Spain Carbapenem Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Meropenem, Imipenem, Ertapenem, and Others), By Application (Urinary Tract Infections, Bloodstream Infections, Intra-abdominal Infections, Pneumonia, and Others), and Spain Carbapenem Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareSpain Carbapenem Market Insights Forecasts to 2033

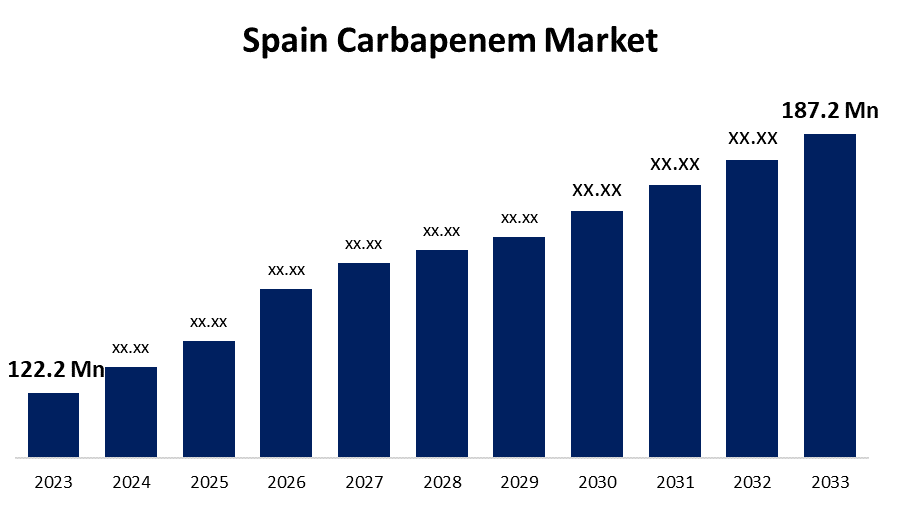

- The Spain Carbapenem Market Size was valued at USD 122.2 Million in 2023.

- The Market Size is Growing at a CAGR of 4.36% from 2023 to 2033

- The Spain Carbapenem Market Size is Expected to Reach USD 187.2 Million by 2033

Get more details on this report -

The Spain Carbapenem Market Size is Anticipated to Reach USD 187.2 Million by 2033, growing at a CAGR of 4.36% from 2023 to 2033.

Market Overview

Carbapenems are a class of broad-spectrum antibiotics used to treat infections caused by bacteria that are resistant to other antibiotics. As a type of beta-lactam antibiotic, carbapenems contain a beta-lactam ring in their chemical structure. They are structurally similar to penicillins, differing only in that they have a carbon atom instead of a sulphur atom. Carbapenems are often employed when other antibiotics have failed and are considered a "drug of last resort." In Spain, there has been a significant increase in the empirical use of carbapenems in hospitals. This trend underscores the growing reliance on this class of antibiotics to treat infections, especially in response to the rising prevalence of carbapenem-resistant bacteria in healthcare-associated infections across the country. Studies indicate a rise in carbapenem use among various hospital groups, particularly in regions like Catalonia. Additionally, the demand for carbapenems is driven by the increasing incidence of infectious disorders such as urinary tract infections (UTIs), intra-abdominal infections, and bacterial meningitis. The growing presence of generic pharmaceutical firms has also contributed to the increased demand for carbapenems. Furthermore, increasing partnerships between major pharmaceutical companies have played a role in the growth of this market, particularly due to the rising incidence of infections caused by carbapenem-resistant Enterobacteriaceae.

Report Coverage

This research report categorizes the market for the Spain carbapenem based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain carbapenem market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain carbapenem market.

Spain Carbapenem Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 122.2 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.36% |

| 2033 Value Projection: | USD 187.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 142 |

| Segments covered: | By Drug Class, By Application |

| Companies covered:: | ABAMED PHARMA, ABC FARMA INTERNACIONAL S.L, ACOFARMA, ACTIVA PLATAFORMA DE FORMACIÓN EN SALUD, AECIC, AEI24, AESEG, AFP PHARMACEUTICAL DEVELOPMENT S.L., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several factors are contributing to the growth of the carbapenem market. First, the increasing prevalence of multidrug-resistant bacterial infections has made carbapenems a preferred option for last-resort therapy. Additionally, the aging population is more vulnerable to severe infections, which further drives the demand for these antibiotics. Governments are actively addressing antimicrobial resistance (AMR), leading to a heightened need for effective antibiotics like carbapenems. Moreover, the expansion of healthcare infrastructure especially in emerging economies has improved access to carbapenems. Finally, the rise in infectious diseases, such as urinary tract infections (UTIs), intra-abdominal infections, and bacterial meningitis, has also contributed to the growing demand for carbapenems.

Restraining Factors

Carbapenem antibiotics are generally more expensive than other classes of antibiotics, which can limit their accessibility, particularly in low-income regions. The financial burden on healthcare systems may restrict their widespread use, even when there is a clinical necessity. Furthermore, strict regulatory requirements for the approval of new antibiotics can delay the introduction of innovative carbapenem products. Navigating complex clinical trials and approval processes may also discourage potential new entrants into the market.

Market Segmentation

The Spain carbapenem market share is classified into drug class and application.

- The meropenem segment is expected to hold the largest market share through the forecast period.

The Spain carbapenem market is segmented by drug class into meropenem, imipenem, ertapenem, and others. Among these, the meropenem segment is expected to hold the largest market share through the forecast period. Meropenem is effective against a wide range of gram-positive and gram-negative bacteria, including many strains resistant to other antibiotics. This broad spectrum makes it a versatile option for treating various infections. It is particularly potent against multi-drug-resistant organisms (MDROs), including those producing extended-spectrum beta-lactamases (ESBLs) and carbapenem-resistant Enterobacteriaceae (CRE). Furthermore, meropenem can be administered intravenously, allowing for flexible dosing schedules tailored to the severity of the infection and patient needs. This flexibility is particularly beneficial in hospital settings, thus driving market growth.

- The urinary tract infections segment is expected to dominate the Spain carbapenem market during the forecast period.

Based on the application, the Spain carbapenem market is divided into urinary tract infections, bloodstream infections, intra-abdominal infections, pneumonia, and others. Among these, the urinary tract infections segment is expected to dominate the Spain carbapenem market during the forecast period. Urinary tract infections (UTIs) are among the most common bacterial infections, affecting millions of people around the world each year. They are especially prevalent in women, with about half experiencing a UTI at some point in their lives. This high incidence contributes to the prominence of UTIs in the context of bacterial infections overall. The increasing number of clinical trials focusing on carbapenems for the treatment of UTIs is expected to have significant implications for the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain carbapenem market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABAMED PHARMA

- ABC FARMA INTERNACIONAL S.L

- ACOFARMA

- ACTIVA PLATAFORMA DE FORMACIÓN EN SALUD

- AECIC

- AEI24

- AESEG

- AFP PHARMACEUTICAL DEVELOPMENT S.L.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Venus Remedies has obtained marketing authorization in Spain for meropenem. This approval, granted through its German subsidiary Venus Pharma GmbH, covers 500 mg, 1 g, and 2 g injections of this last-resort antibiotic.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Carbapenem Market based on the below-mentioned segments

Spain Carbapenem Market, By Drug Class

- Meropenem

- Imipenem

- Ertapenem

- Others

Spain Carbapenem Market, By Application

- Urinary Tract Infections

- Bloodstream Infections

- Intra-abdominal Infections

- Pneumonia

- Others

Need help to buy this report?