Spain Eyewear Market Size, Share, and COVID-19 Impact Analysis, By Product (Contact Lenses, Prescription (RX) Glasses, and Sunglasses), By Distribution Channel (E-Commerce and Brick & Mortar), and Spain Eyewear Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Eyewear Market Insights Forecasts to 2033

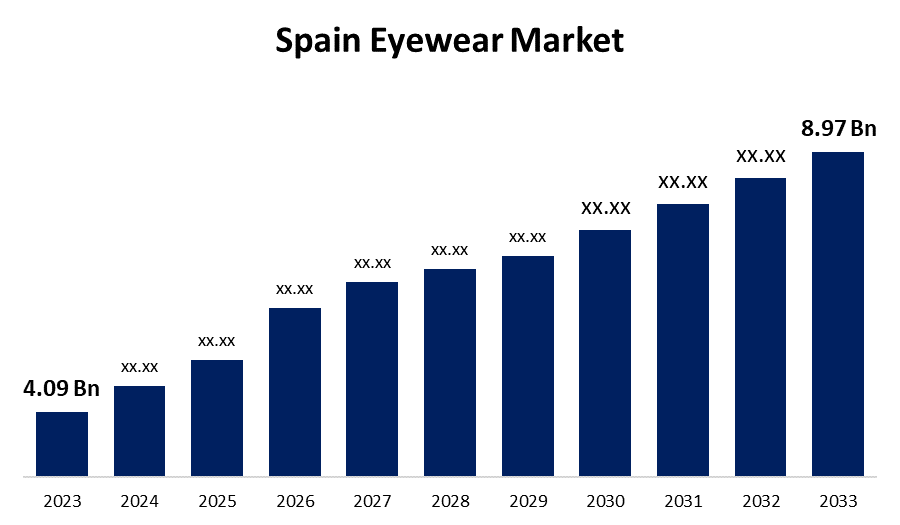

- The Spain Eyewear Market Size was valued at USD 4.09 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.17% from 2023 to 2033.

- The Spain Eyewear Market Size is Expected to Reach USD 8.97 Billion by 2033

Get more details on this report -

The Spain Eyewear Market Size is Anticipated to Reach USD 8.97 Billion by 2033, growing at a CAGR of 8.17% from 2023 to 2033.

Market Overview

Eyewear refers to any accessory worn on or around the eyes for vision correction, protection against environmental hazards, or simply as a fashion statement. It typically includes items such as glasses, sunglasses, and goggles. In Spain, eyewear serves various purposes. Spanish eyewear is renowned for its creativity and innovation and it is used to express Spanish heritage and contemporary fashion. Eyewear protects against environmental elements and can enhance visual acuity. Contact lenses offer the option to change the color or shape of the eyes. The Spain eyewear market encompasses a variety of products, such as spectacle lenses, sunglasses, spectacle frames, and contact lenses. Furthermore, the Shift towards fashion-forward eyewear has sparked a surge in demand for designer brands, as people seek to make a statement with their eyeglasses and sunglasses. Eyewear collections are constantly evolving to meet this demand, with regular updates introducing new designs and patterns. From bold and colorful frames to subtle and sophisticated ones, eyewear has become a canvas for self-expression, driving a dynamic and ever-expanding market at the intersection of fashion and functionality.

Report Coverage

This research report categorizes the market for the Spain eyewear based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain eyewear market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain eyewear market.

Spain Eyewear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.09 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.17% |

| 2033 Value Projection: | USD 8.97 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Distribution Channel. |

| Companies covered:: | Biofinity, Conant, Crizal, Hoya, Persol, Prada, Ray-Ban, SofLens, Transitions, Varilux, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for corrective eyewear is increasing due to several factors. As the population ages, natural declines in eyesight lead to the need for eyeglasses and contact lenses. In addition, the increased screen time from digital devices strains our eyes, further increasing the need for corrective lenses. Furthermore, growing awareness of eye health, driven by public health campaigns and improved access to information, highlights the importance of proactive eye care, resulting in a higher demand for corrective eyewear. These converging trends are reshaping the eyewear industry, emphasizing the vital role of vision correction in maintaining overall health and well-being.

Restraining Factors

The Spanish optical market faces several restraints. There is intense competition, making it difficult to maintain high profit margins. The cost of luxury eyewear products, especially those with advanced lens technology and manufacturing designs, can be high, limiting affordability.

Market Segmentation

The Spain eyewear market share is classified into product and distribution channel.

- The prescription (rRX) glasses segment is expected to hold the largest market share through the forecast period.

The Spain eyewear market is segmented by product into contact lenses, prescription (RX) glasses, and sunglasses. Among these, the prescription (RX) glasses segment is expected to hold the largest market share through the forecast period. The growing number of eye conditions, such as myopia, hyperopia, astigmatism, and presbyopia, is increasing the need for corrective eyewear. Additionally, advancements in lens technology, such as the creation of thinner, lighter, and more scratch-resistant lenses, have made prescription glasses more comfortable and visually appealing. The variety of prescription eyewear options available, including designer frames and customized lenses, has improved the market prospects for prescription glasses.

- The brick & mortar segment is expected to dominate the Spain eyewear market during the forecast period.

Based on the distribution channel, the Spain eyewear market is divided into e-commerce and brick & mortar. Among these, the brick & mortar segment is expected to dominate the Spain eyewear market during the forecast period. This is due to the strong consumer preference for physical stores and the numerous associated advantages, customers can receive personalized advice from trained opticians on frame selection, lens prescriptions, and adjustments. Additionally, these stores allow customers to physically try on frames to ensure proper fit and comfort, which expedites the purchase decision. Furthermore, these stores offer attractive discounts and have a wide variety of brands, which enhances consumer demand and supports segmental growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain eyewear market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biofinity

- Conant

- Crizal

- Hoya

- Persol

- Prada

- Ray-Ban

- SofLens

- Transitions

- Varilux

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Hawkers, a brand that has redefined the eyewear market with its stylish and affordable products, has recently taken a significant step in its retail strategy by opening an optical store in Barcelona’s Diagonal Mar shopping center. Known primarily for its strong online presence, Hawkers is now expanding its physical retail footprint, signaling a new phase in the company’s growth.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain eyewear market based on the below-mentioned segments:

Spain Eyewear Market, By Product

- Contact Lenses

- Prescription (RX) Glasses

- Sunglasses

Spain Eyewear Market, By Distribution Channel

- E-Commerce

- Brick & Mortar

Need help to buy this report?