Spain Diabetes Care Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Insulin, DPP-4 Inhibitors, GLP-1 Receptor Agonists, SGLT2 Inhibitors, and Others), By Diabetes Type (Type 1 and Type 2), By Route of Administration (Oral, Subcutaneous, and Intravenous), By Distribution Channel (Online Pharmacies, Hospital Pharmacies, and Retail Pharmacies), and Spain Diabetes Care Drugs Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Diabetes Care Drugs Market Insights Forecasts to 2033

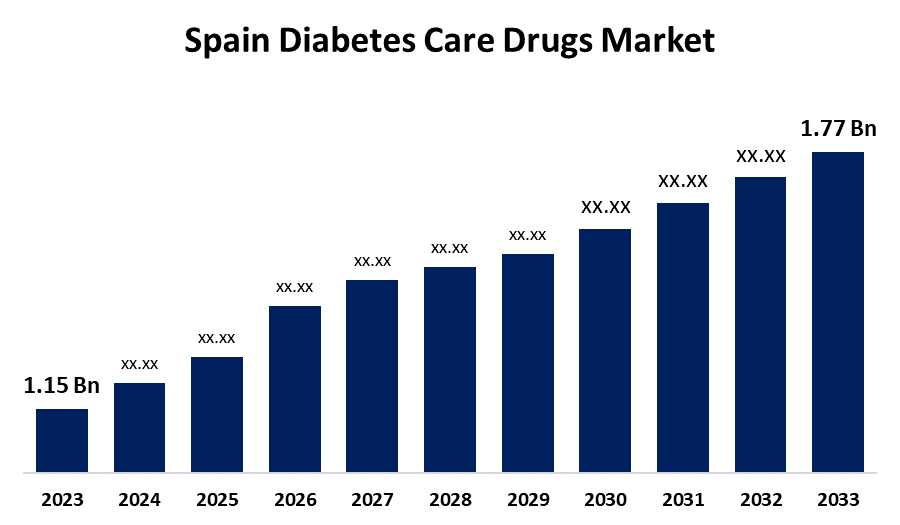

- The Spain Diabetes Care Drugs Market Size was valued at USD 1.15 Billion in 2023.

- The Market is growing at a CAGR of 4.41% from 2023 to 2033

- The Spain Diabetes Care Drugs Market Size is expected to reach USD 1.77 Billion by 2033

Get more details on this report -

The Spain Diabetes Care Drugs Market is anticipated to exceed USD 1.77 Billion by 2033, growing at a CAGR of 4.41% from 2023 to 2033. The increasing prevalence of diabetes, rising geriatric population, and surging R&D of diabetes drugs are driving the growth of the diabetes care drugs market in Spain.

Market Overview

The diabetes care drugs market refers to the pharmaceutical industry that develops, produces, and sells drugs to treat diabetes. Diabetes care drugs include pills, injections, and other medications that aid in lowering blood sugar levels. They play a crucial role in managing blood sugar levels in diabetic patients and preventing complications associated with high sugar levels. The drugs aid in the utilization of insulin more effectively, ultimately reducing the risk of serious health issues such as heart disease, kidney damage, and vision loss associated with poorly controlled diabetes. Pharmaceutical firms and academic institutions are making efforts to create cutting-edge treatments to deal with the complications of diabetes, such as innovative medication formulations and personalized medical regimes. The diabetes care drugs market is expanding as a result of increasing R&D activity, which also encourages the launch of innovative treatments and promotes the continuous improvement of therapies, improving patient outcomes. The increasing need for effective diabetes management solutions owing to the growing aging population along with the rising prevalence of diabetes is offering lucrative market growth opportunities.

Report Coverage

This research report categorizes the market for the Spain diabetes care drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain diabetes care drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain diabetes care drugs market.

Spain Diabetes Care Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.15 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.41% |

| 023 – 2033 Value Projection: | USD 1.77 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 61 |

| Segments covered: | By Drug Class, By Diabetes Type, By Route of Administration, By Distribution Channel |

| Companies covered:: | Takeda, Novo Nordisk, Pfizer, Eli Lilly, Janssen Pharmaceuticals, Astellas, Boehringer Ingelheim, Merck And Co., AstraZeneca, Bristol Myers Squibb, Novartis, Sanofi, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The increased prevalence of diabetes drives the need for medications such as pills, injections, and insulin pumps to manage diabetes conditions, thereby driving the market demand. As per the report of statista, the number of Spanish citizens over 65 reached 9.93 million as of January 2024, maintaining the growing trend. The number of old age people grew by over three million between 2002 and 2024. The increasing ageing population in the country is also responsible for propelling the market as diabetes is commonly diagnosed in older people. In addition, the increasing focus on clinical studies for treatment effectiveness and patterns of existing diabetes drugs is expected to drive market growth.

Restraining Factors

The economic burden of diabetes treatment and the increased cost of advanced diabetes drugs are challenging the diabetes care drugs market.

Market Segmentation

The Spain diabetes care drugs market share is classified into drug class, diabetes type, route of administration, and distribution channel.

- The GLP-1 receptor agonists segment held the largest market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain diabetes care drugs market is segmented by drug class into insulin, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT2 inhibitors, and others. Among these, the GLP-1 receptor agonists segment held the largest market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The increasing need for novel drugs and increasing R&D investments by the key players are propelling the market growth in the GLP-1 receptor agonists segment.

- The type 2 segment dominated the market with the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period.

The Spain diabetes care drugs market is segmented by diabetes type into type 1 and type 2. Among these, the type 2 segment dominated the market with the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period. The high prevalence of type 2 diabetes and increasing clinical trial studies on the treatment of type 2 diabetes are expected to drive market growth.

- The subcutaneous segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

The Spain diabetes care drugs market is segmented by route of administration into oral, subcutaneous, and intravenous. Among these, the subcutaneous segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The growing consumption of insulin subcutaneous injection and the availability of biosimilar and generic equivalents are propelling the market.

- The retail pharmacies segment held the largest share of the diabetes care drugs market in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

The Spain diabetes care drugs market is segmented by distribution channel into online pharmacies, hospital pharmacies, and retail pharmacies. Among these, the retail pharmacies segment held the largest share of the diabetes care drugs market in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The availability of diabetes drugs in retail stores at affordable cost aids in driving the market demand in the retail pharmacies segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain diabetes care drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takeda

- Novo Nordisk

- Pfizer

- Eli Lilly

- Janssen Pharmaceuticals

- Astellas

- Boehringer Ingelheim

- Merck And Co.

- AstraZeneca

- Bristol Myers Squibb

- Novartis

- Sanofi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, the European Commission approved a label extension for Kerendia (finerenone) in the European Union (EU) to include results on cardiovascular (CV) outcomes from the Phase III FIGARO-DKD study. Kerendia (finerenone) granted expanded indication in the EU for broad range of patients with chronic kidney disease and type 2 diabetes.

- In April 2022, the European Commission (EC) approved anti-VEGF therapy Beovu (brolucizumab) 6 mg for diabetic macular edema (DME), marking the therapy’s second indication in the bloc. Ophthalmic pharmaceutical giant Novartis announced the clearance on 31 March that applied to all 27 European Union (EU) member states as well as Iceland, Norway and Liechtenstein.

Market Segment

- This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain diabetes care drugs market based on the below-mentioned segments

Spain Diabetes Care Drugs Market, By Drug Class

- Insulin

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- SGLT2 Inhibitors

- Others

Spain Diabetes Care Drugs Market, By Diabetes Type

- Type 1

- Type 2

Spain Diabetes Care Drugs Market, By Route of Administration

- Oral

- Subcutaneous

- Intravenous

Spain Diabetes Care Drugs Market, By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Need help to buy this report?