Spain Biopesticide Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bioherbicides, BioInsecticides, BioFungicides, and Others), By Application (Seed Treatment, Foliar Spray, and Soil Spray), and Spain Biopesticide Market Insights, Industry Trend, Forecasts to 2033

Industry: AgricultureSpain Biopesticide Market Size Insights Forecasts to 2033

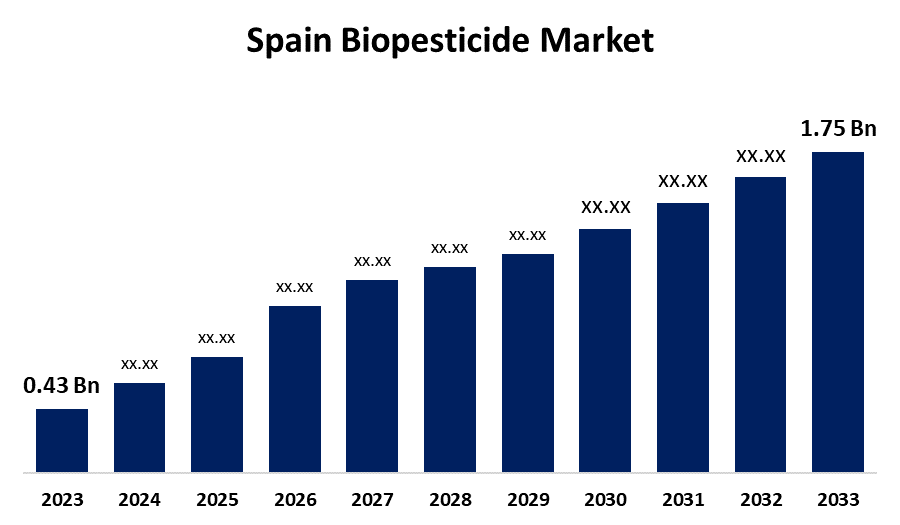

- The Spain Biopesticide Market Size was valued at USD 0.43 Billion in 2023.

- The Spain Biopesticide Market Size is Growing at a CAGR of 15.07% from 2023 to 2033

- The Spain Biopesticide Market Size is Expected to reach USD 1.75 Billion by 2033

Get more details on this report -

The Spain Biopesticide Market Size is Anticipated to Exceed USD 1.75 Billion by 2033, Growing at a CAGR of 15.07% from 2023 to 2033. The rising sustainable agriculture practices and government initiatives for organic farming are driving the Growth of the Biopesticide Market in the Spain.

Market Overview

The biopesticide market refers to the industry that sells pesticides derived from natural materials such as plants, animals, bacteria, and minerals. These pesticides are considered a more environmentally friendly alternative to synthetic pesticides. They include naturally occurring substances such as biochemical pesticides, microbial pesticides, and plant-incorporated protectants or PIPs. The increasing environmental concerns and emphasis on reducing the use of chemical pesticides lead to increased farmer’s preference for biopesticides. There is an increasing adoption of biopesticides as a sustainable alternative to chemical pesticides in the Spanish agriculture industry. Precision agriculture which enhances the effectiveness and efficiency of pest management is significantly propelling the market growth opportunity for biopesticides. This includes technologies such as drones, GPS-guided equipment, and sensor-based systems that allow targeted application of biopesticides in precise locations where waste is not induced and ensures efficient coverage of fields.

Report Coverage

This research report categorizes the market for the Spain biopesticide market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain biopesticide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain biopesticide market.

Spain Biopesticide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.43 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.07% |

| 2033 Value Projection: | USD 1.75 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Bayer crop science, BASF, Seipasa, Valent Biosciences, Certis LLc, Koppert Biological System, Novozyme Biological, Marrone Bio innovations, De Sangosse, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The implementation of sustainable agricultural practices in the country is promoting the use of biopesticides, thereby propelling market growth. The government initiatives for organic farming are also propelling the market for biopesticides. For instance, the National Strategic Plan under the Common Agricultural Policy (CAP) aims to dedicate 25% of agricultural land to organic production by 2030. In addition, a rising need for organic food as consumers increasingly seek healthy and environmentally friendly practices, thereby propelling the market demand for biopesticides.

Restraining Factors

The lack of awareness about the products among the farmers leads to restricting their adoption, thereby restraining the market. Further, the high cost and limited shelf life of the products are challenging the biopesticides market growth. In addition, regulatory compliance issues and competition from synthetic pesticides are hampering the biopesticides market.

Market Segmentation

The Spain biopesticide market share is classified into product type and application.

- The biofungicides segment dominates the market with the largest market share and is anticipated to grow at a significant CAGR during the forecast period.

The Spain biopesticide market is segmented by product type into bioherbicides, bioinsecticides, biofungicides, and others. Among these, the biofungicides segment dominates the market with the largest market share and is anticipated to grow at a significant CAGR during the forecast period. Seitylis, Araw, and Taegro are some of the biofungicides products used for controlling crops' fungal diseases. The development of more sophisticated biofungicide formulations owing to the advancement in microbial technologies is propelling the market in the biofungicides segment.

- The foliar spray segment dominated the biopesticide market with the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period.

The Spain biopesticide market is segmented by application into seed treatment, foliar spray, and soil spray. Among these, the foliar spray segment dominated the biopesticide market with the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period. Foliar spray is most frequently used for applying pesticides for pest management in trees. The increased popularity of foliar spray application owing to the immediate plant response and efficiency is propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain biopesticide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer crop science

- BASF

- Seipasa

- Valent Biosciences

- Certis LLc

- Koppert Biological System

- Novozyme Biological

- Marrone Bio innovations

- De Sangosse

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, ACI’s Biopesticides Europe 2024 conference taking place on the 5th & 6th of June 2024 in Barcelona, Spain. The two-day event bring together industry leaders, researchers, innovators, and stakeholders from around the world and aims to explore the exciting advancements, challenges, and opportunities shaping the Biopesticide industry.

- In September 2023, The ALGAENAUTS innovation project aims to achieve and validate the pre-commercial industrial production of microalgae-based biopesticides and biostimulant products for agriculture. The project is funded under the EMFF Funding Programme (now European Maritime, Fisheries and Aquaculture Fund - EMFAF).

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain biopesticide market based on the below-mentioned segments:

Spain Biopesticide Market, By Product Type

- Bioherbicides

- BioInsecticides

- BioFungicides

- Others

Spain Biopesticide Market, By Application

- Seed Treatment

- Foliar Spray

- Soil Spray

Need help to buy this report?