Spain Feed Additives Market Size, Share, and COVID-19 Impact Analysis, By Type (Amino Acids, Vitamins & Minerals, Antioxidants, and Others), By Animal Type (Cattle, Poultry, Swine, and Others), and Spain Feed Additives Market Insights, Industry Trend, Forecasts to 2033

Industry: AgricultureSpain Feed Additives Market Size Insights Forecasts to 2033

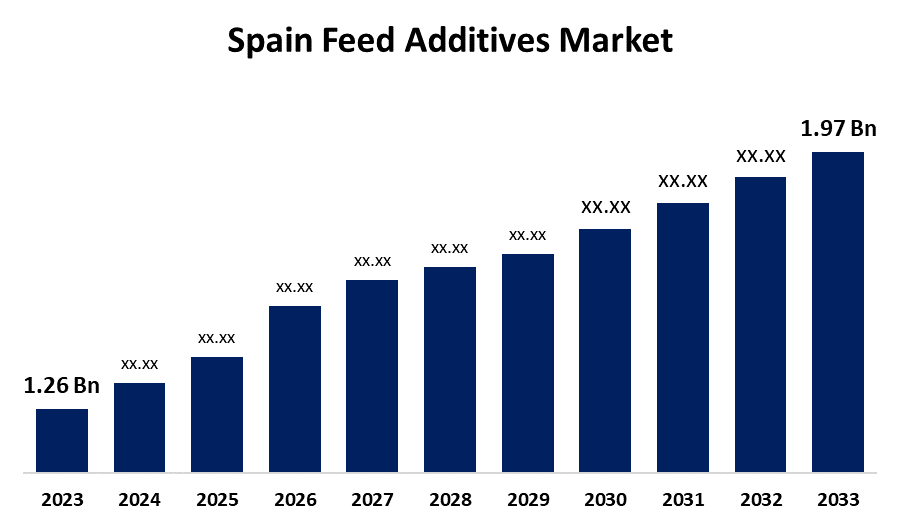

- The Spain Feed Additives Market Size was valued at USD 1.26 Billion in 2023.

- The Spain Feed Additives Market Size is Growing at a CAGR of 4.57% from 2023 to 2033

- The Spain Feed Additives Market Size is Expected to reach USD 1.97 Billion by 2033

Get more details on this report -

The Spain Feed Additives Market Size is Anticipated to Exceed USD 1.97 Billion by 2033, Growing at a CAGR of 4.57% from 2023 to 2033. The rising meat consumption, surging innovation in feed additives, and increased awareness of animal health are driving the growth of the feed additives market in the Spain.

Market Overview

The feed additives market refers to the industry selling substances called feed additives added to animal feed to improve its nutritional value, promote growth, or enhance overall health. These additives are extra nutrients or drugs for livestock. It includes vitamins, amino acids, fatty acids, minerals, pharmaceuticals, fungal products, and steroidal compounds. Further, the additives might impact feed presentation, hygiene, digestibility, or effect on intestinal health. The occurrence of Bovine Spongiform Encephalopathy (BSE, mad cow disease) has shifted consumer preference, surging the need for implementing more stringent nutritional standards across the industry. The consumer need for premium meat products and heightened awareness about animal health protocols owing to livestock disease outbreaks lead to sustainable growth in the animal feed industry in the country. The increasing awareness about animal health is bolstering the market growth opportunity for feed additives for boosting immunity and preventing disease in livestock.

Report Coverage

This research report categorizes the market for the Spain feed additives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain feed additives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain feed additives market.

Spain Feed Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.26 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.57% |

| 2033 Value Projection: | USD 1.97 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Animal Type and COVID-19 Impact Analysis |

| Companies covered:: | Pfizer Animal Health, Nutriad International, BASF SE, Novozymes A/S., Archer Daniels Midland Co., Cargill Inc., DSM Nutritional Products Inc., Adisseo France S.A.S., Evonik Industries AG, Novus International Inc., Nutreco N.V., Azelis Animal Nutrition, Borregaard AS, and Others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increased meat consumption in Spain is responsible for driving the market demand for feed additives. Spain is among the top meat consumers in Europe. As per the data from Ministry of Agriculture and Food (MAPA) and the National Institute of Statistics, in the Spanish market, the consumption of meat and pork products has grown in 2023 to reach 1.01 million tons, representing 1.5% compared to the same period of the year above according to the reports by the Interprofessional INTERPORC. The surging innovation in feed additives using microbiome technology by Nutreco and BiomEdit for enhancing animal health solutions and drive sustainability in animal feed industry leads to propel the feed additives market growth. Additionally, the adaptability and response of veterinary healthcare to an emerging infectious disease positively influence market growth.

Restraining Factors

The high cost associated with feed additives manufacturing and increasing consumer preference for vegan food is challenging the feed additives market.

Market Segmentation

The Spain feed additives market share is classified into type and animal type.

- The amino acids segment dominated the feed additives market with the largest market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain feed additives market is segmented by type into amino acids, vitamins & minerals, antioxidants, and others. Among these, the amino acids segment dominated the feed additives market with the largest market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Amino acid is used in dietary supplements in animal feed as a source of energy, playing a significant role in health nutrition. It enhances the metabolic rate and provides nutrition to animals such as cattle, broilers, and pigs, and helps in maintaining the health, reproduction, and lactation of animals. The flexibility provided by the amino acids additives is responsible for driving the market demand in the amino acids segment.

- The poultry segment dominated the feed additives market with the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period.

The Spain feed additives market is segmented by animal type into cattle, poultry, swine, and others. Among these, the poultry segment dominated the feed additives market with the largest market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period. Feed additives are primarily used in poultry diets to improve the efficiency of the bird’s growth and/or laying capacity, preventing disease and improving feed utilization. The increasing poultry sector due to the growing need for eggs and chicken for consumption is propelling the market in the poultry segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain feed additives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Animal Health

- Nutriad International

- BASF SE

- Novozymes A/S.

- Archer Daniels Midland Co.

- Cargill Inc.

- DSM Nutritional Products Inc.

- Adisseo France S.A.S.

- Evonik Industries AG

- Novus International Inc.

- Nutreco N.V.

- Azelis Animal Nutrition

- Borregaard AS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Archer Daniels Midland, a leader in science-based nutrition solutions, opened a new production facility in Valencia, Spain, with a $30 million investment to increase its production capacity five-fold and meet growing global demand for probiotics and postbiotics.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain feed additives market based on the below-mentioned segments:

Spain Feed Additives Market, By Type

- Amino Acids

- Vitamins & Minerals

- Antioxidants

- Others

Spain Feed Additives Market, By Animal Type

- Cattle

- Poultry

- Swine

- Others

Need help to buy this report?