South Korea Water Purifiers Market Size, Share, and COVID-19 Impact Analysis, By Technology (UV, RO, and Gravity Based), By Portability (Portable and Non-Portable), By Distribution Channel (Retail Stores, Direct Sales, and Online), By End-User (Commercial and Residential), and South Korea Water Purifiers Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsSouth Korea Water Purifiers Market Insights Forecasts to 2033

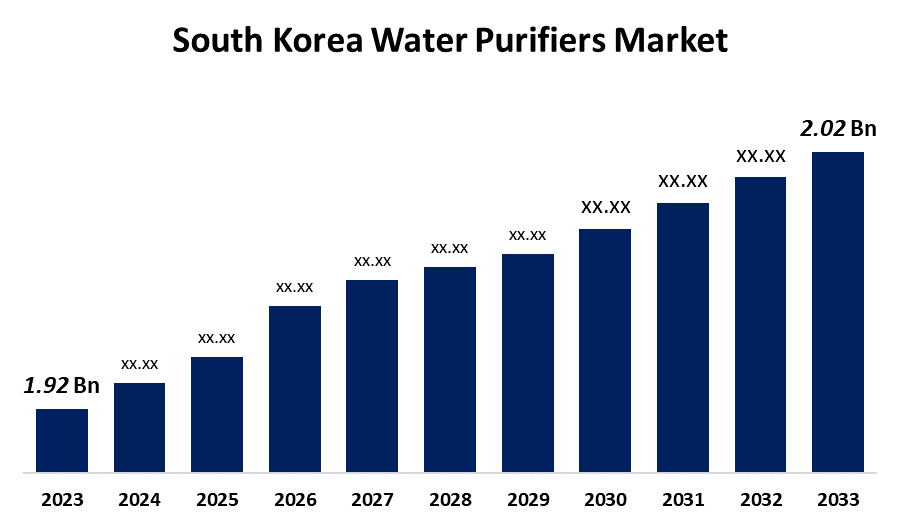

- The South Korea Water Purifiers Market Size was valued at USD 1.92 billion in 2023.

- The Market is growing at a CAGR of 5.21% from 2023 to 2033

- The South Korea Water Purifiers Market Size is expected to reach USD 2.02 billion by 2033

Get more details on this report -

The South Korea Water Purifiers Market is anticipated to exceed USD 2.02 billion by 2033, growing at a CAGR of 5.21% from 2023 to 2033. The growing preference for purified drinking water and continuous technological advancements in products are driving the growth of the water purifiers market in the South Korea.

Market Overview

Water purifiers are devices that are used to remove unwanted biological contaminants and chemicals from water obtained from water bodies like lakes, rivers, etc. to produce pure drinking water, which is fit for human consumption. South Korea has an integrated water management system to provide water to the country via water treatment, recycling, and delivery. As per the survey by the Ministry of Environment in 2021, 36% drink water from the tap, and even some of those still boil it first. This situation surges the demand for water purifiers in South Korea. Investments in R&D for the development of innovative products including improved connectivity, AI-powered automation like voice control integration, and enhanced user interfaces are the new trend of water purifiers. Coway and Chungho the leading players that were operating in reverse osmosis technology are now using nanofiltration and hollow fiber membrane (UF) methods in water purifiers. Additionally, the countertop water purifier provides a hassle-free way to access purified water for drinking and cooking without the need for a larger filtration system. Moreover, countertop water purifiers in South Korea often feature advanced filtration technologies such as activated carbon filters, reverse osmosis (RO) membranes, or multi-stage filtration systems. Some water purifier companies are selling water purifiers in a rental method to target consumers who are reluctant to purchase expensive water purifiers costing more than 2-3 million won per unit.

Report Coverage

This research report categorizes the market for the South Korea water purifiers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Water Purifiers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the water purifiers market.

South Korea Water Purifiers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.92 billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 5.21% |

| 2033 Value Projection: | USD 2.02 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Technology, By Portability, By Distribution Channel, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | LG Electronics Co., Ltd., Coway Co. Ltd., 3M Korea Co., Ltd., Amway Korea Co., Ltd., SK Magic Co., Ltd., ChungHo Nais Co., Ltd., Cuckoo Electronics Co. Ltd., Kyowon Property Wells Co., Ltd., Picogram Co., Ltd., WACO Corporation, Others Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The preference for purified drinking water and continuous technological advancements in products are significantly driving the South Korea water purifiers market. The benefits associated with the use of water purifiers such as safe and pure drinking water, elimination of disease-causing micro-organisms, and removal of dissolved solids are driving the market demand. The preference for quality drinking water among the people is also driving the market demand. The emphasis on health and well-being as well as growing awareness about the importance of clean and safe drinking water are significantly responsible for propelling the market growth.

Restraining Factors

The frequent maintenance of complex filtration systems which have multiple components such as filters, membranes, and UV lamps is considered a major market challenge. Further, the high installation costs of water purifiers compared to tap water restrict the sale of water purifiers which may lead to restrain the market growth.

Market Segmentation

The South Korea Water Purifiers Market share is classified into technology, portability, distribution channel, and end-user.

- The RO segment dominates the market with the largest market share during the forecast period.

The South Korea water purifiers market is segmented by technology into UV, RO, and gravity based. Among these, the RO segment dominates the market with the largest market share during the forecast period. RO water purifier possesses high-performance efficiency, low electricity consumption, and regular technological innovation. The adoption of RO water purifiers due to their efficiency and cost-effectiveness is driving the market growth in the RO segment.

- The non-portable segment is dominating the South Korea water purifiers market during the forecast period.

The South Korea water purifiers market is segmented by portability into portable and non-portable. Among these, the non-portable segment is dominating the South Korea water purifiers market during the forecast period. Large volumes of water can be stored and purified with a water purifier. The rising adoption and affordability of water purifiers are driving the market growth in the non-portable segment.

- The retail stores segment accounted for the largest share of the South Korea water purifiers market during the forecast period.

Based on the distribution channel, the South Korea water purifiers market is divided into retail stores, direct sales, and online. Among these, the retail stores segment accounted for the largest share of the South Korea water purifiers market during the forecast period. Higher affinity of consumers towards physical stores, as these are perceived to be safe and allow consumers to try the product before purchase. The advantage of immediate gratification boosts popularity which is likely to drive the market.

- The residential segment accounted for the largest share of the South Korea water purifiers market in 2023.

Based on the end-user, the South Korea water purifiers market is divided into commercial and residential. Among these, the residential segment accounted for the largest share of the South Korea water purifiers market in 2023. Water purifier is popularly used by residential users as it is essential for overall well-being and family health. The growing urbanization and increased incidence of waterborne diseases are driving the market demand in the residential users segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korea water purifiers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LG Electronics Co., Ltd.

- Coway Co. Ltd.

- 3M Korea Co., Ltd.

- Amway Korea Co., Ltd.

- SK Magic Co., Ltd.

- ChungHo Nais Co., Ltd.

- Cuckoo Electronics Co. Ltd.

- Kyowon Property Wells Co., Ltd.

- Picogram Co., Ltd.

- WACO Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2021, Samsung Electronics introduced its first-ever water purifier as the tech giant enters the fast-growing home water purifier market amid the pandemic-induced stay-at-home trend. Samsung's BESPOKE water purifier is an under-sink, modular-type product that offers enhanced customising options.

Market Segment

This study forecasts revenue at South Korea, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Korea Water Purifiers Market based on the below-mentioned segments:

South Korea Water Purifiers Market, By Technology

- UV

- RO

- Gravity Based

South Korea Water Purifiers Market, By Portability

- Portable

- Non-Portable

South Korea Water Purifiers Market, By Distribution Channel

- Retail Stores

- Direct Sales

- Online

South Korea Water Purifiers Market, By End-User

- Commercial

- Residential

Need help to buy this report?