South Korea Oil & Gas Market Size, Share, and COVID-19 Impact Analysis, By Type (Upstream, Midstream, Downstream), By Application (Residential, Commercial, Industrial, Others), and South Korea Oil & Gas Market Insights Forecasts to 2032

Industry: Energy & PowerSouth Korea Oil & Gas Market Insights Forecasts to 2032

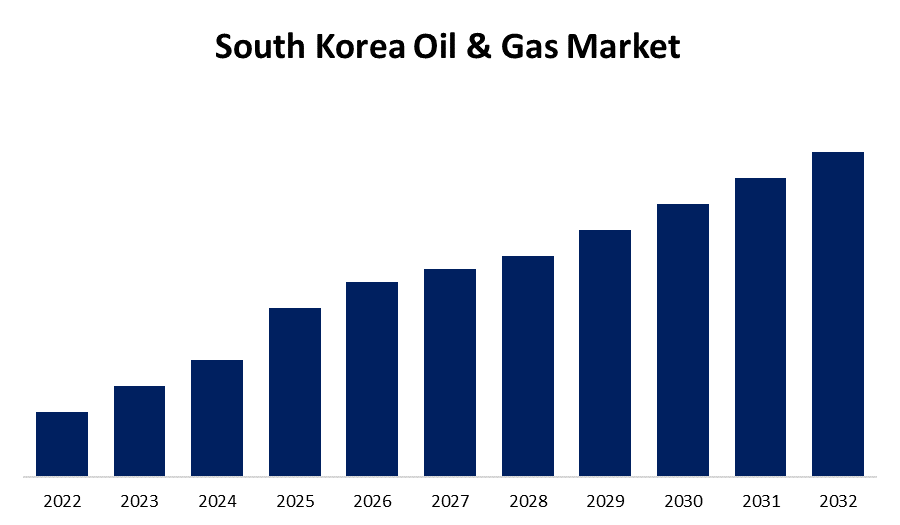

- The Market Size is Growing at a CAGR of 1.42% from 2022 to 2032.

- The South Korea Oil & Gas Market Size is Expected to Hold a Significant Share by 2032.

Get more details on this report -

The South Korea Oil & Gas Market Size is Expected to Hold a Significant Share by 2032, at a CAGR of 1.42% during the forecast period 2022 to 2032.

Market Overview

Pipelines, refineries, drilling platforms, terminals, storage facilities, and processing plants are examples of oil and gas infrastructure. Growing exploration and production activities along with rising natural gas demand are expected to benefit the business environment. Since natural gas is a cleaner option than coal and oil, the market is seeing a boost in demand. Because of its reduced carbon emissions, natural gas is regarded as a transitional fuel and is therefore a desirable option for transportation, industry, and power generation. Natural gas is being promoted by governments all over the world as a component of their energy transition plans to lower greenhouse gas emissions. The development of sophisticated extraction techniques, such as shale gas extraction, and the expansion of the trade in liquefied natural gas (LNG) further drive the demand for natural gas, thereby supporting the oil and gas market in South Korea. Furthermore, the potential of the market has increased due to the realization of unconventional oil and gas resources through the use of drilling technologies like hydraulic fracturing and horizontal drilling. Domestic and foreign investment in the oil and gas sector is encouraged by the government of South Korea's initiatives, which include tax incentives and regulatory changes.

Report Coverage

This research report categorizes the market for the South Korean oil & gas market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea oil & gas market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korean oil & gas market.

South Korea Oil & Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 1.42% |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application. |

| Companies covered:: | Hankook Shell Oil Co., Ltd, CNCITY Energy Co., Ltd, Daesung Industrial Co., Ltd, GS Caltex Corp, SGS Group, Korea National Oil Corporation, Korea Gas Corporation, S-Oil Corporation, SK Energy, Hyundai Oilbank Co., Ltd, Kukdong Oil & Chemicals Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Industry growth will be influenced by the ongoing utilization of oil and natural gas facilities as well as the enhancement of storage operations as a result of the growing demand for natural gas in a variety of applications. The market demand will be positively impacted by an increase in the need for refined petroleum products, such as gasoline, diesel fuel, kerosene, fuel oil, and liquified natural gas. Nonetheless, the market outlook will be driven by the growing demand for cutting-edge technological solutions that operate more safely in remote locations in South Korea.

Restraining Factors

The oil and gas industry are facing more difficulties due to the growing utilization of efficient and affordable renewable energy sources such as geothermal, wind, and solar power. Oil and gas prices are declining as a result of the shift to renewable energy, which is preventing businesses from making new project investments and increasing their production capabilities. The market for gas and oil pumps is being directly impacted by this decrease in capital expenditures, which could result in a decline in the demand for pump systems. Thus, such factors are hampering the market growth in the forecast period.

Market Segment

- In 2022, the downstream segment accounted for the largest revenue share over the forecast period.

Based on the type, the South Korea oil & gas market is segmented into upstream, midstream, and downstream. Among these, the downstream segment has the largest revenue share over the forecast period. Crude oil is converted into a variety of valuable products, including jet fuel, gasoline, diesel, and petrochemicals, through the processes of refining, processing, and distribution. To meet the South Korean energy demands and guarantee that refined products are available to a wide range of consumers and industries, the downstream sector is essential. The growth of this segment is impacted by variables such as shifts in demand patterns, investments in refining capacity, and environmental regulations.

- In 2022, the industrial segment accounted for the largest revenue share over the forecast period.

Based on application, the South Korea oil & gas market is segmented into residential, commercial, industrial, and others. Among these, the industrial segment has the largest revenue share over the forecast period. The majority of oil and gas products are consumed by the industrial sector, which finds use in petrochemicals, manufacturing, power generation, and other industrial processes. Energy-intensive processes, economic growth, and industrial activities all have an impact on this segment's demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea oil & gas market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hankook Shell Oil Co., Ltd

- CNCITY Energy Co., Ltd

- Daesung Industrial Co., Ltd

- GS Caltex Corp

- SGS Group

- Korea National Oil Corporation

- Korea Gas Corporation

- S-Oil Corporation

- SK Energy

- Hyundai Oilbank Co., Ltd

- Kukdong Oil & Chemicals Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On July 2022, South Korea's state-owned Korea Gas Corp (KOGAS) signed a 20-year LNG supply agreement with Qatar beginning in 2025. According to the terms of the contract, KOGAS will purchase 2 million tons of LNG from Qatar Petroleum each year. According to the energy ministry, KOGAS has long-term contracts with Qatar that allow it to purchase 9 million tons of LNG annually; one such contract, worth 4.9 million tons, is scheduled to expire in 2024.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea oil & gas market based on the below-mentioned segments:

South Korea Oil & Gas Market, By Type

- Upstream

- Midstream

- Downstream

South Korea Oil & Gas Market, By Application

- Residential

- Commercial

- Industrial

- Others

Need help to buy this report?