Spain Contraceptive Market Size, Share, and COVID-19 Impact Analysis, By Product (Contraceptive Drugs and Contraceptive Devices), By End User (Hospitals, Home Care, Clinics, and Ambulatory Surgical Centres), and Spain Contraceptive Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Contraceptive Market Insights Forecasts to 2033

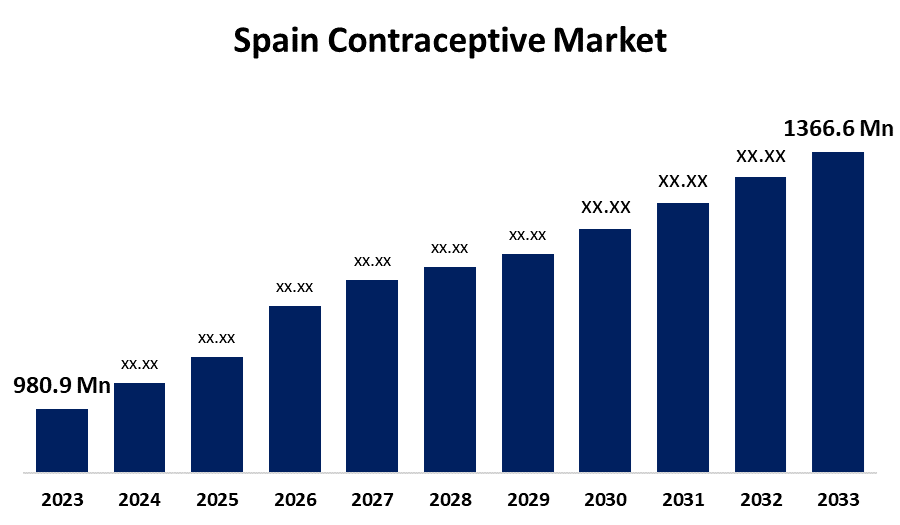

- The Spain Contraceptive Market Size was valued at USD 980.9 Million in 2023

- The Market is Growing at a CAGR of 3.37% from 2023 to 2033

- The Spain Contraceptive Market Size is Expected to Reach USD 1366.6 Million by 2033

Get more details on this report -

The Spain Contraceptive Market Size is Anticipated to Reach USD 1366.6 Million by 2033, Growing at a CAGR of 3.37% from 2023 to 2033.

Market Overview

Contraception refers to methods used to prevent pregnancy, which can include devices, medications, procedures, or behavioral approaches. It enables women to manage their reproductive health and participate in family planning. In 2022, the most commonly used contraceptive method in Spain was condoms, with 36% of women of reproductive age utilizing them. Birth control pills were the second most popular option, used by 17% of women. Furthermore, over 22% of women reported not using any form of contraception, and around 190,000 unplanned pregnancies occur each year, which accounts for 35% of all pregnancies. Among women aged 15–19, the highest percentage using condoms was recorded at 29.2%. Overall, 50% of women aged 15–49 always used a contraceptive method, while 20% frequently had intercourse without any form of contraception. Additionally, the rising prevalence of sexually transmitted diseases (STDs) and the increasing demand for contraceptive drugs and devices among women are key factors driving market growth. Additionally, the growing acceptance of contraception among young women, alongside their higher educational achievements, is also contributing to this trend.

Report Coverage

This research report categorizes the market for the Spain contraceptive based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain contraceptive market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain contraceptive market.

Spain Contraceptive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 980.9 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.37% |

| 2033 Value Projection: | USD 1366.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product, By End User and COVID-19 Impact Analysis. |

| Companies covered:: | Crinetics Pharmaceuticals Inc, CR Pharmaceutical, Janssen Pharmaceuticals, Helm AG, Cupid, Afaxys, Veru Inc, Agile Therapeutics Inc, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several factors can influence the contraceptive market in Spain. Contraception is widely accessible, either for free or at a low cost. Spanish women enjoy both access to contraception and social acceptance of their choices regarding contraceptive methods. However, there is a need to enhance contraceptive counseling, including the development of decision-support tools. The most commonly used contraceptive methods are short-acting reversible contraceptives (SARC), such as condoms, vaginal rings, and combined oral contraceptives (COC). Long-acting reversible contraceptives (LARC) are more frequently used by women over the age of 35. Over five years, the total cost of managing reversible contraception in Spain is approximately €12.5 billion. It's important to note that the price per woman for SARC methods is higher than for LARC methods.

Restraining Factors

Factors that can influence contraceptive use in Spain include the cost of contraception, as short-acting reversible contraceptives (SARCs), such as condoms and combined oral contraceptives (COCs), can be more expensive for women over five years compared to long-acting reversible contraceptives (LARCs). Additionally, the social perception of oral contraceptives may have shifted, leading to the male condom becoming the preferred choice. The economic recession may also have impacted various indicators of sexual and reproductive health.

Market Segmentation

The Spain contraceptive market share is classified into product and end user.

- The contraceptive devices segment is expected to hold the largest market share through the forecast period.

The Spain contraceptive market is segmented by product into contraceptive drugs and contraceptive devices. Among these, the contraceptive devices segment is expected to hold the largest market share through the forecast period. This is due to increased awareness of STDs and the effectiveness of condoms in preventing infections, including HIV. The contraceptive device segment is further divided into condoms, subdermal implants, IUDs, vaginal rings, and diaphragms.

- The hospitals segment is expected to dominate the Spain contraceptive market during the forecast period.

Based on the end user, the Spain contraceptive market is divided into hospitals, home care, clinics, and ambulatory surgical centres. Among these, the hospitals segment is expected to dominate the Spain contraceptive market during the forecast period. Hospitals are a primary destination for women seeking contraceptive services, significantly contributing to the growth of this sector. They offer a comprehensive range of services, including counseling, testing, and access to various types of contraceptives. With advanced medical equipment and highly skilled professionals, hospitals provide patients with high-quality healthcare.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain contraceptive market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Crinetics Pharmaceuticals Inc

- CR Pharmaceutical

- Janssen Pharmaceuticals

- Helm AG

- Cupid

- Afaxys

- Veru Inc

- Agile Therapeutics Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Xiromed LLC launched EnilloRing, a generic version of Nuvaring, in the United States. EnilloRing is a contraceptive vaginal ring that was developed and manufactured in Leon, Spain.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Contraceptive Market based on the below-mentioned segments:

Spain Contraceptive Market, By Product

- Contraceptive Drugs

- Contraceptive Devices

Spain Contraceptive Market, By End User

- Hospitals

- Home Care

- Clinics

- Ambulatory Surgical Centres

Need help to buy this report?