Spain Food Emulsifier Market Size, Share, and COVID-19 Impact Analysis, By Product (Mono, Di-Glycerides & Derivatives, Lecithin, Stearoyl Lactylates, Sorbitan Esters, and Others), By Source (Animal and Plant), By Application (Bakery & Confectionery, Convenience Foods, Meat Products, Dairy Products, and Others), and Spain Food Emulsifier Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesSpain Food Emulsifier Market Insights Forecasts to 2033

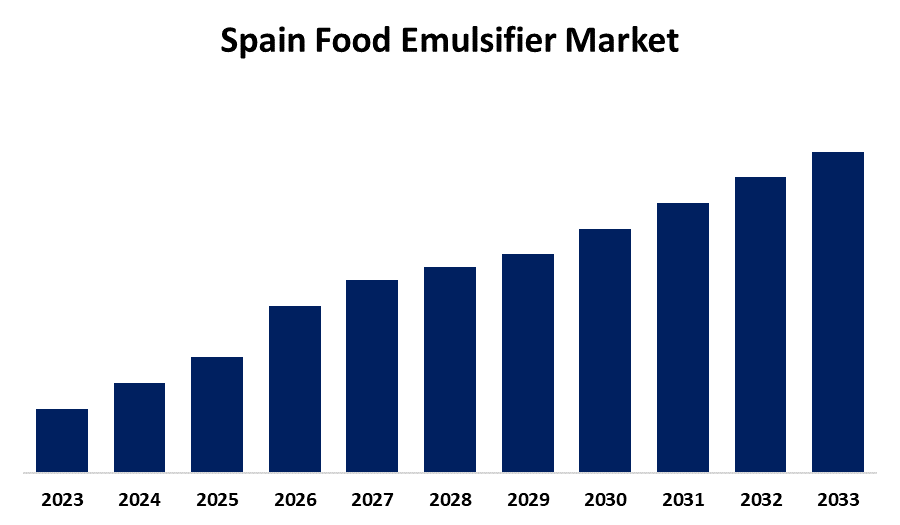

- The Spain Food Emulsifier Market is growing at a CAGR of 3.07% from 2023 to 2033

- The Spain Food Emulsifier Market Size is expected to hold a significant share by 2033

Get more details on this report -

The Spain Food Emulsifier Market is anticipated to hold a significant share by 2033, growing at a CAGR of 3.07% from 2023 to 2033. The growing demand for convenient and processed foods, health awareness, and advancement in food technology is driving the growth of the food emulsifier market in the Spain.

Market Overview

The food emulsifier market refers to the industry for substances that aid in the mixing of oil and water-based ingredients in food products, including bakery, confectionary, dairy, and convenience food products. Food emulsifiers, also known as emulgent, are food ingredients that act as stabilizers for emulsion. They form the border between two immiscible liquids like oil and water, allowing them to be blended into stable emulsions. They also reduce stickiness, control crystallization, and prevent separation of the components, thereby enhancing the overall quality of the product and giving greater consumer satisfaction. They are popularly used for improving texture and longer shelf life in food and beverage products and creating smooth and consistent texture in foods such as mayonnaise and ice cream. The surging innovation in product development, such as starch-based emulsifiers from macro and nanoparticles for improvement of stabilization to improve products structure and shelf life is escalating lucrative market growth opportunity for food emulsifier.

Report Coverage

This research report categorizes the market for the Spain food emulsifier market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain food emulsifier market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain food emulsifier market.

Spain Food Emulsifier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.07% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Application, By Source |

| Companies covered:: | Cargill Inc., DuPont de Nemours, Inc., Archer Daniels Midland Company, Ingredion Inc, Kerry Group plc, Lonza Group, BASF SE, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for convenient and processed foods, particularly ready-to-eat meals, owing to the busy lifestyles and urbanization, leads to driving the demand for food emulsifiers to improve texture, stability, and shelf-life of these products, thereby propelling the market demand. The advancements, including nanoemulsions, high internal phrase emulsions (HIPEs), pickering emulsions, multilayer emulsions, solid lipid nanoparticles, and emulgels, are potentially used in the food industry, thereby promoting the market growth.

Restraining Factors

The increased price of natural emulsifiers and health risk factors associated with the consumption of emulsifiers may hamper the food emulsifier market demand. The stringent regulations associated with the use of emulsifying agents are challenging the market growth.

Market Segmentation

The Spain food emulsifier market share is classified into product, source, and application.

- The mono, di-glycerides & derivatives segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The Spain food emulsifier market is segmented by product into mono, di-glycerides & derivatives, lecithin, stearoyl lactylates, sorbitan esters, and others. Among these, the mono, di-glycerides & derivatives segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period. The growing demand for mono and di-glycerides emulsifiers for maintaining texture, extending shelf life, and improving the quality of various food products is propelling the market. The various functional benefits are offered by these derivatives in food applications, especially for convenient food.

- The animal segment held the largest revenue share of the Spain food emulsifier market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain food emulsifier market is segmented by source into animal and plant. Among these, the animal segment held the largest revenue share of the Spain food emulsifier market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Animal-sourced food emulsifiers, including lecithin from egg yolks and certain dairy proteins, are used as food emulsifiers. The adoption of animal-based food emulsifiers due to their functional benefits and efficiency in stabilizing and enhancing food texture is propelling the market.

- The bakery & confectionery segment dominated the Spain food emulsifier market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain food emulsifier market is segmented by application into bakery & confectionery, convenience foods, meat products, dairy products, and others. Among these, the bakery & confectionery segment dominated the Spain food emulsifier market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Food emulsifiers enhance the texture and taste of cakes as well as improve processability and extend shelf life. The upsurging trend of indulgence and premiumization in the bakery and confectionery sectors is fueling the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain food emulsifier market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Inc.

- DuPont de Nemours, Inc.

- Archer Daniels Midland Company

- Ingredion Inc

- Kerry Group plc

- Lonza Group

- BASF SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2024, Ingredion Incorporated, a leading global provider of specialty ingredient solutions to the food and beverage manufacturing industry and pioneer of clean label ingredients, announced NOVATION Indulge 2940 starch, expanding their line of clean label texturizers with the first non-GMO functional native corn starch that provides a unique texture for gelling and co-texturizing for popular dairy and alternative dairy products and desserts.

- In January 2023, Kerry Group plc announced that it has entered into exclusive negotiations to sell the trade and assets of its Sweet Ingredients Portfolio to IRCA (“the Potential Sale”), an international leader in chocolate, creams, and other high-quality semi-finished food ingredients, for a consideration of 500m1.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain food emulsifier market based on the below-mentioned segments:

Spain Food Emulsifier Market, By Product

- Mono, Di-Glycerides & Derivatives

- Lecithin

- Stearoyl Lactylates

- Sorbitan Esters

- Others

Spain Food Emulsifier Market, By Source

- Animal

- Plant

Spain Food Emulsifier Market, By Application

- Bakery & Confectionery

- Convenience Foods

- Meat Products

- Dairy Products

- Others

Need help to buy this report?