Spain Agrochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Fertilizers, Crop Protection Chemicals, Plant Growth Regulators, and Others), By Application (Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others), and Spain Agrochemicals Market Insights, Industry Trend, Forecasts to 2033.

Industry: AgricultureSpain Agrochemicals Market Insights Forecasts to 2033

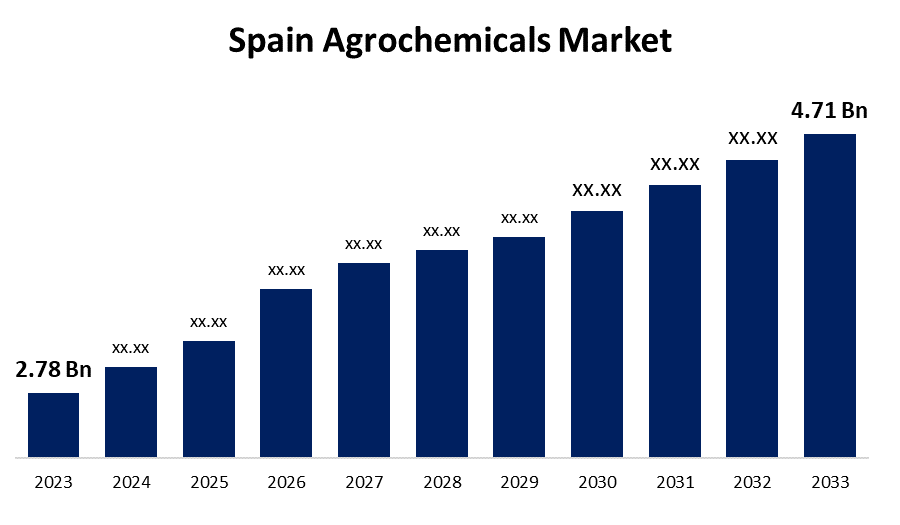

- The Spain Agrochemicals Market Size was valued at USD 2.78 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.41% from 2023 to 2033

- The Spain Agrochemicals Market Size is Expected to Reach USD 4.71 Billion by 2033

Get more details on this report -

The Spain Agrochemicals Market Size is Anticipated to Reach USD 4.71 Billion by 2033, growing at a CAGR of 5.41% from 2023 to 2033.

Market Overview

An agrochemical, or agrichemical, is a chemical product used in agriculture to control pests and diseases that can harm crops, vegetables, fruits, and other agricultural products. Agrochemicals are typically mixtures of two or more chemicals, where the active ingredients provide the desired effects, and the inert ingredients help stabilize or preserve the active ingredients or assist in application. Spain is regarded as a leading European country in terms of agrochemical sales, particularly in pesticide usage. It often ranks as the top seller within the EU due to its diverse agricultural landscape, which necessitates considerable use of crop protection chemicals. This demand is especially concentrated in regions like Andalusia, known for producing a wide variety of fruits and vegetables. Prominent companies such as Bayer CropScience are key manufacturers of pesticides in Spain. The country’s varied climate supports the cultivation of numerous crops, including olives, grapes, almonds, and maize, further contributing to diverse pesticide needs. Spain is also a major exporter of pesticides, ranking among the top countries globally. In 2022, Spain exported $1.69 billion worth of pesticides, making it the sixth-largest exporter in the world. That year, pesticides were the 35th most exported product from Spain. Furthermore, the Spanish agrochemical market operates under European Union regulations regarding pesticide usage and approval.

Report Coverage

This research report categorizes the market for the Spain agrochemicals based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain agrochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain agrochemicals market.

Spain Agrochemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.78 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.41% |

| 2033 Value Projection: | USD 4.71 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 194 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Product, By Application |

| Companies covered:: | ADAMA Agricultural Solutions, Stepan Co, Helena Laboratories, Nufarm Ltd, Croda International PLC, Clariant AG, Solvay SA, Ashland Inc, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Spain agrochemicals market is primarily driven by several factors, including increasing awareness of crop damage, the expansion of high-value crops, and a rise in pest and disease incidents. Additionally, a diverse agroecosystem, a focus on fruit and vegetable production, and government initiatives promoting sustainable agriculture play crucial roles. The growing demand for quality produce in domestic and export markets further emphasizes the need for effective crop protection solutions, such as pesticides and fertilizers. Key factors contributing to this market include fluctuating weather patterns and increased pest infestations due to climate change, which necessitate the use of advanced agrochemicals for improved crop protection.

Restraining Factors

The market for organic food in Spain has been rapidly expanding due to increased awareness of the importance of health, food safety, and environmental protection. There is a growing trend toward accepting and consuming organic food. The rising demand for low-risk, nutrient-dense foods, coupled with an increase in per capita income, is expected to further drive the organic food industry and boost the use of biofertilizers. This shift will impact the composition of chemical fertilizers. As a result, the growth of the organic fertilizer sector is hindering the expansion of the agrochemical market in Spain.

Market Segmentation

The Spain agrochemicals market share is classified into product and application.

- The fertilizers segment is expected to hold the largest market share through the forecast period.

The Spain agrochemicals market is segmented by product into fertilizers, crop protection chemicals, plant growth regulators, and others. Among these, the fertilizers segment is expected to hold the largest market share through the forecast period. This is primarily due to farmers' growing focus on boosting crop yields in a shorter period. The rising global demand for crops and food is putting pressure on agricultural land, leading farmers to use more fertilizers to enhance the productivity and yields of various crops.

- The cereal & grains segment is expected to dominate the Spain agrochemicals market during the forecast period.

Based on the application, the Spain agrochemicals market is divided into cereal & grains, oilseeds & pulses, fruits & vegetables, and others. Among these, the cereal & grains segment is expected to dominate the Spain agrochemicals market during the forecast period. The demand for fertilizers is increasing due to the rising consumption of cereals and grains in various regions, including rice, wheat, rye, corn, oats, sorghum, and barley. In particular, the use of agrochemicals is highest for rice, wheat, and other cereals and grains.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain agrochemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADAMA Agricultural Solutions

- Stepan Co

- Helena Laboratories

- Nufarm Ltd

- Croda International PLC

- Clariant AG

- Solvay SA

- Ashland Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, BASF has launched a new fungicide, Revyona® (75g/L Mefentrifluconazole), for application on grape and fruit crops in Spain. European legislation regarding the renewal and registration of active substances and phytosanitary products is becoming increasingly stringent. As a result, many active substances are not being renewed, and it is becoming more challenging to register new ingredients. This trend is leading to a reduction in the availability of agricultural solutions in Europe.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Agrochemicals Market based on the below-mentioned segments

Spain Agrochemicals Market, By Product

- Fertilizers

- Crop Protection Chemicals

- Plant Growth Regulators

- Others

Spain Agrochemicals Market, By Application

- Cereal & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Need help to buy this report?