South Korea Telecom Market Size, Share, and COVID-19 Impact Analysis, By Service (Voice Service, Data & Messaging Service, OTT & Pay-TV Service), By Transmission (Wireline, Wireless), By End User (Consumer, Business), and South Korea Telecom Market Insights Forecasts 2022 – 2032

Industry: Information & TechnologySouth Korea Telecom Market Insights Forecasts to 2032

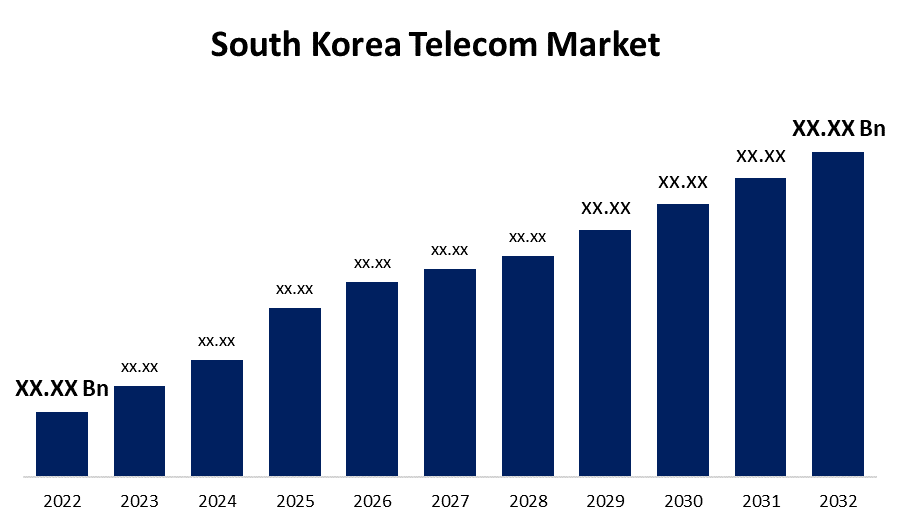

- The South Korea Telecom Market Size was valued at USD XX Billion in 2022.

- The Market is Growing at a CAGR of 3.15% from 2022 to 2032.

- The South Korea Telecom Market Size is Expected To Reach XX Billion by 2032.

Get more details on this report -

The South Korea Telecom Market Size is Expected To Reach USD XX Billion by 2032, at a CAGR of 3.15% during the forecast period 2022 to 2032.

Market Overview

The industry of telecommunications is primarily made up of businesses that enable global communication, whether via phone, internet, airwaves, or cables. These businesses build the infrastructure that allows data to be sent anywhere in the world in the form of text, voice, audio, or video. Phone operators (both wired and wireless), satellite companies, cable companies, and internet service providers are the largest companies in the sector. It minimizes the cost of communication when compared to traditional methods such as postal services and in-person meetings. Businesses use it extensively for virtual seminars, interviews, and webinars. Aside from that, as it connects people and businesses and facilitates international collaboration and trade, demand for telecom is rising in South Korea. The industry's growth is primarily due to the country's growing urban population, as well as a growing number of mobile phones that support 3G, 4G, and 5G services. With the rising adoption of the Internet of Things (IoT) in the sector that connects with wired and wireless broadband, the telecom sector is expected to grow rapidly over the forecast period. Despite low economic and population growth, the South Korean telecommunications market is the third-largest in the world by revenue, with three large fixed and mobile network operators investing heavily in towers and fibre infrastructure over the last two decades.

Report Coverage

This research report categorizes the market for the South Korean telecom market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean telecom market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korean telecom market.

South Korea Telecom Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD XX Billion |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 3.15% |

| 022 – 2032 Value Projection: | USD XX Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service, By Transmission, By End User, and COVID-19 Impact Analysis. |

| Companies covered:: | Hyundai CNS, KT, LG Uplus, CMB, Dreamline, D'Live, SK Telecom, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industry's growth is primarily driven by the rising population, communication services, and the increasing adoption of smartphone services. Premium connectivity and content services in South Korea account for the majority of market growth. Consumers, on the other hand, benefit from robust and forward-thinking regulatory regimes for these services even though telecom service revenues have increased due to users primarily adopting work-from-home practices and spending more time streaming video, games, and other forms of entertainment while at home during the pandemic.

Market Segment

- In 2022, the data & messaging services segment accounted for the largest revenue share over the forecast period.

Based on the services, the South Korean telecom market is segmented into voice service, data & messaging services, OTT and Pay-TV Services. Among these, the data & messaging services segment has the largest revenue share over the forecast period. The reason behind growth is the marked increase in the number of consumers using smartphones. Demand for high-speed broadband services for corporate and residential applications is expected to drive segment growth over the forecast period.

- In 2022, the wireless segment accounted for the largest revenue share over the forecast period.

Based on transmission, the South Korea telecom market is segmented into wireline and wireless. Among these, the wireless segment has the largest revenue share over the forecast period. The development of cloud computing technologies, artificial intelligence, and IoT is expected to significantly contribute to the global expansion of wireless communication channels. Wireless Local Area Network (WLAN) systems have been rapidly deployed over the years, enabling internet usage from cellular devices in private homes, public spaces, airports, office buildings, cafeterias, and various other areas.

- In 2022, the consumer segment is expected to hold the largest share of the South Korea telecom market during the forecast period.

Based on the end user, the South Korea telecom market is classified into consumer and business. Among these, the consumer segment is expected to hold the largest share of the South Korean telecom market during the forecast period. Remote working and bring your device (BYOD) are the major factors, which drive the demand for telecommunication services in consumer applications. In addition, with the growing need for wide and strong connectivity, enterprises are opting for telecommunication services that transmit at power levels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea telecom market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hyundai CNS

- KT

- LG Uplus

- CMB

- Dreamline

- D'Live

- SK Telecom

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, LG Uplus announced the launch of its new AI product offering as part of its digital strategy. The new service is part of the company's long-term strategy to become a provider of digital platform services. According to South Korea's third largest telecom service provider, the new AI service known as "ixi" provides AI-powered services for small business administration, customer call centers, sports match predictions, and content suggestions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea telecom market based on the below-mentioned segments:

South Korea Telecom Market, By Service

- Voice Service

- Data and Messaging Service

- OTT & Pay-TV Service

South Korea Telecom Market, By Transmission

- Wireline

- Wireless

South Korea Telecom Market, By End- User

- Consumer

- Business

Need help to buy this report?