Global Space Debris Monitoring and Removal Market Size, Share, and COVID-19 Impact Analysis, By Debris Size Range (1mm to 1cm, 1cm to 10cm, and Greater Than 10cm), By Orbit Type (Low Earth Orbit (LEO) and Geostationary Earth Orbit (GEO)), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Space Debris Monitoring and Removal Market Insights Forecasts to 2033

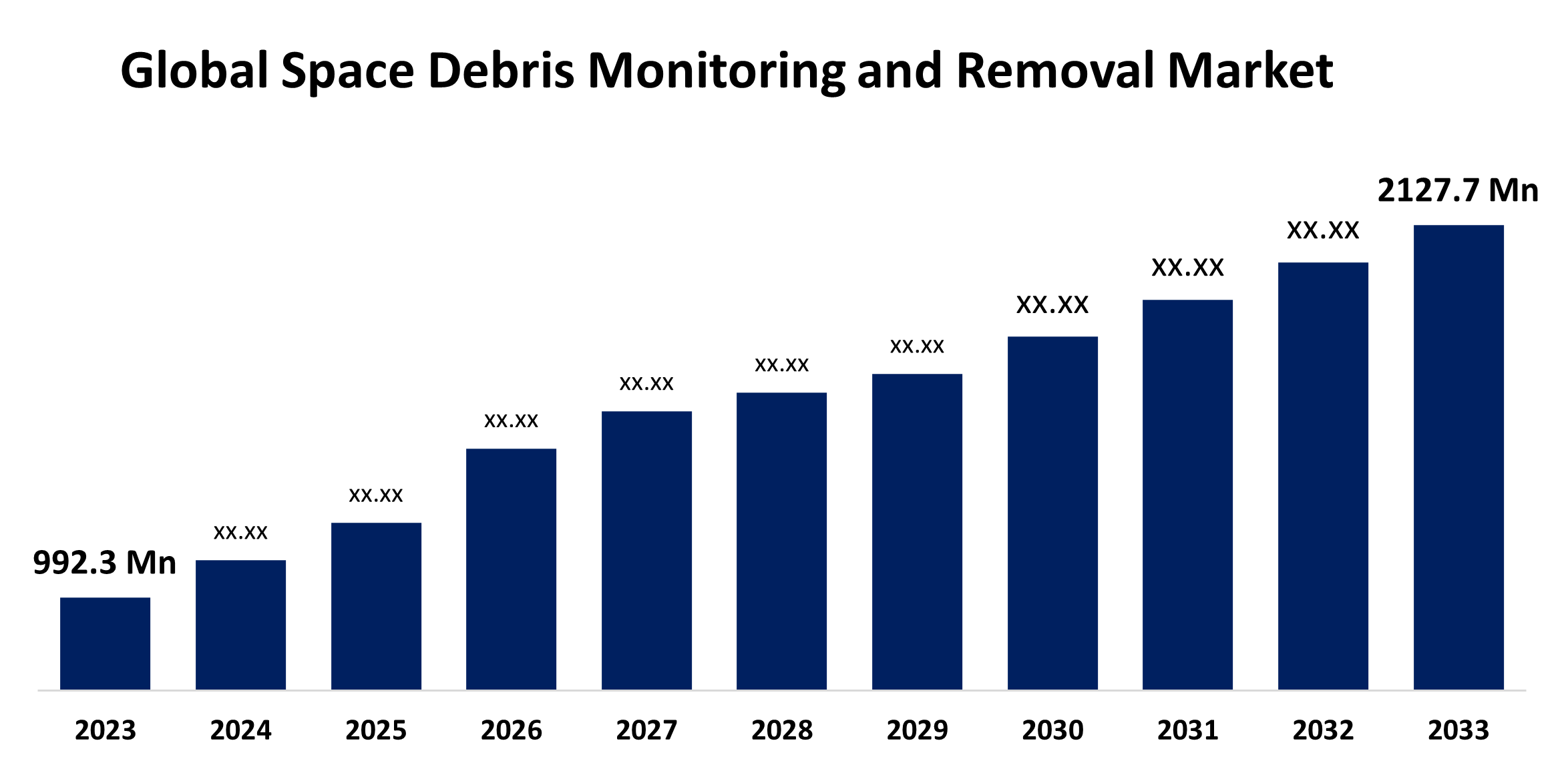

- The Global Space Debris Monitoring and Removal Market Size was Valued at USD 992.3 Million in 2023

- The Market Size is Growing at a CAGR of 7.93% from 2023 to 2033

- The Worldwide Space Debris Monitoring and Removal Market Size is Expected to Reach USD 2,127.7 Million by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Space Debris Monitoring and Removal Market Size is anticipated to exceed USD 2,127.7 Million by 2033, growing at a CAGR of 7.93% from 2023 to 2033.

Market Overview

Artificial objects that are no longer in use but still orbit the Earth are referred to as space trash. Anything in orbit, including defunct spacecraft, parts of launch vehicles, and other abandoned equipment with no use, is considered space junk. The growth of space organizations and agencies has led to a sharp rise in demand for space debris monitoring and clearance services. The market is growing as a result of the deployment of various satellites for various purposes. The market's growth has been greatly aided by the rise of space solution service providers. Companies that monitor and clean up space debris are essential to the space sector and are in charge of dealing with the problem. Numerous space exploration initiatives are driving up market demand. The market is being driven by the substantial expansion of network-based and communication services, which is increasing demand for satellite launches. There are several locations throughout the world where orbital launches have been enhanced. The market for tracking and getting rid of space trash is growing due to the cooperation of important players from different countries to spread awareness about space solutions.

Report Coverage

This research report categorizes the global space debris monitoring and removal market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global space debris monitoring and removal market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global space debris monitoring and removal market.

Global Space Debris Monitoring and Removal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 992.3 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.93% |

| 023 – 2033 Value Projection: | USD 2,127.7 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 257 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Debris Size Range,By Orbit Type, By Regional Analysis |

| Companies covered:: | Airbus SAS, Altius Space Machines, Astroscale Holdings, ClearSpace, D-Orbit, Electro Optic Systems, Lockheed Martin Corporation, Northrop Grumman Corporation, Obruta Space Solutions Corp., Orbit Guardians Corporation, Share my space, and Other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industry is expanding as a result of the launch of several satellites for diverse uses. The growth rate of the space debris monitoring and removal market is accelerated when network-based technologies support satellite launches. In human history, there have only been roughly 6,300 successful rocket launches, yet millions of pieces of man-made debris have orbited the planet as a result. The sustainability of space is becoming a serious worry due to the enormous growth in space debris, which could result from tens of thousands more launches over the next ten years. The need for the space debris monitoring and removal market is being driven by the growing amount of space debris, since efficient management is becoming essential to the long-term viability of space operations. Additionally, the Union of Concerned Scientists (UCS), which keeps track of operating satellites, has established that, as of January 2022, there are 8,261 spacecraft circling the Earth, of which only 4,852 are active (as of the end of December 2021). This information is based on UNOOSA statistics. Inactive satellites in orbit and in space are becoming more common, which is driving up demand for the space debris monitoring and removal market.

Restraints & Challenges

The cost of tracking and removing space junk is high. The development and deployment of monitoring technologies, such as space-based sensors and ground-based radars, come with significant costs.

Market Segmentation

The global space debris monitoring and removal market share is classified into debris size range and orbit type.

- The 1mm to 1cm segment is expected to hold the largest share of the global space debris monitoring and removal market during the forecast period.

Based on the debris size range, the global space debris monitoring and removal market is categorized as 1mm to 1cm, 1cm to 10cm, and greater than 10cm. Among these, the 1mm to 1cm segment is expected to hold the largest share of the global space debris monitoring and removal market during the forecast period. The main cause of this was an increase of rocket bodies and small particles brought on by satellite launches all around the world. There are over 128 million objects in orbit around the Earth, according to the European Space Agency. Due to an increase in space exploration activities, the 1 to 10 cm section is expanding at the highest rate.

- The low earth orbit segment is expected to grow at the fastest CAGR during the forecast period.

Based on the orbit type, the global space debris monitoring and removal market is categorized as low earth orbit (LEO) and geostationary earth orbit (GEO). Among these, the low earth orbit segment is expected to grow at the fastest CAGR during the forecast period. The rise is attributed to the participants' growing desire to place communication satellites in the low earth orbit (LEO) throughout the course of the following five years. Within the next five years, SpaceX hopes to provide internet access everywhere. As part of the Starlink effort, the company intends to launch 1,440 satellites to provide internet access. As a result, there will be more space trash in the Low Earth Orbit (LEO), which will encourage market growth.

Regional Segment Analysis of the Global Space debris monitoring and removal Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global space debris monitoring and removal market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global space debris monitoring and removal market over the forecast period. This is due to the US government's strict regulations on the sale and distribution of space-related products, as well as the increasing number of space launches in the region, North America dominated the market for the entire projected period. The United States has emerged as the main possible regulator because of its substantial influence on the industry and the presence of the International Traffic in Arms Regulations (ITAR). ITAR is a regulatory framework in the United States that controls the production, distribution, trade, and use of goods related to space and defense.

Europe is expected to grow at the fastest CAGR growth of the global space debris monitoring and removal market during the forecast period. This can be explained by a number of important aspects, including the use of satellites in military operations, collaboration between important parties to deal with space debris, and a number of other space-related initiatives. The UK Space Agency granted ClearSpace and Astroscale a EUR 4 million grant in September 2022 to develop missions to clear current space junk in orbit. Collaboration with a group of industry partners will be required for these missions. In addition, there are numerous reasons for the region's development, including the increase in space exploration activities, increased investment in space launches, the expansion of major corporations into new regions, and the active participation of governmental and nonprofit institutions in the market sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global space debris monitoring and removal market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus SAS

- Altius Space Machines

- Astroscale Holdings

- ClearSpace

- D-Orbit

- Electro Optic Systems

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Obruta Space Solutions Corp.

- Orbit Guardians Corporation

- Share my space

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In May 2024, the European Space Agency (ESA) has successfully received the first Sentinel-5 instrument from Airbus Defence and Space, which will be integrated into the MetOp Second Generation Satellite A. The UVNS (Ultraviolet Visible Near-infrared Short-wave infrared Spectrometer) apparatus will improve monitoring of wildfire emissions, ozone layer changes, and air quality.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global space debris monitoring and removal market based on the below-mentioned segments:

Global Space Debris Monitoring and Removal Market, By Debris Size Range

- 1mm to 1cm

- 1cm to 10cm

- Greater Than 10cm

Global Space Debris Monitoring and Removal Market, By Orbit Type

- Low Earth Orbit (LEO)

- Geostationary Earth Orbit (GEO)

Global Space Debris Monitoring and Removal Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global space debris monitoring and removal market over the forecast period?The global space debris monitoring and removal market size is expected to grow from USD 992.3 Million in 2023 to USD 2,127.7 Million by 2033, at a CAGR of 7.93% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global space debris monitoring and removal market?North America is projected to hold the largest share of the global space debris monitoring and removal market over the forecast period.

-

3. Who are the top key players in the global space debris monitoring and removal market?Airbus SAS, Altius Space Machines, Astroscale Holdings, ClearSpace, D-Orbit, Electro Optic Systems, Lockheed Martin Corporation, Northrop Grumman Corporation, Obruta Space Solutions Corp., Orbit Guardians Corporation, Share My Space, and Others.

Need help to buy this report?