South Korea Real Time Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (P2P, P2B), By End User (Retail & E-commerce, BFSI, IT & Telecom, Travel & Tourism, Government, Healthcare, Energy & Utilities, Others), and South Korea Real Time Payments Market Insights Forecasts to 2032

Industry: Electronics, ICT & MediaSouth Korea Real Time Payments Market Insights Forecasts to 2032

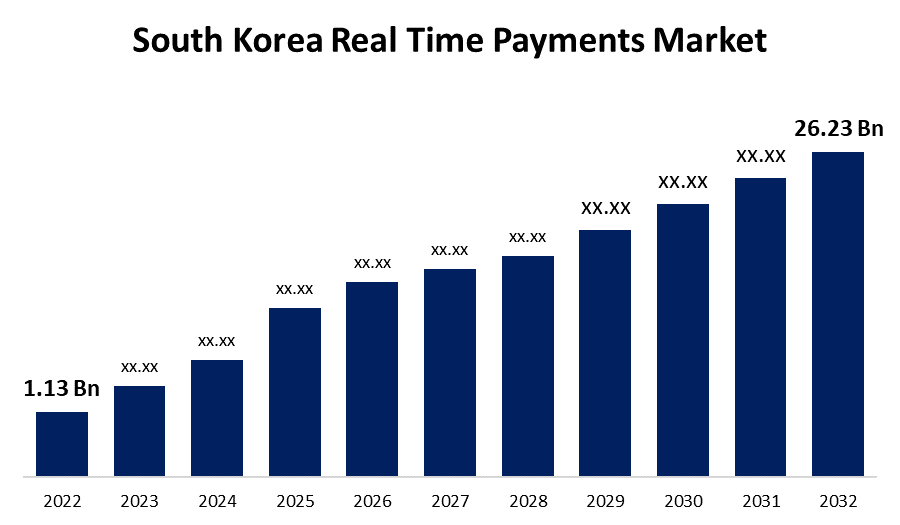

- The South Korea Real Time Payments Market Size was valued at USD 1.13 Billion in 2022.

- The Market Size is Growing at a CAGR of 36.95% from 2022 to 2032.

- The South Korea Real Time Payments Market Size is Expected to Reach USD 26.23 Billion by 2032.

Get more details on this report -

The South Korea Real Time Payments Market Size is Expected to Reach USD 26.23 Billion by 2032, at a CAGR of 36.95% during the forecast period 2022 to 2032.

Market Overview

Financial transactions referred to as "real-time payments" are those that are completed instantaneously and enable the prompt transfer of money between parties. Typically, their architecture consists of a settlement process, payment gateways, and a clearing mechanism. Numerous benefits come with real-time payments, including quicker processing times, data-rich transactions, 24/7 accessibility, and instant payment confirmation. Real-time payments have several advantages, including better cash flow management, lower fraud risk, more convenience, and increased liquidity. Furthermore, the payment system is renowned for their capacity to meet deadlines, improve customer satisfaction, optimize processes, adhere to changing legal requirements, and adjust to market needs. rising levels of digitalization, the desire for quick financial transactions, and technical developments. Real-time payment systems are becoming essential to the banking and finance industry. Rising levels of digitalization, the desire for quick financial transactions, and technical developments. In addition, real-time payments are becoming more and more popular due to the increasing use of smart devices and the boom in the online retail industry in South Korea.

Report Coverage

This research report categorizes the market for South Korean real-time payments market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean real time payments market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the South Korea real time payments market.

South Korea Real Time Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.13 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 36.95% |

| 2032 Value Projection: | USD 26.23 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Payment Type, By End User, and COVID-19 Impact Analysis. |

| Companies covered:: | Fiserv Inc., PayCo, ACI Worldwide Inc., American Express Company, Toss, KakaoPay, Naver-Pay, VISA Inc., Mastercard Inc. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding due to the growing need for real-time payment solutions in the economy for the prompt distribution of wages. In addition, traditional banks are updating their payment infrastructure due to increased competitive pressure from fintech companies, which is fostering a favorable outlook for market growth in South Korea. Furthermore, the market is anticipated to grow more quickly due to rising customer demand for faster payment settlements and rising government and financial institution investments to encourage the use of real-time payment solutions. The demand for real-time payment solutions is also anticipated to increase as a result of the integration of cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT) into digital payment platforms.

Restraining Factors

One of the main barriers to the growth of the real-time payments market is the potential for security breaches. These transactions happen fast, so hackers might attempt to access them without authorization. This could lead to data theft, financial fraud, and service outages. Security holes could undermine user trust, prevent adoption, and result in financial losses for both customers and businesses if they are exploited. Robust authentication protocols, continual threat monitoring, and robust encryption are necessary to lower the risks and foster a secure environment for real-time payments.

Market Segment

- In 2022, the P2B segment accounted for the largest revenue share over the forecast period.

Based on the payment type, the South Korea real time payments market is segmented into P2P and P2B. Among these, the P2B segment has the largest revenue share over the forecast period. Lower-cost P2B transactions give businesses that can profit from real-time liquidity a new level of cash management because they settle instantly and provide an additional degree of customer service by instantly notifying the customer of the transaction's status.

- In 2022, the retail & e-commerce segment is expected to hold the largest share of the South Korea real time payments market during the forecast period.

Based on the end user, the South Korea real time payments market is classified into retail & e-commerce, BFSI, it & telecom, travel & tourism, government, healthcare, energy & utilities, and others Among these, the retail & e-commerce segment is expected to hold the largest share of the South Korea real-time payments market during the forecast period. The adoption of real-time payment solutions in this market has accelerated due to retailers' and merchants' growing demand for instantaneous payment settlement. Another significant factor fueling this segment's growth is the increasing preference for mobile-based shopping.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea real time payments market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fiserv Inc.

- PayCo

- ACI Worldwide Inc.

- American Express Company

- Toss

- KakaoPay

- Naver-Pay

- VISA Inc.

- Mastercard Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On March 2023, the Financial Regulator of South Korea gave its approval for Apple Pay to be introduced in the nation and permitted regional credit card companies to introduce Apple Pay Service. The financial authority anticipates that Apple Pay's introduction will help the NFC payment system gain traction in South Korea.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea real time payments market based on the below-mentioned segments:

South Korea Real Time Payments Market, By Payment Type

- P2P

- P2B

South Korea Real Time Payments Market, By End User

- Retail & E-commerce

- BFSI

- IT & Telecom

- Travel & Tourism

- Government

- Healthcare

- Energy & Utilities

- Others

Need help to buy this report?