Global Space Launch Services Market Size, Share, and COVID-19 Impact Analysis, By Orbit Type (LEO, GEO, and Others), By Launch Vehicle (Small Lift Launch Vehicle, Medium Lift Launch Vehicle, and Heavy Lift Launch Vehicle), By Payload (Satellite, Cargo, Human Spacecraft, and Testing Probes), By End User (Civil & Military and Commercial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Space Launch Services Market Insights Forecasts to 2033

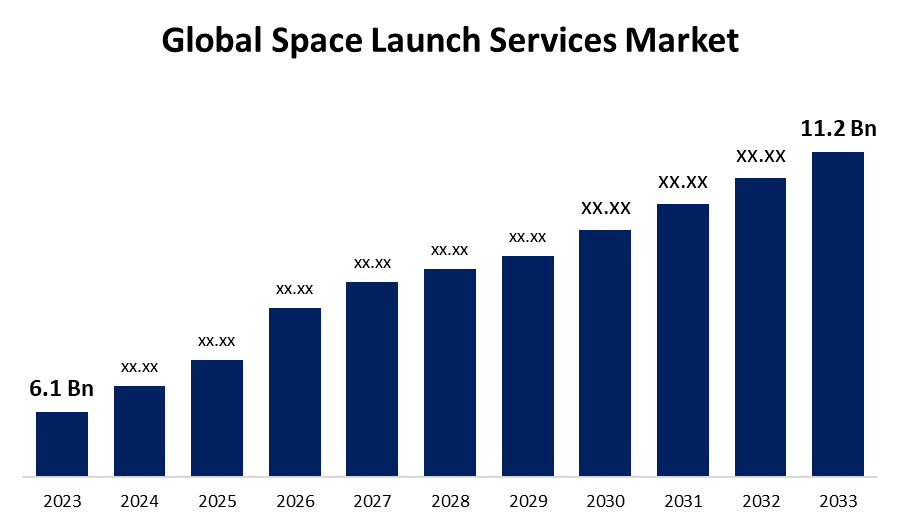

- The Space Launch Services Market Size was valued at USD 6.1 Billion in 2023.

- The Market Size is growing at a CAGR of 6.26% from 2023 to 2033.

- The Worldwide Space Launch Services Market is expected to reach USD 11.2 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Space Launch Services Market Size is expected to reach USD 11.2 Billion by 2033, at a CAGR of 6.26% during the forecast period 2023 to 2033.

The space launch services market is experiencing significant growth, driven by increasing satellite deployments, advancements in reusable launch technologies, and rising government and commercial investments in space exploration. The demand for small satellite launches, fueled by sectors like telecommunications, Earth observation, and navigation, is expanding rapidly. Key players, including SpaceX, Blue Origin, and ULA, are focusing on cost-efficient and reusable launch systems to enhance accessibility to space. Government space agencies such as NASA, ESA, and ISRO are also investing in deep-space missions and commercial partnerships. Additionally, the rise of private space tourism and lunar exploration initiatives is further shaping the market. However, challenges such as high launch costs, regulatory constraints, and environmental concerns remain key hurdles. The industry is set to evolve with continued technological advancements and increasing global collaborations.

Space Launch Services Market Value Chain Analysis

The space launch services market value chain consists of multiple interconnected stages, from raw material suppliers to end-users. It begins with raw material and component suppliers, providing essential elements like composite materials, propulsion systems, and avionics. Next, launch vehicle manufacturers such as SpaceX, ULA, and Rocket Lab design and assemble rockets using advanced engineering. Launch service providers manage mission planning, payload integration, and launch execution for government and commercial clients. Ground support and infrastructure includes spaceports, tracking stations, and communication networks ensuring smooth operations. Regulatory bodies like NASA, ESA, and FAA oversee compliance and safety standards. Finally, end-users, including satellite operators, defense agencies, and space tourism companies, utilize launch services for applications like telecommunications, Earth observation, and deep-space exploration. Collaboration across these stages drives industry efficiency and innovation.

Space Launch Services Market Opportunity Analysis

The space launch services market presents significant opportunities driven by increasing demand for satellite deployment, deep-space exploration, and commercial space ventures. The rise of small satellites and mega-constellations for communication, Earth observation, and IoT applications is fueling market expansion. Reusable rocket technology, pioneered by companies like SpaceX and Blue Origin, is reducing costs and making space more accessible. Emerging markets, including space tourism, lunar exploration, and asteroid mining, offer new revenue streams. Government initiatives and public-private partnerships are further accelerating innovation in launch services. Additionally, advancements in hypersonic travel and interplanetary missions present long-term growth prospects. However, addressing challenges like regulatory constraints, space debris management, and cost efficiency will be crucial for sustaining growth. The market is poised for continuous expansion with increasing global participation.

Global Space Launch Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 238 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Orbit Type, By Launch Vehicle, By Payload, By End User, By Region |

| Companies covered:: | SpaceX Blue Origin Virgin Galactic Rocket Lab United Launch Alliance Arianespace China Aerospace Science and Technology Corporation Mitsubishi Heavy Industries Eurockot Launch Services Northrop Grumman ExPace Firefly Aerospace Relativity Space Orbital ATK International Launch Services Antrix Corporation Vector Launch Spaceflight Industries ISRO NASA Virgin Orbit Boeing |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Space Launch Services Market Dynamics

The rise of private space organizations is driving market growth

SpaceX, Blue Origin, and Rocket Lab are revolutionizing the industry with reusable rocket technology, reducing launch costs and increasing accessibility to space. Private firms are also partnering with government agencies like NASA and ESA for satellite launches, deep-space missions, and lunar exploration. The growing demand for commercial satellite deployment, space tourism, and interplanetary exploration is further accelerating market expansion. Venture capital and corporate investments are fueling advancements in propulsion systems, small satellite launches, and hypersonic travel. As competition intensifies, the industry is expected to witness rapid technological progress, making space more accessible for commercial, scientific, and defense applications.

Restraints & Challenges

High launch costs remain a major barrier, limiting access for smaller players and emerging markets. Regulatory complexities, including strict safety and environmental regulations, pose hurdles for new entrants and delay launch approvals. Space debris is an increasing concern, raising risks of collisions and necessitating advanced mitigation strategies. Technical challenges such as propulsion system failures, payload integration issues, and mission delays also impact operational efficiency. Additionally, geopolitical tensions and fluctuating government funding can affect market stability. The dominance of a few key players creates intense competition, making it difficult for startups to establish themselves. Addressing these challenges through cost reductions, policy reforms, and technological advancements will be crucial for sustainable market growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

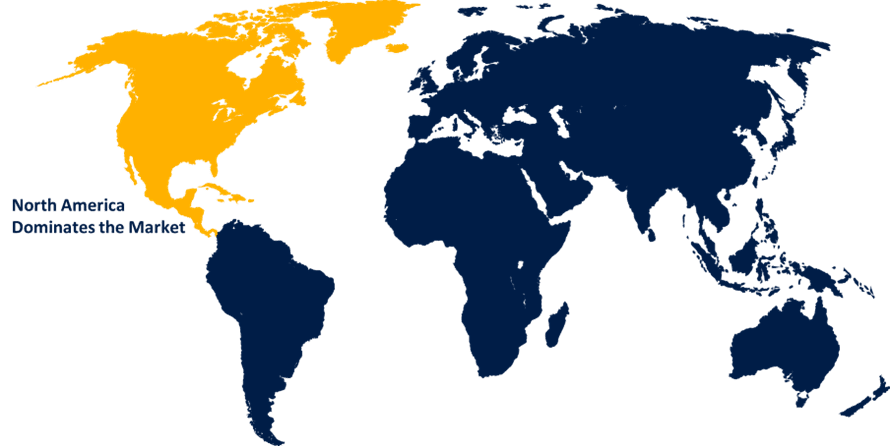

North America is anticipated to dominate the Space Launch Services Market from 2023 to 2033. The increasing demand for small satellite launches, deep-space exploration, and space tourism further fuels market growth. Advancements in reusable rocket technology and public-private partnerships enhance cost efficiency and innovation. The U.S. government’s support for space commercialization, along with collaborations with Canada’s space sector, strengthens regional growth. However, regulatory challenges and growing competition from other regions remain key considerations for market expansion.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China’s CNSA and private firms like iSpace and LandSpace are advancing reusable rocket technology and satellite deployment. India’s ISRO and private startups like Skyroot Aerospace are expanding low-cost launch capabilities. Japan’s JAXA continues to develop innovative launch systems, including partnerships for lunar exploration. The demand for satellite-based communication, Earth observation, and navigation services is fueling market expansion. Emerging players from South Korea and Australia are also entering the industry. However, regulatory challenges, competition with Western companies, and the need for cost-effective launch solutions remain key factors shaping the market’s future growth.

Segmentation Analysis

Insights by Orbit Type

The LEO segment accounted for the largest market share over the forecast period 2023 to 2033. LEO, ranging from 180 to 2,000 km above Earth, is preferred for communication, Earth observation, and navigation satellites due to its low latency and cost-effectiveness. Companies like SpaceX (Starlink), OneWeb, and Amazon (Project Kuiper) are driving LEO satellite deployments for global broadband services. Additionally, government agencies such as NASA and ISRO are investing in LEO-based research and space station initiatives. The rise of small satellite launches and reusable rocket technology is further accelerating LEO growth. However, challenges like space debris and congestion require advanced mitigation strategies to ensure sustainable development in this expanding segment.

Insights by Launch Vehicle

The heavy lift launch vehicle segment accounted for the largest market share over the forecast period 2023 to 2033. HLVs, capable of carrying heavy and multiple payloads to geostationary orbits and beyond, are critical for satellite constellation deployment, deep-space exploration, and large-scale infrastructure projects. Key players like SpaceX’s Falcon Heavy, ULA’s Delta IV Heavy, and NASA’s Space Launch System (SLS) are leading advancements in HLV technology. The growing demand for government and private sector missions, including interplanetary exploration and lunar landings, further fuels the market. Despite the high cost of launching heavy payloads, technological advancements, such as reusability and cost-reduction strategies, are making HLVs more viable for both commercial and governmental applications.

Insights by Payload

The satellite segment accounted for the largest market share over the forecast period 2023 to 2033. The rise of small satellites, particularly for communication networks and Internet of Things (IoT) services, has led to a surge in commercial satellite launches. Companies like SpaceX, Rocket Lab, and Arianespace are actively launching satellite constellations, including SpaceX’s Starlink, which aims to provide global broadband coverage. Government agencies like NASA and ESA also contribute to the market through missions involving communication satellites, space exploration, and environmental monitoring. The trend toward cost-effective, reusable launch systems is further driving satellite deployment, making space more accessible for commercial and government entities.

Insights by End User

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. The rise of small satellite constellations for global communications, IoT services, and Earth observation is significantly expanding market opportunities. Additionally, the growing interest in space tourism, led by companies like Virgin Galactic and Blue Origin, is further fueling the commercial space sector’s expansion. Investments from venture capital and the increasing commercialization of space missions, including lunar and Mars exploration, are enhancing innovation and accessibility. As private companies increasingly collaborate with government agencies, the commercial segment is set to play a pivotal role in the future of space exploration and commercialization.

Recent Market Developments

- In July 2023, Land Space, a private Chinese company, successfully developed and launched the world’s first methane-liquid oxygen rocket into orbit. The Suzaku-2 rocket lifted off from the Jiuquan Satellite Launch Center in northwestern China at 9 am, successfully completing its flight.

Competitive Landscape

Major players in the market

- SpaceX

- Blue Origin

- Virgin Galactic

- Rocket Lab

- United Launch Alliance

- Arianespace

- China Aerospace Science and Technology Corporation

- Mitsubishi Heavy Industries

- Eurockot Launch Services

- Northrop Grumman

- ExPace

- Firefly Aerospace

- Relativity Space

- Orbital ATK

- International Launch Services

- Antrix Corporation

- Vector Launch

- Spaceflight Industries

- ISRO

- NASA

- Virgin Orbit

- Boeing

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Space Launch Services Market, Orbit Type Analysis

- LEO

- GEO

- Others

Space Launch Services Market, Launch Vehicle Analysis

- Small Lift Launch Vehicle

- Medium Lift Launch Vehicle

- Heavy Lift Launch Vehicle

Space Launch Services Market, Payload Analysis

- Satellite

- Cargo

- Human Spacecraft

- Testing Probes

Space Launch Services Market, End User Analysis

- Civil and Military

- Commercial

Space Launch Services Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East and Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Space Launch Services Market?The global Space Launch Services Market is expected to grow from USD 6.1 billion in 2023 to USD 11.2 billion by 2033, at a CAGR of 6.26% during the forecast period 2023-2033.

-

2. Who are the key market players of the Space Launch Services Market?Some of the key market players of the market are SpaceX; Blue Origin; Virgin Galactic; Rocket Lab; United Launch Alliance; Arianespace; China Aerospace Science and Technology Corporation; Mitsubishi Heavy Industries; Eurockot Launch Services; Northrop Grumman; ExPace; Firefly Aerospace; Relativity Space; Orbital ATK; International Launch Services; Antrix Corporation; Vector Launch; Spaceflight Industries; ISRO; NASA; Virgin Orbit; Boeing.

-

3. Which segment holds the largest market share?The commercal segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?