Spain Freight and Logistics Market Size, Share, and COVID-19 Impact Analysis, By Shipping Type (Airways, Railways, Roadways, and Waterways), By Service (Inventory Management, Packaging, Warehousing, Transportation, Distribution, Custom Clearance, and Others), and Spain Freight and Logistics Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationSpain Freight and Logistics Market Insights Forecasts to 2033

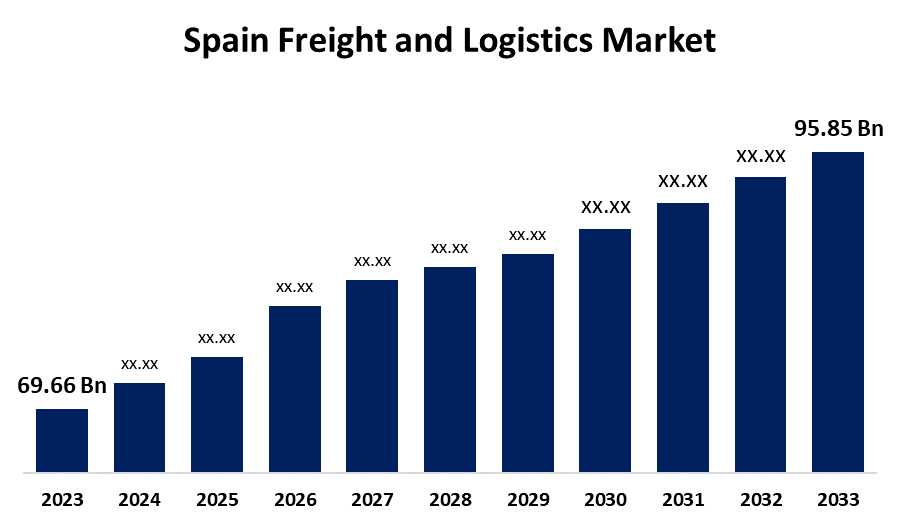

- The Spain Freight and Logistics Market Size was valued at USD 69.66 Billion in 2023.

- The Spain Freight and Logistics Market Size is Growing at a CAGR of 3.24% from 2023 to 2033

- The Spain Freight and Logistics Market Size is expected to reach USD 95.85 Billion by 2033

Get more details on this report -

The Spain Freight and Logistics Market Size is anticipated to exceed USD 95.85 Billion by 2033, growing at a CAGR of 3.24% from 2023 to 2033. The growing advancement in infrastructure, e-commerce expansion, technological advancements, sustainability initiatives, and significant government expansion are driving the growth of the freight and logistics market in the Spain.

Market Overview

The freight and logistics market refers to the industry managing the transportation and storage of goods and services. This is the overseeing and management of a cost-effective operation and the delivery of goods. Freight logistic activities in their most basic form include making contact and selecting and engaging carriers and transport companies. It is the process of moving goods from one place to another, including transportation, warehousing, and supply chain management. It includes transportation of goods and commodities by rail, trucks, road cars, and large boats conveying containers and airplanes. The growth in the trade-related agreements and logistics infrastructure, as well as technical improvements in the logistics sector for rapid delivery and supply chain, are propelling the market for freight and logistics. The growing outsourcing services like distribution, transportation, and logistics management are offering lucrative market growth opportunities for freight and logistics.

Report Coverage

This research report categorizes the market for the Spain freight and logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain freight and logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain freight and logistics market.

Spain Freight and Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 69.66 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.24% |

| 2033 Value Projection: | USD 95.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Shipping Type, By Service |

| Companies covered:: | CMA CGM Group (including CEVA Logistics), DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Damietta Container & Cargo Handling Co. (DCHC), Deutsche Bahn AG (including DB Schenker), Kadmar Group (including EGL Egypt), Kuehne+Nagel, LATT Trading and Shipping SAE, MISR Logistics, NACITA Corporation, NIS Logistics, Rockit Transport Services & Logistics Solutions, and Others |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The advancement in infrastructure for reducing cost, improving efficiency, and creating jobs are promoting the freight and logistics market. The e-commerce expansion in freight and logistics involves storing and shipping inventory for an online store or marketplace also contributing to drive the market expansion. Sustainability initiatives for reducing the environmental impact of freight and logistics operations are propelling market growth. There is expanding the country’s freight and logistics sector through significant infrastructure investments, particularly emphasizing that rail freight networks are responsible for the market growth of freight and logistics.

Restraining Factors

The poor road infrastructure and increased logistics costs are challenging the Spain freight and logistics market.

Market Segmentation

The Spain freight and logistics market share is classified into shipping type and service.

- The waterways segment dominated the market with a major market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain freight and logistics market is segmented by shipping type into airways, railways, roadways, and waterways. Among these, the waterways segment dominated the market with a major market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Waterways are a very cost-effective way of shipping goods particularly for long distances. The increasing preference for waterways logistics due to its several benefits such as dependable and congested transit is propelling the market.

- The transportation segment dominated the freight and logistics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain freight and logistics market is segmented by service into inventory management, packaging, warehousing, transportation, distribution, custom clearance, and others. Among these, the transportation segment dominated the freight and logistics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Rail, road, air, sea, pipeline, and international transport are the several ways of transportation for freight and logistics. The rising network of agreements leads to more trade and investment possibilities, thereby driving market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain freight and logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CMA CGM Group (including CEVA Logistics)

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Damietta Container & Cargo Handling Co. (DCHC)

- Deutsche Bahn AG (including DB Schenker)

- Kadmar Group (including EGL Egypt)

- Kuehne+Nagel

- LATT Trading and Shipping SAE

- MISR Logistics

- NACITA Corporation

- NIS Logistics

- Rockit Transport Services & Logistics Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, DSV A/S signed an agreement with Deutsche Bahn to acquire 100% of Schenker AG and its affiliates in an all-cash transaction. The transaction values Schenker at EUR 14.3 billion (approximately DKK 107 billion) on an Enterprise Value basis. The acquisition of Schenker is a transformative transaction for DSV, creating a world-leading player within the global transport and logistics industry.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain freight and logistics market based on the below-mentioned segments:

Spain Freight and Logistics Market, By Shipping Type

- Airways

- Railways

- Roadways

- Waterways

Spain Freight and Logistics Market, By Service

- Inventory Management

- Packaging

- Warehousing

- Transportation

- Distribution

- Custom Clearance

- Others

Need help to buy this report?