Spain Clear Aligners Market Size, Share, and COVID-19 Impact Analysis, By Age (Adults and Teens), By Material Type (Polyurethane, Plastic Polyethylene Terephthalate Glycol, and Others), and Spain Clear Aligners Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareSpain Clear Aligners Market Insights Forecasts to 2033

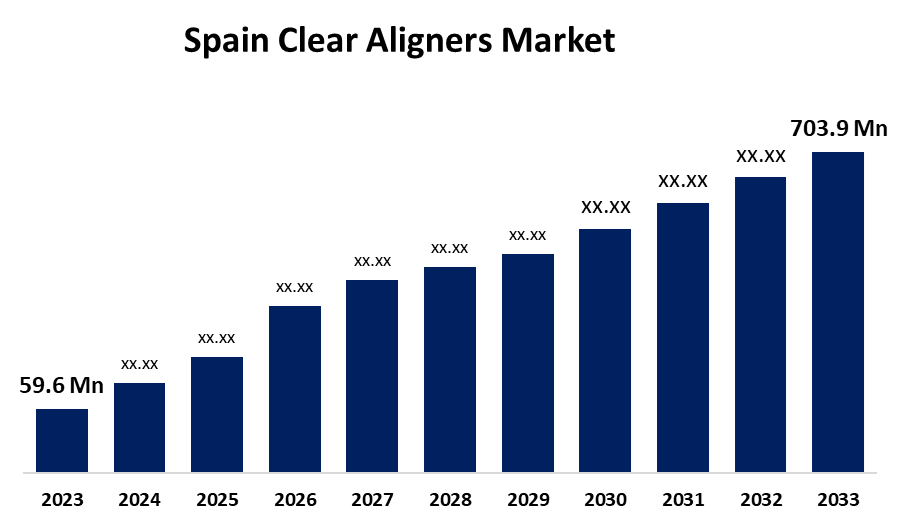

- The Spain Clear Aligners Market Size was valued at USD 59.6 Million in 2023.

- The Market Size is Growing at a CAGR of 28.00% from 2023 to 2033

- The Spain Clear Aligners Market Size is Expected to Reach USD 703.9 Million by 2033

Get more details on this report -

The Spain Clear Aligners Market Size is Anticipated to Reach USD 703.9 Million by 2033, growing at a CAGR of 28.00% from 2023 to 2033

Market Overview

Clear aligners consist of a series of thin, transparent, custom-designed plastic trays that progressively shift teeth into straighter positions. They offer a discreet alternative to traditional metal braces, being nearly invisible and removable for eating and maintaining oral hygiene. A sequence of aligners is worn over the teeth to apply gentle pressure, gradually moving them into the desired alignment. Clear aligners are suitable for addressing mild to moderate orthodontic concerns, such as gaps, overcrowding, or misaligned teeth. These aligners are crafted using digital virtual models, computer-aided design (CAD-CAM), and thermoformed plastic materials like copolyester or polycarbonate. The discomfort associated with metal and ceramic braces and prolonged gum sensitivity has led to an increased preference for clear aligners among both patients and dentists. Designed for the user's comfort, these aligners are flexible. A significant segment of the Spanish population seeks dental care in private practices, further enhancing the adoption of clear aligners. Invisalign is well-known and widely accessible in Spain, often regarded as the leading choice for clear aligners.

Report Coverage

This research report categorizes the market for Spain clear aligners based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain clear aligners market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain clear aligners market.

Spain Clear Aligners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 59.6 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 28.00% |

| 2033 Value Projection: | USD 703.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Age, By Material Type, |

| Companies covered:: | Angelalign Technology Inc Ordinary Shares, Envista Holdings Corp Ordinary Shares, Align Technology Inc, Henry Schein Inc, Dentsply Sirona Inc, 3M Co, And Other Key Vendors. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

In Spain, the clear aligners market is fueled by multiple factors, including the increasing rates of malocclusion across Europe, leading key players to focus on developing innovative products. The rapid advancement of dental technology is another driving force. There is also a growing demand for tailor-made aligners alongside heightened interest in aesthetic dental solutions. Additionally, government initiatives are propelling market growth. Other factors influencing the clear aligners market include the advantages of clear aligners over traditional orthodontics, the unmet needs within the patient population, and the emergence of direct-to-consumer companies in developed nations like Spain.

Restraining Factors

Several challenges restrain the Spain Clear Aligners market, such as the high cost of treatment, limited public knowledge regarding malocclusion, inadequate dental insurance coverage for orthodontic procedures, concerns about the expenses associated with clear aligners compared to conventional braces, and potential restrictions on the types of dental issues that clear aligners can address, which may deter patients from pursuing this treatment option.

Market Segmentation

The Spain clear aligners market share is classified into age and material type.

- The adult segment is expected to hold the largest market share through the forecast period.

The Spain clear aligners market is segmented by age into adults and teens. Among these, the adults segment is expected to hold the largest market share through the forecast period. Dental issues such as malocclusion are common in the general population and, in addition to diminishing quality of life, can result in complications like impaired facial aesthetics, oral function disturbances including chewing, swallowing, and speech, and an increased risk of trauma and gum disease. In today's society, an appealing aesthetic, particularly concerning dental appearance, plays an essential role. Among adolescents, there is a growing concern for their dental aesthetics. Aligner therapy is rapidly gaining popularity in orthodontics, significantly influenced by patients seeking a more comfortable, convenient, and discreet option compared to traditional braces.

- The polyurethane segment is expected to dominate the Spain clear aligners market during the forecast period.

Based on the material type, the Spain clear aligners market is divided into polyurethane, plastic polyethylene terephthalate glycol, and others. Among these, the polyurethane segment is expected to dominate the Spain clear aligners market during the forecast period. The rise of Invisalign clear aligners, made from polyurethane, has contributed to this trend. When used in aligners, polyurethane provides several benefits. Its diverse properties make it suitable for both rigid and flexible components. This material can be engineered to create products strong enough to shift teeth into alignment while remaining soft enough for extended wear.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain clear aligners market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Angelalign Technology Inc Ordinary Shares

- Envista Holdings Corp Ordinary Shares

- Align Technology Inc

- Henry Schein Inc

- Dentsply Sirona Inc

- 3M Co

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, the clear aligner company Impress, based in Barcelona, has launched its inaugural clinic in New York, marking its 11th site in the United States. Impress is present in over 160 cities across the U.K., Spain, Portugal, Italy, Germany, Ukraine, and the U.S. Beyond its new New York location, Impress has established clinics in San Francisco, Chicago, and Seattle, with additional U.S. openings planned as part of its expansion in North America.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Clear Aligners Market based on the below-mentioned segments:

Spain Clear Aligners Market, By Age

- Adults

- Teens

Spain Clear Aligners Market, By Material Type

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

- Others

Need help to buy this report?