South Korea Third-Party Logistics (3PL) Market Size, Share, and COVID-19 Impact Analysis, By Service (Domestic Transportation, International Transportation, Value-Added Warehousing, Distribution, Others), By Mode of Transport (Railways, Roadways, Waterways, Airways), By Application (Manufacturing, Retail, Healthcare, Automotive, Others), and South Korea Third-Party Logistics (3PL) Market Insights Forecasts to 2032

Industry: Automotive & TransportationSouth Korea Third-Party Logistics (3PL) Market Insights Forecasts to 2032

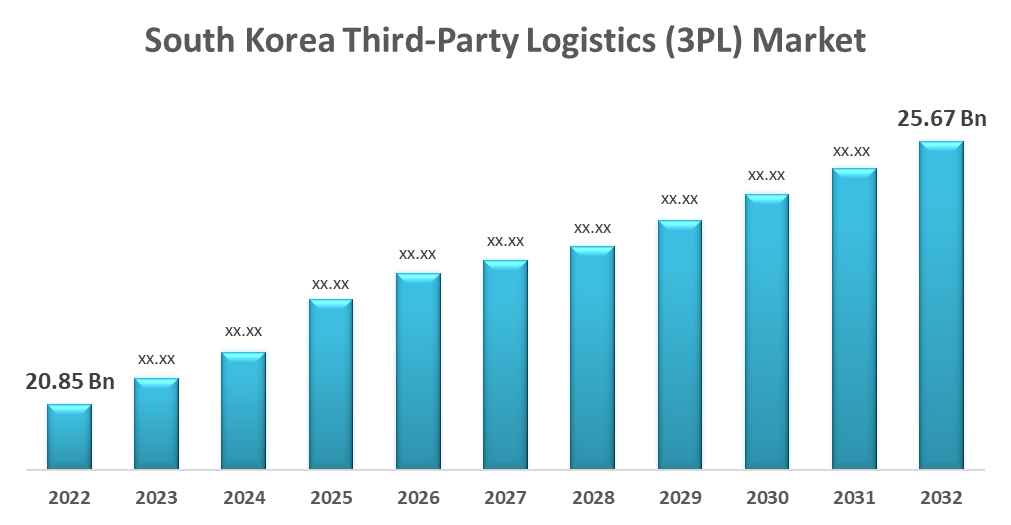

- The South Korea Third-Party Logistics (3PL) Market Size was valued at USD 20.85 Billion in 2022.

- The Market Size is Growing at a CAGR of 2.1% from 2022 to 2032.

- The South Korea Third-Party Logistics (3PL) Market Size is Expected to reach USD 25.67 Billion by 2032.

Get more details on this report -

The South Korea Third-Party Logistics (3PL) Market Size is expected to reach USD 25.67 Billion by 2032, at a CAGR of 2.1% during the forecast period 2022 to 2032.

Market Overview

Third-party logistics, also known as 3PL, is the practice of outsourcing various operational aspects of logistics and supply chain management to third-party service providers. These services are intended to assist businesses in streamlining their logistics operations, lowering costs, and increasing efficiency, allowing them to focus on core business activities. The third-party (3PL) logistics market in South Korea is a developed market with local and international players actively participating in the logistics of the country. The growth in the market is fuelled by the increasing mergers, acquisitions, and expansion deals by the existing companies to facilitate better service at less cost and at the same time penetrate the South Korean third-party logistics market. Furthermore, the Korean Government proposed the construction of trade and logistics centers and a free economic zone to create joint ventures for food processing, increasing the export capacity of Kyrgyzstan and exporting Kyrgyz organic products to other markets. The Korean company CJ Group was offered the construction of this trade and logistics center and free economic zone.

Report Coverage

This research report categorizes the market for South Korea third-party logistics (3PL) market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korea Third-Party Logistics (3PL) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korea Third-Party Logistics (3PL) market.

South Korea Third-Party Logistics (3PL) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 20.85 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 2.1% |

| 2032 Value Projection: | USD 25.67 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Services, By Mode of Transport, By Application |

| Companies covered:: | DSV, CJ Logistics Corporation, Pantos Logistics, Kuehne + Nagel, Toll Holdings Limited, CJ Logistics Corporation, Pantos Co., Lotte Global Logistics, Sebang Co., Daewoo Logistics, KCTC, Sunjin, SF Express, Jupiter Express, Logos Global and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in the emergence of numerous e-commerce websites along with the availability of low-cost cargo acts as one of the major factors driving the South Korean third-party logistics market. The rise in popularity of C2C and B2C e-commerce websites has increased demand for domestic and international logistics, positively impacting the market. Furthermore, the increase in sales of foreign goods, which encourages cross-border e-commerce, accelerates market growth. Furthermore, the rise in Internet of Things penetration across the region, which allows consumers to purchase products online, drives the third-party logistics market growth. As a result, the rise in the e-commerce industry as a result of increased online purchases by consumers has further influenced the market. The growing popularity of e-commerce websites due to their fast delivery, door-to-door deliveries, and high discounts contributes to the growth of the third-party logistics market over the forecast period.

Restraining Factors

Uncertain economic conditions are a major impediment to the growth of the South Korean third-party logistics (3PL) market. National and regional macroeconomic conditions have a significant impact on the third-party logistics (3PL) industry. Uncertainty about current economic conditions, on the other hand, will be detrimental to the third-party logistics (3PL) industry, as customers may postpone spending in response to tighter credit, a decline in income or asset values, or negative financial news.

Market Segment

- In 2022, the domestic transportation segment accounted for a major share over the forecast period.

Based on the service, the South Korean third-party logistics (3PL) market is segmented into domestic transportation, international transportation, value-added warehousing, distribution, and others. Among these, the domestic transportation segment accounted for a major share over the forecast period. This is primarily due to South Korean third-party logistics conglomerates acquiring other logistics service providers during the forecast period to expand their businesses and market share. For example, Rhenus Group acquired the logistics group LOXX in May 2020, which focuses on general cargo, less-than-truckload (LTL), and full truckload (FTL) business segments, to improve the company's LTL and domestic transportation abilities in Germany.

- In 2022, the roadways segment accounted fastest growth over the forecast period.

Based on mode of transportation, the South Korean third-party logistics (3PL) market is segmented into railways, roadways, waterways, and airways. Among these, the roadways segment accounted fastest growth over the forecast period. The improvement of road infrastructure and an increase in cross-border trade between landlocked countries across South Korea can be attributed to the growth. Furthermore, increased highway traffic congestion is an important driver in the growth of railway logistics transportation. As a result, rising modes of transportation options for third-party logistics have a positive impact on the growth of the South Korean third-party logistics market over the forecast period.

- In 2022, the automotive segment accounted fastest growth over the forecast period.

Based on application, the South Korean third-party logistics (3PL) market is segmented into manufacturing, retail, healthcare, automotive, and others. Among these, the automotive segment accounted fastest growth over the forecast period. In South Korea, many automobile manufacturers are partnering with specialist automotive third-party logistics service providers to find effective solutions and enter in new market, for secure and effective transportation of products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea third-party logistics (3PL) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DSV

- CJ Logistics Corporation

- Pantos Logistics

- Kuehne + Nagel

- Toll Holdings Limited

- CJ Logistics Corporation

- Pantos Co.

- Lotte Global Logistics

- Sebang Co.

- Daewoo Logistics

- KCTC

- Sunjin

- SF Express

- Jupiter Express

- Logos Global

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, DSV and Gymshark entered into a strategic partnership to enable Gymshark to meet growing international sales, complex supply chain requirements, and customer expectations. As an official logistics and transport partner of the British fitness community and apparel brand, Gymshark, DSV will play a key role in supporting the company's ambitious growth strategy. In this capacity, DSV will provide international multimodal transport solutions for Gymshark's fitness wear, apparel, and accessories.

- In August 2022, Daewoo Logistics opened a container yard catering to Busan New Port on 24 August, capable of handling 3,580 TEU daily. The 45,608-square meter facility is located in Jinhae district in Changwon in South Gyeongsam province. The Busan-Jinhae Economic Free Economic Zone is a logistics hub in northeast Asia.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korea third-party logistics (3PL) market based on the below-mentioned segments:

South Korea Third-Party Logistics (3PL) Market, By Service

- Domestic Transportation

- International Transportation

- Value-Added Warehousing

- Distribution

- Others

South Korea Third-Party Logistics (3PL) Market, By Mode of Transport

- Railways

- Roadways

- Waterways

- Airways

- Others

South Korea Third-Party Logistics (3PL) Market, By Application

- Manufacturing

- Retail

- Healthcare

- Automotive

- Others

Need help to buy this report?