South Korea Surgical Dressing Market Size, Share, and COVID-19 Impact Analysis, By Dressing Type (Primary and Secondary), By Product (Traditional and Advanced), By End User (Hospitals, Ambulatory Surgical Centers, and Others), and South Korea Surgical Dressing Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareSouth Korea Surgical Dressing Market Insights Forecasts to 2033

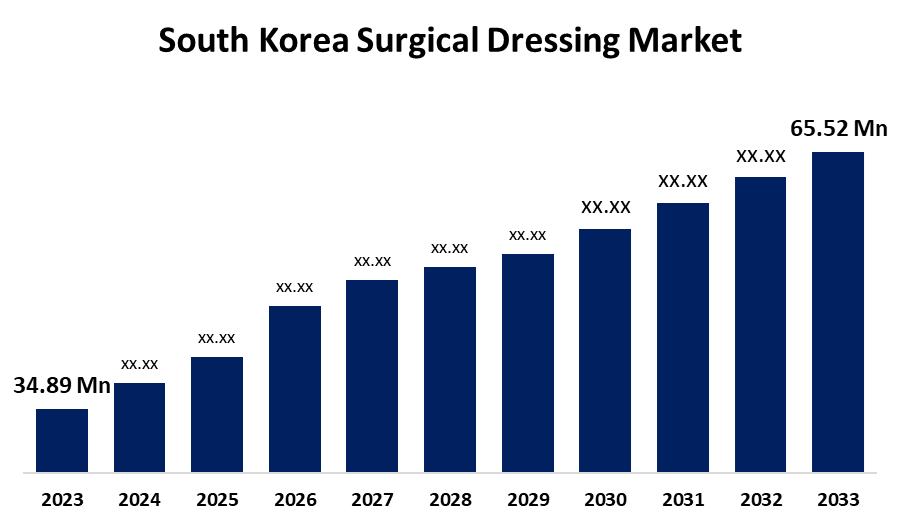

- The South Korea Surgical Dressing Market Size was valued at USD 34.89 Million in 2023.

- The Market Size is Growing at a CAGR of 6.5% from 2023 to 2033

- The South Korea Surgical Dressing Market Size is Expected to Reach USD 65.52 Million by 2033

Get more details on this report -

The South Korea Surgical Dressing Market Size is anticipated to reach USD 65.52 Million by 2033, growing at a CAGR of 6.5% from 2023 to 2033.

Market Overview

Surgical dressings play a critical role in wound care, helping to prevent infection and heal wounds more quickly. South Korea's established healthcare infrastructure and high levels of medical care drive demand for high-quality dressing materials such as gauze, bandages, hydrocolloids, and silicone-based dressings. Government efforts to enhance healthcare services and raise medical reimbursements also drive market growth. The growing incidence of chronic illnesses, surgeries, and accidents also contributes significantly to the increasing demand for surgical dressings. Furthermore, with an emphasis on new, non-invasive, and patient-centric solutions, there has been growth in advanced wound care products like antimicrobial and hydrophilic dressings. Players are investing in product development and network expansion to leverage the growing demand. Consequently, the South Korean market for surgical dressing is likely to keep growing in the years ahead, driven by advances in technology, population changes, and enhancements in health.

Report Coverage

This research report categorizes the market for the South Korea surgical dressing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea surgical dressing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea surgical dressing market.

South Korea Surgical Dressing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 34.89 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.5% |

| 2033 Value Projection: | USD 65.52 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By End User and COVID-19 Impact Analysis |

| Companies covered:: | 3M Company, Coloplast, Cardinal Health Inc., B. Braun SE, Essity Aktiebolag AB, Organogenesis Holdings Inc., Johnson and Johnson, Smith and Nephew plc., Convatec Group PLC, Molnlycke Health Care AB, and Other Key Players |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Technological advancements in healthcare and product 0development, such as antimicrobial, hydrophilic, and silicone dressings, are also stimulating the growth. Furthermore, government initiatives aimed at improving healthcare services and raising reimbursement levels for medical procedures also drive demand for surgical dressings. The rising number of surgeries and awareness regarding the significance of infection prevention and wound healing are also crucial drivers for the industry's growth.

Restraining Factors

The industry is challenged by intense competition from generic and lower-priced equivalents, which could stifle the market for newer, higher-quality offerings. Regulatory hurdles and strict approval procedures for medical devices may also hinder the launch of new products.

Market Segmentation

The South Korea surgical dressing market share is classified into dressing type, product, and end user.

- The primary segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The South Korea surgical dressing market is segmented by dressing type into primary and secondary. Among these, the primary segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growth in the segment is due to the development in the primary dressing making it effective in wound healing. Moreover, the extensive product range provided by the major players is driving the use of primary dressings and thereby, enhancing the market growth.

- The traditional segment accounted for the highest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The South Korea surgical dressing market is segmented by product into traditional and advanced. Among these, the traditional segment accounted for the highest share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The growth is due to the affordability of the traditional dressings that enhance their use in wound treatment in both the developed and developing regions.

- The hospital segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The South Korea surgical dressing market is segmented by end user into hospitals, ambulatory surgical centers, and others. Among these, the hospital segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The growth is credited to the resumption of delayed surgeries, and the rise in demand for surgical dressings from hospitals. Furthermore, a rise in patient visits to hospitals post-pandemic increases the growth of the hospital segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea surgical dressing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- Coloplast

- Cardinal Health Inc.

- B. Braun SE

- Essity Aktiebolag AB

- Organogenesis Holdings Inc.

- Johnson and Johnson

- Smith and Nephew plc.

- Convatec Group PLC

- Molnlycke Health Care AB

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Convatec announced the U.S. launch of ConvaFoam, a family of advanced foam dressings that can be used on a spectrum of wound types at any stage for wound management and skin protection.

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Korea surgical dressing market based on the below-mentioned segments:

South Korea Surgical Dressing Market, By Dressing Type

- Primary

- Secondary

South Korea Surgical Dressing Market, By Product

- Traditional

- Advanced

South Korea Surgical Dressing Market, By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

Need help to buy this report?