the forecast period.

The South Korea non-volatile memory market is segmented by traditional memory type into EEPROM, SRAM, EPROM, and others. Among these, the EEPROM segment is expected to hold the largest market share through the forecast period. This is attribute to the EEPROMs could be broadly used in applications such as automotive, consumer electronics, and industrial devices, which require significant reliability and the possibility of reprogramming.

- The consumer electronics segment is expected to hold the largest market share through the forecast period.

The South Korea non-volatile memory market is segmented by end users into healthcare, IT & telecom, automotive, manufacturing, consumer electronics, and others. Among these, the consumer electronics segment is expected to hold the largest market share through the forecast period. This is attributed to the growing demand for smart devices, wearables, and connected technologies with high-capacity memory solutions for data storage and performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea non-volatile memory market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung Electronics

- SK Hynix

- LG Electronics

- Micron Technology

- Nexchip Semiconductor

- Simmtech

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, Samsung Electronics has started mass producing its 9th generation of V-NAND memory. The first dies coming from their latest NAND tech are released in a 1 Tb capacity based on a triple-level cell, or TLC architecture, where the data transfer rates are capped at 3.2 GT/s. The first early customers for the new 3D TLC NAND memory are going to be manufacturing high-capacity and high-performance SSDs that can further solidify Samsung's hold in the storage market.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea non-volatile memory market based on the below-mentioned segments

South Korea Non-Volatile Memory Market, By Traditional Memory Type

- EEPROM

- SRAM

- EPROM

- Others

South Korea Non-Volatile Memory Market, By End Users

- Healthcare

- IT & Telecom

- Automotive

- Manufacturing

- Consumer Electronics

- Others

Need help to buy this report?