Spain Cell Therapy Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Therapy (T-cell Therapies, Dendritic Cell Therapies, Tumor Cell Therapies, and Stem Cell Therapies), By Source of Cell (Autologous and Allogenic), By Application (Oncology, Cardiovascular Diseases, Orthopedic Diseases, and Others), and Spain Cell Therapy Manufacturing Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Cell Therapy Manufacturing Market Insights Forecasts to 2033

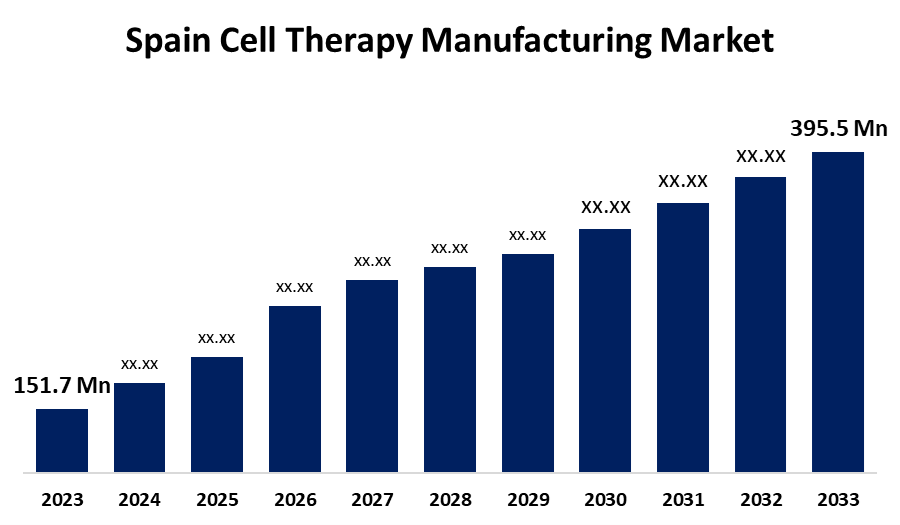

- The Spain Cell Therapy Manufacturing Market Size was valued at USD 151.7 Million in 2023.

- The Spain Cell Therapy Manufacturing Market Size is growing at a CAGR of 10.06% from 2023 to 2033

- The Spain Cell Therapy Manufacturing Market Size is expected to reach USD 395.5 Million by 2033

Get more details on this report -

The Spain Cell Therapy Manufacturing Market Size is anticipated to exceed USD 395.5 Million by 2033, growing at a CAGR of 10.06% from 2023 to 2033. The rising demand for personalized medicine, advancements in cell therapy R&D, and the prevalence of chronic diseases are driving the growth of the cell therapy manufacturing market in the Spain.

Market Overview

The cell therapy manufacturing market refers to the business of producing cells for therapeutic use. The process involves isolation, expansion, modification, and testing of cells to produce a sufficient number of functional cells. Therapeutic products are created using living cells, tissues, or organs for treating a variety of diseases. The ongoing developmental breakthroughs in the biotechnology industry and FDA-approved therapies are demonstrating the potential of cell therapy for treating oncological disorders, rare diseases, and chronic diseases. Furthermore, there is an increasing shift towards the optimization of the cell therapy manufacturing process by considering the therapeutic potential of cellular therapies and sufficient evidence for validating clinical benefits. The increasing investment in the discovery and development of cell therapies is bolstering the market growth opportunities for cell therapy manufacturing.

Report Coverage

This research report categorizes the market for the Spain cell therapy manufacturing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain cell therapy manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain cell therapy manufacturing market.

Spain Cell Therapy Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 151.7 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.06% |

| 2033 Value Projection: | USD 395.5 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By Therapy and COVID-19 Impact Analysis |

| Companies covered:: | Novartis AG, F.Hoffmann La Roche AG, Gilead Sciences, Inc, Thermo Fischer Scientific, Inc, Catalent, Inc, Merck KGaA, Lonza Biologics O Porriño SL, Charles River Laboratories España S.A., Fujifilm Holdings Corporation, AMGEN S.A., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The rising demand for personalized medicine ultimately drives the cell therapy manufacturing market. The advancements in cell therapy R&D which includes base editing and dual antigen targeting for enhancing the safety and efficacy across cancer types are also responsible for market growth. thereby propelling the market demand for cell therapy manufacturing. The increasing prevalence of chronic diseases in Spain is responsible for driving market demand. It was estimated that chronic diseases are the leading cause of death, thus driving demand for cell therapy for treatment.

Restraining Factors

The challenges associated with the cost and resource management for cell therapy manufacturing hamper its growth and widespread adoption, thereby restraining the market.

Market Segmentation

The Spain cell therapy manufacturing market share is classified into therapy, source of cell, and application.

- The T-cell therapies segment dominates the market with a major market share and is anticipated to grow at the fastest CAGR during the forecast period.

The Spain cell therapy manufacturing market is segmented by therapy into T-cell therapies, dendritic cell therapies, tumor cell therapies, and stem cell therapies. Among these, the T-cell therapies segment dominates the market with a major market share and is anticipated to grow at the fastest CAGR during the forecast period. T-cell therapies including CAR T-cell therapies are manufactured by collecting a patient’s blood, isolating T-cells, and genetically engineering them to target cancer cells. The increasing need for innovative and personalized treatment options promotes the market in the T-cell therapies segment.

- The autologous segment dominated the cell therapy manufacturing market with a maximum market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain cell therapy manufacturing market is segmented by source of cell into autologous and allogenic. Among these, the autologous segment dominated the cell therapy manufacturing market with a maximum market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Autologous cell therapy manufacturing is a personalized process that involves the use of a patient’s own cells for treating various disorders. The widespread use of this therapy in orthopedics and dermatology for therapeutic and cosmetic purposes respectively is propelling the market growth.

- The oncology segment dominated the cell therapy manufacturing market in 2023 and is expected to grow at a significant CAGR growth during the predicted timeframe.

The Spain cell therapy manufacturing market is segmented by application into oncology, cardiovascular diseases, orthopedic diseases, and others. Among these, the oncology segment dominated the cell therapy manufacturing market in 2023 and is expected to grow at a significant CAGR growth during the predicted timeframe. For instance, chimeric antigen receptor (CAR) T-cell therapies are approved for patients with leukemia, lymphoma, and myeloma. The advancement of biotechnology, personalized medicine, and innovative treatment methods are driving the market in the oncology segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain cell therapy manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novartis AG

- F.Hoffmann La Roche AG

- Gilead Sciences, Inc

- Thermo Fischer Scientific, Inc

- Catalent, Inc

- Merck KGaA

- Lonza Biologics O Porriño SL

- Charles River Laboratories España S.A.

- Fujifilm Holdings Corporation

- AMGEN S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, The SJD Barcelona Children's Hospital launched a new platform to produce and develop advanced therapies and medications, such as CAR-T cells, which are used primarily on patients with acute lymphoblastic leukemia who have not responded to conventional treatments.

- In January 2024, REPROCELL's clinical stem cells manufacturing partner Histocell has obtained AEMPS authorisation and GMP certification for its new manufacturing plant, that is located in Larrabetzu, Spain. Histocell's manufacturing plant produces cell therapy and associated biological medicinal products.

- In August 2024, Alcura, a provider of specialised clinical trial services and a part of Cencora, was granted a Manufacturing and Importation Authorization (MIA) license for cell and gene therapies (CGT) by the Spanish Agency of Medicines and Medical Devices.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain cell therapy manufacturing market based on the below-mentioned segments:

Spain Cell Therapy Manufacturing Market, By Therapy

- T-cell Therapies

- Dendritic Cell Therapies

- Tumor Cell Therapies

- Stem Cell Therapies

Spain Cell Therapy Manufacturing Market, By Source of Cell

- Autologous

- Allogenic

Spain Cell Therapy Manufacturing Market, By Application

- Oncology

- Cardiovascular Diseases

- Orthopedic Diseases

- Others

Need help to buy this report?