South Korea SiC Ingots Market Size, Share, and COVID-19 Impact Analysis, By Product (Black Silicon Carbide and Green Silicon Carbide), By Application (Steel, Automotive, Aerospace, Military & Defense, Electronics, and Others), and South Korea SiC Ingots Market Insights Forecasts to 2033

Industry: Semiconductors & ElectronicsSouth Korea SiC Ingots Market Insights Forecasts to 2033

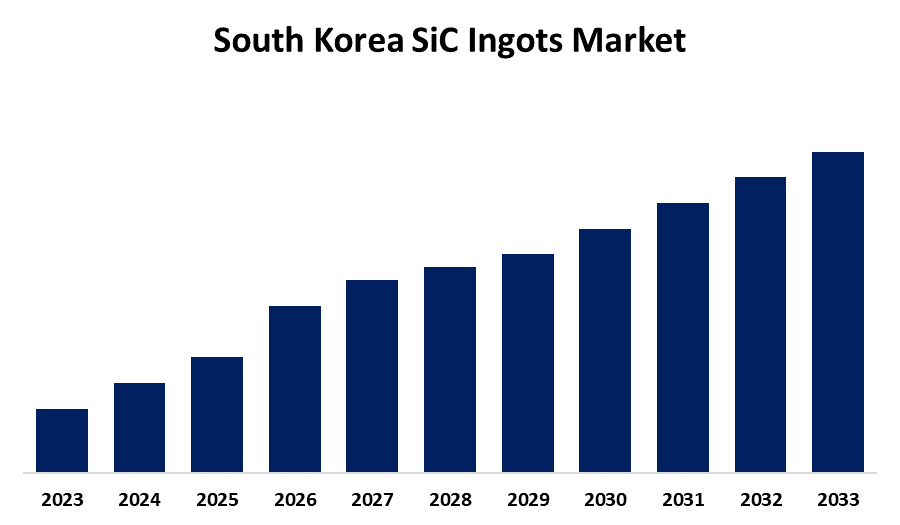

- The Market Size is Growing at a CAGR of 22.6% from 2023 to 2033

- The South Korea SiC Ingots Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The South Korea SiC Ingots Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 22.6% from 2023 to 2033.

Market Overview

Silicon carbide ingots are large-sized, monocrystalline, or polycrystalline masses of silicon carbide or SiC produced through different processes at high temperatures. As raw materials, silicon carbide ingots permit the production of semiconductor products and components, including power electronics, high-frequency devices, and light-emitting diodes (LED). The high-performance applications of silicon carbide are maximized through a unique set of properties: good thermal conductivity, electric breakdown strength, and resistance under high temperatures and radiation. These ingots are then cut into very thin wafers and further processed to manufacture electronic components. Furthermore, SiC is more thermally conductive than silicon, which permits the efficient dissipation of heat in high-power and high-temperature applications. It can tolerate more electric fields before breakdown; hence, the devices designed on this material may be fabricated at higher voltage and power levels. It can be operated at much higher temperatures compared to silicon, thus finding applications in harsh environments, thus reducing the need for cooling systems, which is thereby propelling the revenue of the silicon carbide ingot market.

Report Coverage

This research report categorizes the market for South Korea's SiC ingots market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea SiC ingots market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea SiC ingots market.

South Korea SiC Ingots Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 22.6% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 161 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | SK Materials, POSCO, Samsung SDI, Hanwa Chemical, LS Materials, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The South Korea SiC ingots market is driven by increasing demand for high-performance materials in various industries such as automotive, electronics, and renewable energy. The rise in electric vehicle (EV) production accelerates the need for SiC-based components like power semiconductors, which offer higher efficiency and durability. Technological advancements in semiconductor devices, coupled with growing investments in clean energy solutions, further support market growth. Additionally, the government's push for industrial modernization and the expanding semiconductor manufacturing sector contribute to the sustained demand for SiC ingots. These factors together foster a robust market outlook for SiC ingots in South Korea.

Restraining Factors

High production costs, limited raw material availability, and technological challenges in SiC ingot manufacturing hinder market growth. Additionally, competition from alternative materials and fluctuating energy prices add to market constraints.

Market Segment

The South Korea SiC ingots market share is classified into product and application.

- The green silicon carbide segment is expected to hold the largest market share through the forecast period.

The South Korea SiC ingots market is segmented by product into black silicon carbide and green silicon carbide. Among these, the green silicon carbide segment is expected to hold the largest market share through the forecast period. This is attributed to the green silicon carbide offers superior hardness, higher purity, and better thermal conductivity compared to black silicon carbide, making it highly suitable for applications in power electronics, automotive, and semiconductor industries. As demand for high-performance materials, particularly in electric vehicles (EVs) and renewable energy sectors, continues to rise, green silicon carbide’s advanced properties are likely to drive its dominant market share.

- The electronics segment is expected to hold the largest market share through the forecast period.

The South Korea SiC ingots market is segmented by application into steel, automotive, aerospace, military & defense, electronics, and others. Among these, the electronics segment is expected to hold the largest market share through the forecast period. This is attributed to the growing demand for high-performance semiconductors, particularly in power devices, which is a key driver. Silicon carbide's superior properties, such as high efficiency, thermal conductivity, and voltage tolerance, make it ideal for power electronics applications, including electric vehicles (EVs), renewable energy systems, and advanced electronics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea SiC ingots market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SK Materials

- POSCO

- Samsung SDI

- Hanwa Chemical

- LS Materials

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the South Korea SiC ingots market based on the below-mentioned segments

South Korea SiC Ingots Market, By Product

- Black Silicon Carbide

- Green Silicon Carbide

South Korea SiC Ingots Market, By Application

- Steel

- Automotive

- Aerospace

- Military & Defense

- Electronics

- Others

Need help to buy this report?