Spain Pet Food Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Dogs, Cats, and Others), By Form (Dry Pet Food, Wet Pet Food, and Snacks & Treats), By Source (Animal and Plant), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Online Channel, and Others), and Spain Pet Food Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsSpain Pet Food Market Insights Forecasts to 2033

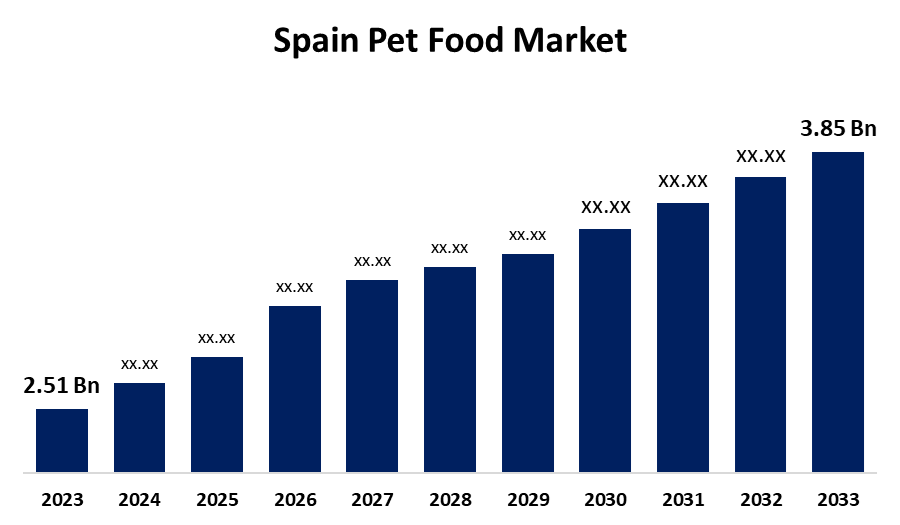

- The Spain Pet Food Market Size was valued at USD 2.51 Billion in 2023.

- The Spain Pet Food Market Size is growing at a CAGR of 4.37% from 2023 to 2033

- The Spain Pet Food Market Size is expected to reach USD 3.85 Billion by 2033

Get more details on this report -

The Spain Pet Food Market Size is anticipated to exceed USD 3.85 Billion by 2033, growing at a CAGR of 4.37% from 2023 to 2033. The growing pet ownership rate, adoption of premium and organic pet food products, and development of wide range of high-quality and safe pet food options are driving the growth of the pet food market in the Spain.

Market Overview

The pet food market refers to the production and sales of food products specifically formulated for domesticated animals, primarily dogs and cats, and includes dry food (kibble), wet food, treats, and snacks. Pet food is a specialized animal feed intended for consumption by pets. This food is typically sold in pet stores and supermarkets and available as per the type of animals like dog food or cat food. The surging trend of pet adoption along with their health concerns leads to the need for pet food with the growing concerns about their health. Further, these products ae manufactured with regards to the standard nutritional requirements of domesticated animals. The launch of innovative product ranges along with increasing pet food product development are offering market growth opportunities.

Report Coverage

This research report categorizes the market for the Spain pet food market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain pet food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain pet food market.

Spain Pet Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.51 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.37% |

| 2033 Value Projection: | USD 3.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Form, By Source and COVID-19 Impact Analysis |

| Companies covered:: | ADM, Affinity Petcare SA, Alltech, Colgate-Palmolive Company (Hill’s Pet Nutrition Inc.), Dechra Pharmaceuticals PLC, General Mills Inc., Mars Incorporated, Nestle (Purina), Schell & Kampeter Inc. (Diamond Pet Foods), Virbac, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing pet ownership rate in the country is driving the pet food market. As per the data by National Association of Pet Food Manufacturers, more households in Spain have pets than children under the age of 15. The pet population is now expected to exceed 20,45 million in 2024 in Spanish homes. The increasing awareness of pet allergies, pet obesity, concerns about pet digestive health, and availability of organic certification are propelling the adoption of premium and organic pet food products, thereby driving the pet food market growth. Further, the development of wide range of high-quality and safe pet food option propels the market. For instance, in November 2023, Spanish pet food producer Nugape Pet Food announced Dec. 7 it has received a notable quality and safety certification from International Featured Standards (IFS).

Restraining Factors

The strict regulations and price sensitivity among consumers are hampering the pet food market growth. In addition, the low recyclability of the multilayer pet food packaging is restraining the market.

Market Segmentation

The Spain pet food market share is classified into animal type, form, source, and distribution channel.

- The dogs segment dominated the market with the largest market share in 2023 and is anticipated to grow at a significant CAGR growth during the projected period.

The Spain pet food market is segmented by animal type into dogs, cats, and others. Among these, the dogs segment dominated the market with the largest market share in 2023 and is anticipated to grow at a significant CAGR growth during the projected period. It is found that dog is the most considerable pet. The launch of dog treats and nutrient-rich food along with the awareness about the animal diseases among owners is significantly driving the market.

- The dry pet food segment dominated the market with the largest market share in 2023 and is anticipated to grow at a significant CAGR growth during the forecast period.

The Spain pet food market is segmented by form into dry pet food, wet pet food, and snacks & treats. Among these, the dry pet food segment dominated the market with the largest market share in 2023 and is anticipated to grow at a significant CAGR growth during the forecast period. The animal based dry pet food are commonly used are chicken meal and poultry by-product meal which are cooked followed by fat removal and then the remaining dried material are used as dry meal.

- The animal segment dominated the Spain pet food market in 2023 and is anticipated to grow at a significant CAGR growth during the forecast period.

The Spain pet food market is segmented by source into animal and plant. Among these, the animal segment dominated the Spain pet food market in 2023 and is anticipated to grow at a significant CAGR growth during the forecast period. Animal derived pet food formulation include ingredients such as meat, fish, eggs, and dairy. The extensive use of fish meal, poultry meal, and animal meal for manufacturing cat and dog food due to strong nutrient profile and ease of availability is driving the market in the animal segment.

- The supermarket/hypermarket segment dominates the market with the largest market share and is anticipated to grow at a significant CAGR growth during the forecast period.

The Spain pet food market is segmented by distribution channel into supermarket/hypermarket, specialty stores, online channel, and others. Among these, the supermarket/hypermarket segment dominates the market with the largest market share and is anticipated to grow at a significant CAGR growth during the forecast period. Supermarket/hypermarket offer convenience and a wide range of brands and prices. The increased preference by the consumer for buying products from supermarket/ hypermarket is propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain pet food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADM

- Affinity Petcare SA

- Alltech

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- Dechra Pharmaceuticals PLC

- General Mills Inc.

- Mars Incorporated

- Nestle (Purina)

- Schell & Kampeter Inc. (Diamond Pet Foods)

- Virbac

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, To further support pets with stomach and skin sensitivities and help create a healthier and more sustainable future, Hill's Pet Nutrition, a global leader in science-led nutrition, announced its popular Science Diet Sensitive Stomach & Skin portfolio is now available with MSC-certified Alaskan Pollock and insect protein.

- In March 2023, Mars Petcare is debuting into the supplements category with the launch of a trio of new Pedigree multivitamins.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain pet food market based on the below-mentioned segments:

Spain Pet Food Market, By Animal Type

- Dogs

- Cats

- Others

Spain Pet Food Market, By Form

- Dry Pet Food

- Wet Pet Food

- Snacks & Treats

Spain Pet Food Market, By Source

- Animal

- Plant

Spain Pet Food Market, By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Online Channel

- Others

Need help to buy this report?