South Korean Luxury Goods Market Size, Share, and COVID-19 Impact Analysis, By Type (Clothing & Apparel, Footwear, Bags, Jewelry & Watches, Others), By Distribution Channel (Single-Brand Stores, Multi-Brand Stores, Online Stores, Others), and South Korea Luxury Goods Market Insights Forecasts to 2032

Industry: Consumer GoodsSouth Korea Luxury Goods Market Insights Forecasts to 2032

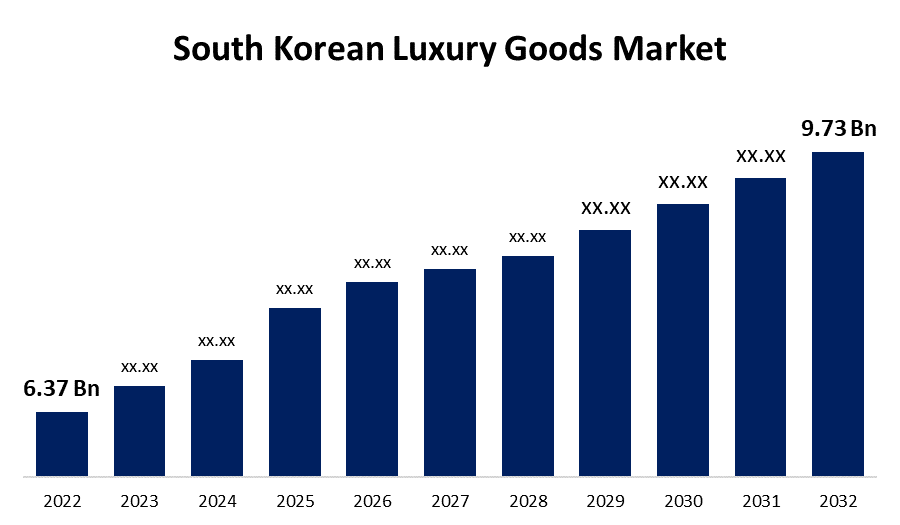

- The South Korea Luxury Goods Market Size was valued at USD 6.37 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.33% from 2022 to 2032.

- The South Korea Luxury Goods Market Size is expected to reach USD 9.73 Billion by 2032.

Get more details on this report -

The South Korean Luxury Goods Market Size is expected to reach USD 9.73 billion by 2032, at a CAGR of 4.33% during the forecast period 2022 to 2032.

Market Overview

In a culture or society, luxury goods are highly desirable even though it is not necessary to survive. A rise in wealth or income is correlated with a rise in demand for luxury goods. Generally, purchases of luxury goods increase proportionately with higher income growth rates. The world's largest luxury goods market, South Korea has grown quickly because of the global fandom of K-pop and K-drama, as well as the growing purchasing power of Gen Z and millennials. Furthermore, one main factor is the strong economy of the nation, which enables consumers to have more disposable income and thus increases the accessibility of luxury goods. The growing impact of Hallyu, or the Korean Wave, which promotes South Korean culture and style internationally and increases the appeal of domestic luxury brands, is another factor contributing to the rise in demand for luxury goods. Cultural trends, celebrity endorsements, and social media have a big impact on their buying decisions. Younger consumers are more likely to make frequent purchases because they are driven by the need for social recognition and personal expression than older generations, who frequently view luxury goods as long-term investments. Moreover, the country of South Korea is emerging as a centre for international luxury brands' design. Numerous factors are driving the substantial growth of the luxury goods market in South Korea during the forecast period.

Report Coverage

This research report categorizes the market for South Korea luxury goods market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Korean luxury goods market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Korean luxury goods market.

South Korean Luxury Goods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 6.37 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.33% |

| 2032 Value Projection: | USD 9.73 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel, and COVID-19 Impact Analysis. |

| Companies covered:: | The Estee Lauder Companies Inc., H & M Hennes & Mauritz AB, Gentle Monster, We11done, Chanel, H & M Hennes & Mauritz AB, Prada Holding S.p.A, LVMH Moet Hennessy Louis Vuitton, Prada Holding S.p.A, Rolex SA, Kering Group, Hermes International SA, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The dynamic retail environment for luxury goods in South Korea is being positively impacted by the quick expansion of digital payment systems and e-commerce platforms. Although brick-and-mortar retail experiences remain important, these online channels are making it easier for consumers to shop for luxury items online. In-store cafes, interactive displays, and art installations are just a few of the experiential ways that brands can interact with customers in physical retail spaces, enhancing the overall shopping experience. In addition, increased expenditure on luxury goods has resulted from the easing of travel restrictions and the nation's standing as a well-liked tourist destination, especially for visitors from China and other nearby nations. Oftentimes, travellers look for luxury goods to give as gifts or status symbols.

Restraining Factors

The South Korean market for original luxury products is expected to be adversely affected by the growing trend of buying rebranded products used or renting luxury goods because the former is often available for less money than the latter. The South Korean market's expansion is also anticipated to be constrained by the expanding counterfeiting trend, which sees lower-priced goods bearing luxury brand names offered.

Market Segment

- In 2022, the jewellers & watches segment accounted for the largest revenue share over the forecast period.

Based on the type, the South Korea luxury goods market is segmented into clothing & apparel, footwear, bags, jewellers & watches, and others. Among these, the jewellers & watches segment has the largest revenue share over the forecast period. The rapidly changing fashion trends, and growing demand from end users, both male and female. The category of watches and jewellery is expected to hold a substantial portion of the market due to the growing demand for a range of jewellery goods and sophisticated luxury watches. However, the demand for luxury goods is expected to rise rapidly, especially for leather goods, which will drive up demand for bags in the South Korean luxury goods market.

- In 2022, the multi-brand stores segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the South Korean luxury goods market is segmented into single-brand stores, multi-brand stores, online stores, and others. Among these, the multi-brand stores segment has the largest revenue share over the forecast period. Having several brands can help attract new consumers and meet a variety of customer needs. Opportunities for cross-selling and up-selling exist for a variety of audiences, including those with varying income levels, ages, tastes, and values.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Korean luxury goods market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Estee Lauder Companies Inc.

- H & M Hennes & Mauritz AB

- Gentle Monster

- We11done

- Chanel

- H & M Hennes & Mauritz AB

- Prada Holding S.p.A

- LVMH Moet Hennessy Louis Vuitton

- Prada Holding S.p.A

- Rolex SA

- Kering Group

- Hermes International SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, the luxury South Korean brand We11done, which is the house brand of the Korean concept store Rare Market, reached an agreement to be acquired by Sequoia Capital China.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the South Korean luxury goods market based on the below-mentioned segments:

South Korea Luxury Goods Market, By Type

- Clothing & Apparel

- Footwear

- Bags

- Jewelry & Watches

- Other

South Korea Luxury Goods Market, By Distribution Channel

- Single-Brand Stores

- Multi-Brand Stores

- Online Store

- Other

Need help to buy this report?