Spain Endoscopy Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Endoscopes, Endoscopy Visualization Systems, Endoscopy Visualization Components, and Operative Devices), By End-use (Hospitals and Outpatient Facilities), and Spain Endoscopy Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Endoscopy Devices Market Insights Forecasts to 2033

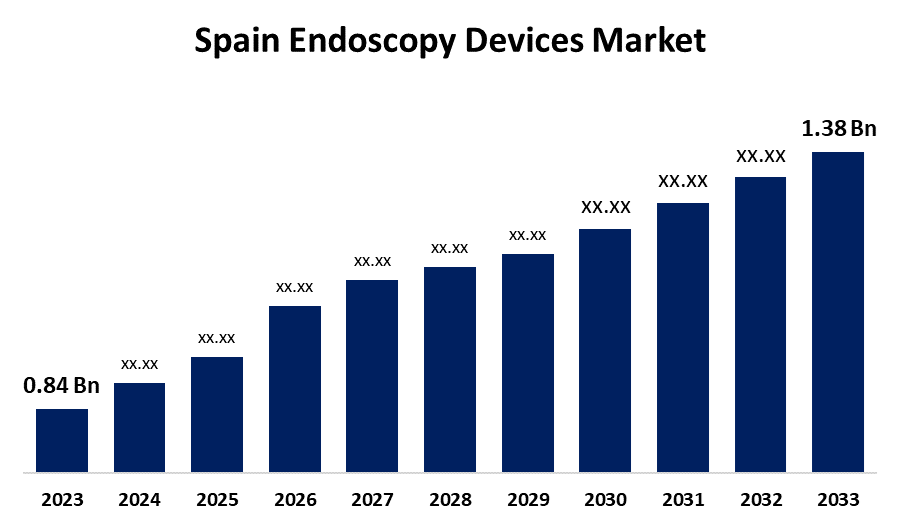

- The Spain Endoscopy Devices Market Size was valued at USD 0.84 Billion in 2023.

- The Spain Endoscopy Devices Market Size is Growing at a CAGR of 5.09% from 2023 to 2033

- The Spain Endoscopy Devices Market Size is Expected to reach USD 1.38 Billion by 2033

Get more details on this report -

The Spain Endoscopy Devices Market Size is Anticipated to exceed USD 1.38 Billion by 2033, Growing at a CAGR of 5.09% from 2023 to 2033. The growing endoscopy adoption for the treatment and diagnosis, preference for minimally invasive surgeries are driving the growth of the endoscopy devices market in the Spain.

Market Overview

The endoscopy devices market refers to the industry of medical devices used for examining the inside of a hollow organ or body cavity through an endoscope such as gastroscopes, colonoscopes, and bronchoscopes. Endoscopy devices visualize inside the body by inserting a flexible, lighted tube with a camera through a natural opening of the body. These instruments have less invasive properties with affordable post and pre-procedure cost. There is a shifting trend toward the use of disposable endoscopic components for minimizing the procedure cost and reducing the chance of cross-contamination. There is surging utilization of technologically advanced endoscopy devices equipped with high-definition cameras and light sources for analyzing internal organs by physicians. The use of minimally invasive surgeries owing to minimized post-procedure complications and reduced hospital stays significantly propel the demand for endoscopy devices. Thus, the technological advancements and demand for minimally invasive procedures are escalating the market growth opportunity for endoscopy devices.

Report Coverage

This research report categorizes the market for the Spain endoscopy devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain endoscopy devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain endoscopy devices market.

Spain Endoscopy Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.84 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.09% |

| 2033 Value Projection: | USD 1.38 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Boston Scientific Corporation, Johnson and Johnson, KARL STORZ, Hoya Corporation (PENTAX Medical), Fujifilm Holdings Corporation, Richard Wolf GmbH, Cook Group, Medtronic PLC, Olympus Corporation and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The adoption of advanced endoscopic devices including minimally invasive procedures for improved patient outcomes is expected to propel the market growth. The increasing demand for minimally invasive surgery surges the need for endoscopes for visualizing and operating within the body through small incisions, thereby propelling the market growth. In addition, the increased prevalence of GI and chronic diseases is also contributing to driving the market demand for endoscopy devices.

Restraining Factors

The shortage of skilled technicians and supply chain disruption leads to restrain the market growth. The increased cost of equipment and procedures related to endoscopes limits its adoption, thereby hindering the market.

Market Segmentation

The Spain endoscopy devices market share is classified into product and end use.

- The endoscopes segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR growth during the projected period.

The Spain endoscopy devices market is segmented by product into endoscopes, endoscopy visualization systems, endoscopy visualization components, and operative devices. Among these, the endoscopes segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR growth during the projected period. Endoscopes are comprise of image sensor, optical lens, light source, and mechanical device for visualizing inside the body. The increasing use of endoscopes for diagnosis of cancer, GI disorders, urinary disorders, and lung disorders is propelling the market.

- The outpatient facilities segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at the fastest CAGR growth during the forecast period.

The Spain endoscopy devices market is segmented by end use into hospitals and outpatient facilities. Among these, the outpatient facilities segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at the fastest CAGR growth during the forecast period. Internal organs can be visually examined by doctors using endoscopy devices without having to make a large incision. The growing inclination towards the use of minimally invasive procedures drives the growth of outpatient facilities like ambulatory surgery centers and diagnostic clinics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain endoscopy devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Scientific Corporation

- Johnson and Johnson

- KARL STORZ

- Hoya Corporation (PENTAX Medical)

- Fujifilm Holdings Corporation

- Richard Wolf GmbH

- Cook Group

- Medtronic PLC

- Olympus Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, PENTAX Medical, a division of HOYA Group, obtained CE marks for two of its latest innovations; PENTAX Medical INSPIRA, the new premium video processor, and the i20c video endoscope series.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain endoscopy devices market based on the below-mentioned segments:

Spain Endoscopy Devices Market, By Product

- Endoscopes

- Endoscopy Visualization Systems

- Endoscopy Visualization Components

- Operative Devices

Spain Endoscopy Devices Market, By End use

- Hospitals

- Outpatient Facilities

Need help to buy this report?