Spain Biorational Market Size, Share, and COVID-19 Impact Analysis, By Product (Botanical, Semi-Chemicals, and Others), By Crop (Fruits & Vegetables, Grains, Cereals, and Corn), and Spain Biorational Market Insights, Industry Trend, Forecasts to 2033.

Industry: AgricultureSpain Biorational Market Insights Forecasts to 2033

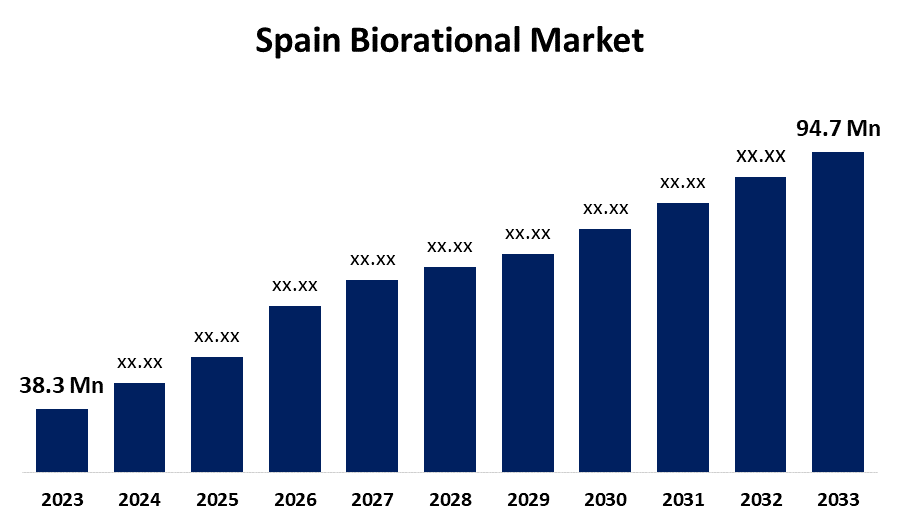

- The Spain Biorational Market Size was valued at USD 38.3 Million in 2023.

- The Market is Growing at a CAGR of 9.48% from 2023 to 2033

- The Spain Biorational Market Size is Expected to Reach USD 94.7 Million by 2033

Get more details on this report -

The Spain Biorational Market is Anticipated to Reach USD 94.7 Million by 2033, growing at a CAGR of 9.48% from 2023 to 2033.

Market Overview

The biorational market refers to the products used as an alternative to traditional pesticides and antimicrobials. Biorationals include biopesticides and other non-pesticidal products that are used for a variety of purposes, such as crop stress management, root growth management, enhanced plant physiology benefits, and postharvest. Additionally, The Spain biorationals market is growing due to concerns about human, animal, and environmental health. The negative effects of chemical pesticides on the environment, water bodies, and soil have led to the promotion of biorationals.

Report Coverage

This research report categorizes the market for the Spain biorational based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain biorational market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain biorational market.

Spain Biorational Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 38.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.48% |

| 2033 Value Projection: | USD 94.7 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Crop |

| Companies covered:: | Monsanto, Syngenta, Agralan, Russell IPM, Suterra, LLC, Summit chemical, Gowan Company, Isagro, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Some factors are driving the biorationals market in the country, the demand for organic food and residue-free crops is increasing, and consumers are concerned about chemical residues in fruits and vegetables. Governments are tightening controls on chemical pesticides and promoting sustainable agriculture through policies and subsidies. Biorationals are compatible with integrated pest management (IPM) programs, which prioritize sustainable and preventative pest control. Technological breakthroughs in biocontrol technologies and pest management strategies have made biorational pesticides more effective. The development of organic seeds to reduce chemical residues in agricultural goods and grains has increased demand.

Restraining Factors

The cost of biorational is much higher as compared to traditional pesticides. The reason behind this is its production cost while producing biorational products. Owing to this factor, the biorational comes at a higher price as compared to its alternative materials, which tends to constrain the growth of the market.

Market Segmentation

The Spain biorational market share is classified into product and crop.

- The botanical segment is expected to hold the largest market share through the forecast period.

The Spain biorational market is segmented by product into botanical, semi-chemicals, and others. Among these, the botanical segment is expected to hold the largest market share through the forecast period. The growing demand for sustainable and eco-friendly agricultural practices is driving a shift towards biorational products. This is due to increased consumer awareness of the harmful effects of chemical pesticides and a preference for organic farming. Biorational products offer effective pest control with minimal environmental impact. Market growth is further boosted by advances in biorational technologies, supportive regulatory policies, and the need for integrated pest management solutions.

- The fruits & vegetables segment is expected to dominate the Spain biorational market during the forecast period.

Based on the crop, the Spain biorational market is divided into fruits & vegetables, grains, cereals, and corn. Among these, the fruits & vegetables segment is expected to dominate the Spain biorational market during the forecast period. The growth is being driven by the increasing adoption of sustainable agricultural practices and the need for effective, eco-friendly pest management solutions. Farmers are turning to biorational products due to the rising demand for organic and residue-free produce, as these products provide a safer alternative to conventional chemical pesticides.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain biorational market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Monsanto

- Syngenta

- Agralan

- Russell IPM

- Suterra, LLC

- Summit chemical

- Gowan Company

- Isagro

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, MAT Holding and Bayer reached an agreement under which the German multinational would transfer its crop protection products factory, located in the Valencian town of Quart de Poblet, to Indústries Químiques del Vallès (IQV), to a plant health company belonging to the Spanish group MAT Holding, led by Pau Relat, leader in solutions for agriculture and water.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Biorational Market based on the below-mentioned segments:

Spain Biorational Market, By Product

- Botanical

- Semi-Chemicals

- Others

Spain Biorational Market, By Crop

- Fruits & Vegetables

- Grains

- Cereals

- Corn

Need help to buy this report?