Spain Excipients Market Size, Share, and COVID-19 Impact Analysis, By Product (Polymers, Alcohols, Sugar, Minerals, and Gelatin), By Formulation (Oral, Topical, Parenteral, and Others), and Spain Excipients Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsSpain Excipients Market Insights Forecasts to 2033

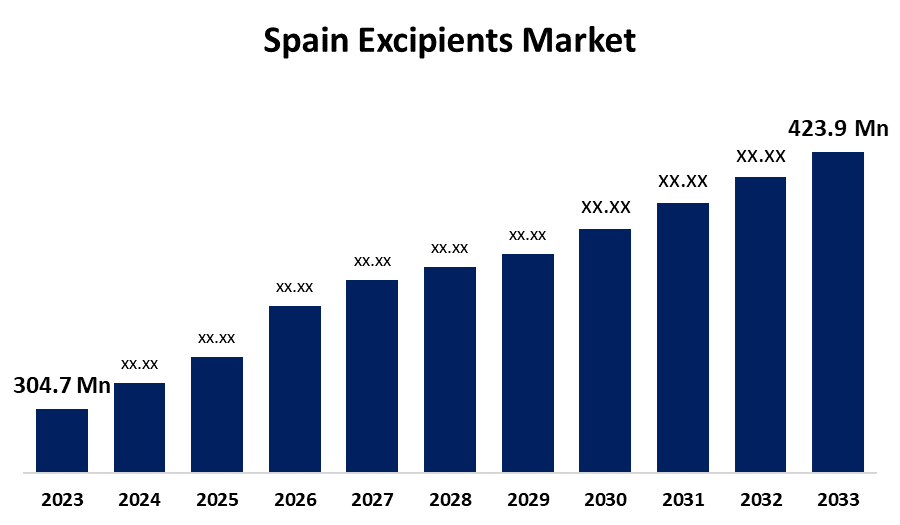

- The Spain Excipients Market Size was valued at USD 304.7 Million in 2023.

- The Market is Growing at a CAGR of 3.36% from 2023 to 2033

- The Spain Excipients Market Size is Expected to Reach USD 423.9 Million by 2033

Get more details on this report -

The Spain Excipients Market is Anticipated to Reach USD 423.9 Million by 2033, growing at a CAGR of 3.36%from 2023 to 2033.

Market Overview

An excipient is a substance added to a medication alongside the active ingredient. Excipients serve various purposes, including enhancing the therapeutic properties of the active ingredient, facilitating drug absorption, reducing viscosity, improving solubility, and ensuring long-term stability by preventing denaturation and aggregation over the expected shelf life. Additionally, excipients can add bulk to solid formulations that contain small amounts of potent active ingredients; in these cases, they are often referred to as "bulking agents," "fillers," or "diluents." Moreover, DFE Pharma is a company that supplies pharmaceutical excipients in Spain, including microcrystalline cellulose for Acfol. Excipients play a crucial role in drug delivery, bioavailability, solubility, taste masking, and more. Spain has specific requirements for the import, storage, and manufacturing of pharmaceutical products. Facilities must implement a quality system and obtain a license from the AEMPS (Spanish Agency of Medicines and Medical Devices). There are established controls and procedures for importing cosmetic, personal care, and biocide products from non-EU countries. Moreover, Spain is a leader in the export of essences and aromas, such as grapefruit, lemon, and orange oils. The country's beauty industry is a significant exporter, with sales of essential oils abroad reaching over 420 million euros.

Report Coverage

This research report categorizes the market for the Spain excipients based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain excipients market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain excipients market.

Spain Excipients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 304.7 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.36% |

| 2033 Value Projection: | USD 423.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Formulation, By Formulation and COVID-19 Impact Analysis |

| Companies covered:: | DFE Pharma, Colorcon, Roquette America, Actylis, JRS Pharma, Bausch Health Companies Inc, Shin-Etsu Chemical Co Ltd, Ashland Inc and Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing use of generic medicines and the demand for multifunctional excipients are key drivers of revenue growth in the pharmaceutical industry. Excipients enhance functionality and competitive advantage in drug formulations, leading to increased usage by companies. Ongoing research into ideal substances for drug delivery is also boosting the market. Additionally, the demand for novel excipients that support nanoparticle drug delivery, especially for oncological medications, is on the rise. The expiration of patents for blockbuster drugs is expected to further accelerate market growth. Companies are currently focused on optimizing excipients and developing innovative formulations, which will significantly impact future product development and marketing.

Restraining Factors

Several factors can hinder the growth of the excipients market. Increasing regulatory strictness related to the approval of drugs and excipients may impede revenue growth. The development of new excipients can be costly and time-consuming, especially for smaller companies. Additionally, consumers may not fully understand the role and benefits of excipients, which can negatively affect market growth. Furthermore, a lack of confidence in generic drugs among medical professionals and patients may stem from inadequate regulatory standards.

Market Segmentation

The Spain excipients market share is classified into product and formulation.

- The polymers segment is expected to hold the largest market share through the forecast period.

The Spain excipients market is segmented by product into polymers, alcohols, sugar, minerals, and gelatin. Among these, the polymers segment is expected to hold the largest market share through the forecast period. Polymers, such as microcrystalline cellulose and pregelatinized starch, have become the most profitable and widely produced category of pharmaceutical products. In the coming years, their increasing use in various dosage forms, including suspensions, capsules, and tablets, is expected to be a key driver for this segment.

- The oral segment is expected to dominate the Spain excipients market during the forecast period.

Based on the formulation, the Spain excipients market is divided into oral, topical, parenteral, and others. Among these, the oral segment is expected to dominate the Spain excipients market during the forecast period. The increased use of oral formulations has led to a higher demand for excipients, including stabilizers, emulsifiers, polymers, and solubilizing agents.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain excipients market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DFE Pharma

- Colorcon

- Roquette America

- Actylis

- JRS Pharma

- Bausch Health Companies Inc

- Shin-Etsu Chemical Co Ltd

- Ashland Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Clariant, a specialty Chemicals Company committed to sustainability, is expanding its portfolio of high-performance pharmaceutical ingredient solutions to support the development of safe and effective medicines. At CPHI Barcelona, Clariant will introduce three new VitiPure excipients, which enable a wide range of formulations and administration routes for Active Pharmaceutical Ingredients (APIs), including sensitive applications such as mRNA vaccines and biologic medications. This solidifies Clariant's position as a comprehensive solutions provider for the industry.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Excipients Market based on the below-mentioned segments

Spain Excipients Market, By Product

- Polymers

- Alcohols

- Sugar

- Minerals

- Gelatin

Spain Excipients Market, By Formulation

- Oral

- Topical

- Parenteral

- Others

Need help to buy this report?