Spain Material Handling Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Cranes & Lifting Equipment, Industrial Trucks, Continuous Handling Equipment, and Racking & Storage Equipment), By Application (Automotive, Food & Beverages, Chemical, Semiconductor & Electronics, E-commerce, Aviation, Pharmaceutical, and Others), and Spain Material Handling Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: Machinery & EquipmentSpain Material Handling Equipment Market Insights Forecasts to 2033

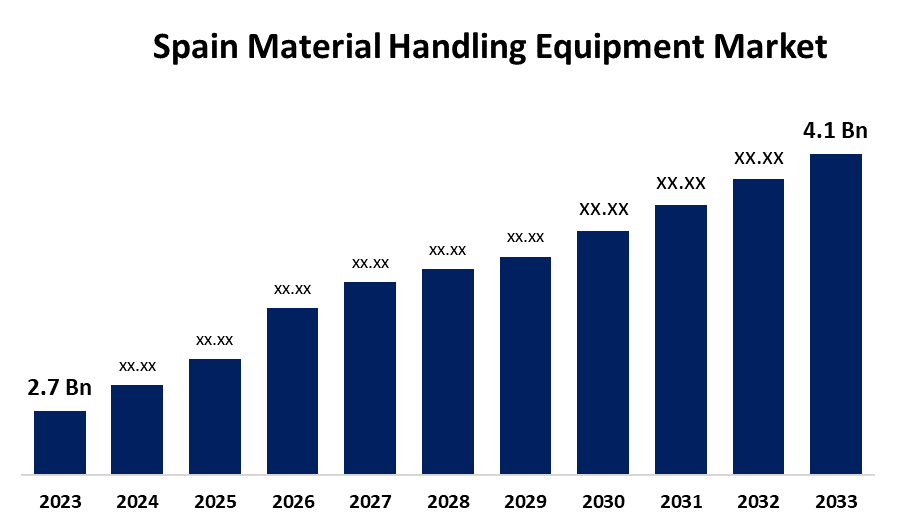

- The Spain Material Handling Equipment Market Size was valued at USD 2.7 Billion in 2023.

- The Spain Material Handling Equipment Market Size is Growing at a CAGR of 4.27% from 2023 to 2033

- The Spain Material Handling Equipment Market Size is Expected to reach USD 4.1 Billion by 2033

Get more details on this report -

The Spain Material Handling Equipment Market Size is Anticipated to Exceed USD 4.1 Billion by 2033, Growing at a CAGR of 4.27% from 2023 to 2033. The growing construction industry, government support, expanding manufacturing sector, and increasing industrial sector are driving the growth of the material handling equipment market in the Spain.

Market Overview

The material handling equipment market refers to the production, distribution, and use of equipment that is designed for moving, storing, controlling, and protecting materials throughout the supply chain, such as manufacturing, distribution, and disposal. Material handling equipment comprises tools, machines, or systems that are used through manufacturing, distribution, and consumption processes. Transport equipment, positioning equipment, unit lead formation equipment, and storage equipment are some of the categories of this equipment. There is a surging trend towards automation in material-handling equipment with the rapid industrialization and growth in industrial equipment investment owing to the requirement of managing bulk materials and worker safety awareness. Warehouse owners are accepting the use of material handling equipment for effectively managing the supply chain ecosystem. The ongoing technology breakthroughs and adoption of automation lead to the establishment of fully automated industrial facilities. Modernization of industrial facilities and infrastructures for improving production capacity as well as the integration of IoT and smart technologies, including predictive analysis and AI that alters logistics and supply chain management, enhancing efficiency, transparency, and decision-making with DHL and FedEx, are escalating the new market growth opportunity in the material handling equipment market.

Report Coverage

This research report categorizes the market for the Spain material handling equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain material handling equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain material handling equipment market.

Spain Material Handling Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.27% |

| 2033 Value Projection: | USD 4.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Mitsubishi Logisnext Europe SA, Liebherr Industrias Metálicas SA, Orona Holding SA, FEM-AEM, Bosch Rexroth, Toyota Material Handling, Rulmeca, ULMA Handling Systems, TGW Logistics Group GmbH, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The crucial role of material handling equipment including cranes, forklifts, and hoists in the construction industry for efficient and safe movement, storage, and management of materials is propelling the market demand. Government support in infrastructure development is contributing to propelling the material handling equipment market growth. It is reported that Spain's manufacturing supply has shown a consistent annual increase of 5.2%. In the 2023 rankings, Spain secured the fourth position. The expanding manufacturing sector surges the demand for these equipment, thereby driving the market. Further, the crucial role of material handling equipment in the industrial sector for facilitating the efficient movement, storage, and control of materials, goods, and products for increased efficiency, safety, and cost reduction is promoting the market growth.

Restraining Factors

The increased initial investment limits its adoption especially among SME, which is hampering the market growth. The lack of skilled labor for the operation and maintenance of advanced equipment is challenging the market.

Market Segmentation

The Spain material handling equipment market share is classified into product and application.

- The cranes & lifting equipment segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period.

The Spain material handling equipment market is segmented by product into cranes & lifting equipment, industrial trucks, continuous handling equipment, and racking & storage equipment. Among these, the cranes & lifting equipment segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the projected period. Cranes & lifting equipment are essentially used for lifting heavy materials and equipment in the construction area. The use of material-handling equipment in construction, manufacturing, and motor vehicle lifts, as well as the emergence of advanced technologies, including IoT and automation, is driving the market demand in the cranes & lifting equipment segment.

- The e-commerce segment held the largest revenue share of the material handling equipment market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain material handling equipment market is segmented by application into automotive, food & beverages, chemical, semiconductor & electronics, e-commerce, aviation, pharmaceutical, and others. Among these, the e-commerce segment held the largest revenue share of the material handling equipment market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Material handling equipment, including conveyor systems and AGVs, are increasingly used for managing online orders and fast deliveries. The growing penetration of online shopping platforms and logistic infrastructure development are propelling the market growth in the e-commerce segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain material handling equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Logisnext Europe SA

- Liebherr Industrias Metálicas SA

- Orona Holding SA

- FEM-AEM

- Bosch Rexroth

- Toyota Material Handling

- Rulmeca

- ULMA Handling Systems

- TGW Logistics Group GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Toyota Material Handling Spain started construction of its new headquarters, which would move from Barberá del Vallés to Sabadell (Barcelona) in 2024 in response to its exponential growth over recent years. The new site would improve connections to communication hubs, and the facilities have been designed to improve after-sales service and provide an innovative environment for the customer experience by showcasing its machinery and automation systems.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain material handling equipment market based on the below-mentioned segments:

Spain Material Handling Equipment Market, By Product

- Cranes & Lifting Equipment

- Industrial Trucks

- Continuous Handling Equipment

- Racking & Storage Equipment

Spain Material Handling Equipment Market, By Application

- Automotive

- Food & Beverages

- Chemical

- Semiconductor & Electronics

- E-commerce

- Aviation

- Pharmaceutical

- Others

Need help to buy this report?