Spain Foodservice Market Size, Share, and COVID-19 Impact Analysis, By Foodservice Type (Cafes & Bars, Cloud Kitchen, Full-service Restaurants, and Quick-service Restaurants), By Outlet (Chained Outlets and Independent Outlets), and Spain Foodservice Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesSpain Foodservice Market Insights Forecasts to 2033

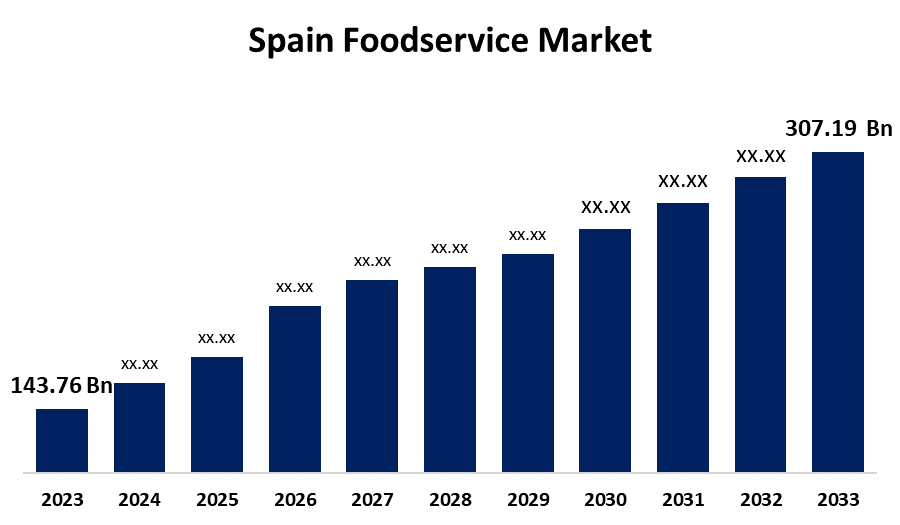

- The Spain Foodservice Market Size was valued at USD 143.76 Billion in 2023.

- The Market is Growing at a CAGR of 7.89% from 2023 to 2033

- The Spain Foodservice Market Size is Expected to Reach USD 307.19 Billion by 2033

Get more details on this report -

The Spain Foodservice Market Size is Anticipated to Reach USD 307.19 Billion by 2033, Growing at a CAGR of 7.89% from 2023 to 2033.

Market Overview

The Spain foodservice market is a business that delivers food and drinks to consumers from home, including restaurants, bars, cafés, fast foods, catering firms, and institutional foodservice. The market is driven by factors such as increasing convenience, time-saving demands, a thriving food culture and tourism, and health-oriented consumers seeking plant-based, organic, and locally sourced foods. The government has introduced policies to promote local agriculture and sustainable practices, reduce food wastage, and improve food safety levels. The government has also favored digitalization of the foodservice sector, allowing companies to adapt to the increasing trend of ordering food online and having it delivered. These initiatives aim to make the industry more efficient, and support sustainability, and customer satisfaction, while also ensuring sustainability and customer satisfaction.

Report Coverage

This research report categorizes the market for the Spain foodservice market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain foodservice market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain foodservice market.

Spain Foodservice Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 143.76 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.89% |

| 2033 Value Projection: | USD 307.19 |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Foodservice Type, By Outlet and COVID-19 Impact Analysis |

| Companies covered:: | Alsea SAB de CV, AmRest Holdings SE, Comess Group, Compass Group PLC, Food Delivery Brands, Groupo Ibersol, McDonald’s Corporation, Restalia Grupo De Eurorestauracion SL, Restaurant Brands Iberia, Áreas SAU, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing popularity of convenience and eating while on the go, as customers with limited time are seeking out quick and easy meal options, such as takeout and ready-to-eat meals. Additionally, a steady stream of patrons seeking out genuine and varied dining experiences is fueled by Spain's rich culinary heritage and high tourism levels. Another motivating factor is health-conscious consumer preferences, which are emphasizing more locally produced, organic, and plant-based foods. Foodservice businesses are encouraged by this trend to adapt to shifting dietary needs and broaden their offerings. Furthermore, the expansion of online ordering and delivery platforms has transformed the market by giving customers greater accessibility and convenience.

Restraining Factors

Excessive operating expenses, particularly in labor and raw materials, can hinder foodservice companies, leading to price hikes and customer dissatisfaction. Economic uncertainty can also affect demand for eating out, especially during economic hardships. The competitive foodservice industry poses challenges for smaller operations, who struggle to maintain profitability amidst big chains and international brands. Additionally, managing food waste and ensuring sustainability compliance can be overwhelming, limiting growth opportunities for some owners.

Market Segmentation

The Spain foodservice market share is classified into foodservice type and outlet.

- The quick-service restaurants segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Spain foodservice market is segmented by foodservice type into cafes & bars, cloud kitchen, full-service restaurants, and quick-service restaurants. Among these, the quick-service restaurants segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Fast food chains and other QSRs are very well-liked because of their quick service, affordability, and convenience, which appeals to many customers' hectic, on-the-go lifestyles. The increased need for quick and easy meal options, especially among younger populations and city dwellers, is advantageous to the category.

- The chained outlets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the outlet, the Spain foodservice market is divided into chained outlets and independent outlets. Among these, the chained outlets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Chained stores in Spain, including coffee shops, QSRs, and multinational fast-food companies, have gained dominance due to local and global expansion. These stores are appealing to residents and visitors due to their reliability, affordability, and familiarity, particularly in cities and tourist destinations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain foodservice market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alsea SAB de CV

- AmRest Holdings SE

- Comess Group

- Compass Group PLC

- Food Delivery Brands

- Groupo Ibersol

- McDonald's Corporation

- Restalia Grupo De Eurorestauracion SL

- Restaurant Brands Iberia

- Áreas SAU

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2025, a Spanish plant-based food technology company called Heura has been causing a stir with its cutting-edge goods and eco-friendly initiatives. They have been acknowledged for their notable decrease in their environmental impact and have recently increased their B Corp grade by 18%.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain foodservice market based on the below-mentioned segments:

Spain Foodservice Market, By Foodservice Type

- Cafes & Bars

- Cloud Kitchen

- Full-service Restaurants

- Quick-service Restaurants

Spain Foodservice Market, By Outlet

- Chained Outlets

- Independent Outlets

Need help to buy this report?