Spain Dental Implants Market Size, Share, and COVID-19 Impact Analysis, By Material (Titanium, Zirconium, and Others), By Design (Tapered Implants and Parallel Walled Implants), By Type (Endosteal Implants, Subperiosteal Implants, and Transosteal Implants), By End-User (Solo Practices, DSO/Group Practices, and Others), and Spain Dental Implants Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Dental Implants Market Insights Forecasts to 2033

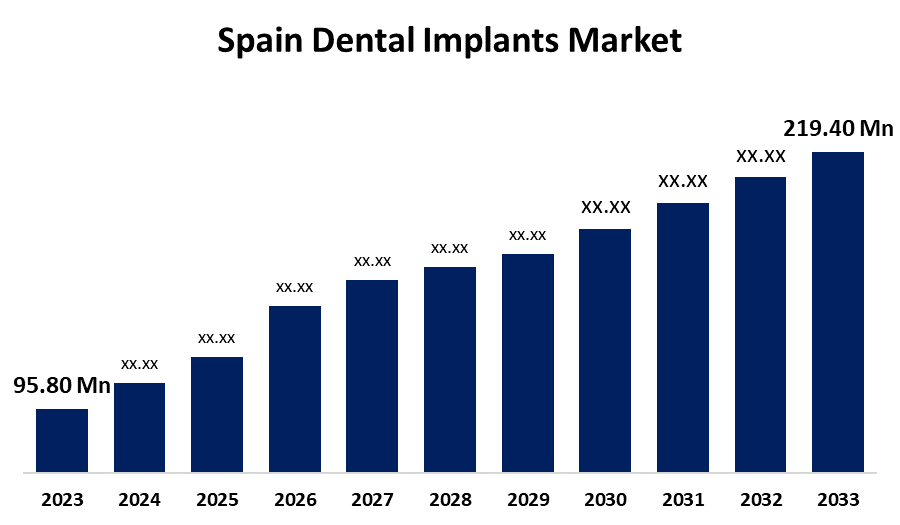

- The Spain Dental Implants Market Size was valued at USD 95.80 Million in 2023.

- The Market Size is growing at a CAGR of 8.64% from 2023 to 2033

- The Spain Dental Implants Market Size is expected to reach USD 219.40 Million by 2033

Get more details on this report -

The Spain Dental Implants Market Size is anticipated to exceed USD 219.40 Million by 2033, growing at a CAGR of 8.64% from 2023 to 2033. The growing need for aesthetics, improved dental technology, and increasing awareness about the benefits of dental implants surgery are driving the growth of the dental implants market in the Spain.

Market Overview

The dental implant market refers to the industry dealing with the surgical replacement of missing teeth with artificial tooth roots. Dental implants are artificial tooth roots that are surgically placed into the jawbone to replace missing teeth. They provide support for artificial teeth, which include crowns, bridges, or dentures. Replacing a tooth with a dental implant enhances a person’s health and quality of life, eliminating the discomfort causing side effects such as altered chewing habits, accelerated bone loss, or impaired speech. There is a growing demand for implants coated with antibacterial materials. Implants with antimicrobial coatings are more often used because of their increased longevity. Additionally, the antibacterial coating shields against dangerous oral germs that cause tooth decay and other dental issues increasing their demand and enhancing patient outcomes. Precision implant placement using 3D technology, the rise in edentulous patient population, and increased demand for non-premium dental implants are the factors that are escalating lucrative market growth opportunities for dental implants.

Report Coverage

This research report categorizes the market for the Spain dental implants market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain dental implants market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain dental implants market.

Spain Dental Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 95.80 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.64% |

| 2033 Value Projection: | USD 219.40 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Material, By Design, By Type, By End-User |

| Companies covered:: | Straumann Group, Dentsply Sirona, Zimmer Biomet Limited, Henry Schein Holdings Limited, Thommen Medical AG, Bio Horizons Ltd, Nobel Bio care, Osstem Implant, Astra Tech Dental, Megagen Implant, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for dental implants due to the implants’ ability to restore function and aesthetics is driving the dental implants market. There is an increasing use of dental implants as long-lasting and natural looking alternatives owing to the advancements in technology and technique. The implementation of patient education programs and counselling centers for increasing awareness about the benefits of dental implants is propelling market growth. In addition, the increasing disposable income has enabled more people to afford dental implant treatments, thereby propelling the market growth.

Restraining Factors

The concerns regarding the complications including infection and implant failures negatively affecting the treatment adoption rates, thereby challenging the dental implants market. Further, the increased cost and regulatory hurdles associated with dental implant may hamper the market growth.

Market Segmentation

The Spain dental implants market share is classified into material, design, type, and end-user.

- The titanium segment holds the largest market share and is anticipated to grow at a significant CAGR during the forecast period.

The Spain dental implants market is segmented by material into titanium, zirconium, and others. Among these, the titanium segment holds the largest market share and is anticipated to grow at a significant CAGR during the forecast period. The increasing adoption of titanium and titanium alloys among patients & dental professionals and the improved comfort of prosthetics are driving the market in the titanium segment.

- The tapered implants segment dominated the market with the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period.

The Spain dental implants market is segmented by design into tapered implants and parallel walled implants. Among these, the tapered implants segment dominated the market with the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period. Tapered implants are a common choice because they are easier to put and more stable than straight-walled implants. The increased benefit of tapered implants over parallel walled implants is responsible for propelling the market.

- The endosteal implants segment accounted for the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period.

The Spain dental implants market is segmented by type into endosteal implants, subperiosteal implants, and transosteal implants. Among these, the endosteal implants segment accounted for the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period. Endosteal implants are directly integrated with the jawbone. The higher stability, higher success rate, and better bone preservation by the endosteal implant are responsible for driving market growth.

- The solo practices segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Spain dental implants market is segmented by end-user into solo practices, DSO/group practices, and others. Among these, the solo practices segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. There is an increasing number of dentists population, which would spur the opening of well-equipped dental clinics. The increasing prevalence of dental ailments is driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain dental implants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Straumann Group

- Dentsply Sirona

- Zimmer Biomet Limited

- Henry Schein Holdings Limited

- Thommen Medical AG

- Bio Horizons Ltd

- Nobel Bio care

- Osstem Implant

- Astra Tech Dental

- Megagen Implant

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain dental implants market based on the below-mentioned segments:

Spain Dental Implants Market, By Material

- Titanium

- Zirconium

- Others

Spain Dental Implants Market, By Design

- Tapered Implants

- Parallel Walled Implants

Spain Dental Implants Market, By Type

- Endosteal Implants

- Subperiosteal Implants

- Transosteal Implants

Spain Dental Implants Market, By End-user

- Solo Practices

- DSO/Group Practices

- Others

Need help to buy this report?