Spain Polyamide Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyamide 6, Polyamide 66, Bio-Based Polyamide, and Specialty Polyamides), By Application (Engineering Plastics and Fibers), and Spain Polyamide Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsSpain Polyamide Market Insights Forecasts to 2033

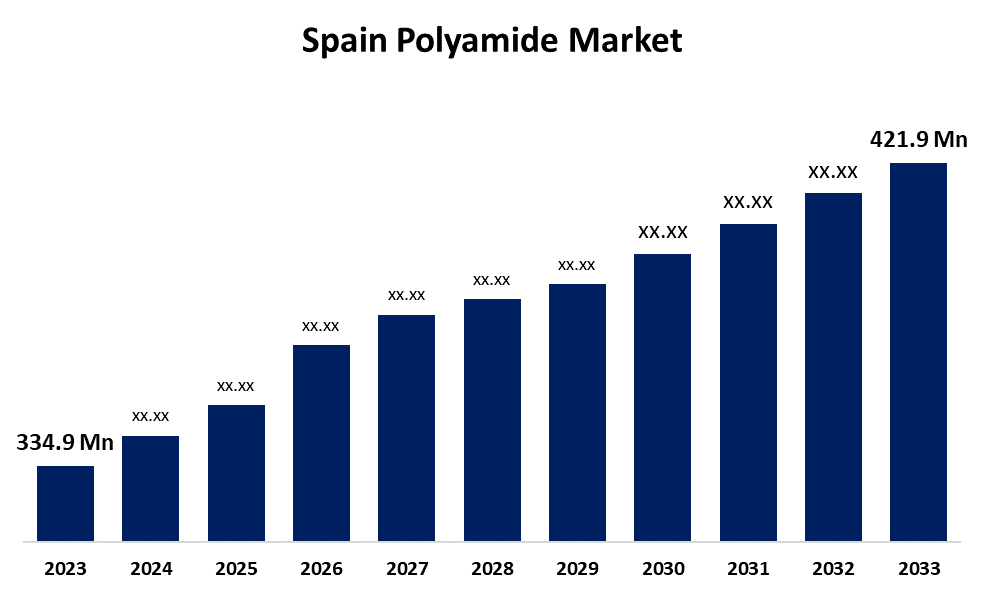

- The Spain Polyamide Market Size was valued at USD 334.9 Million in 2023.

- The Market Size is Growing at a CAGR of 2.34% from 2023 to 2033

- The Spain Polyamide Market Size is Expected to Reach USD 421.9 Million by 2033

Get more details on this report -

The Spain Polyamide Market Size is Anticipated to Reach USD 421.9 Million by 2033, Growing at a CAGR of 2.34% from 2023 to 2033

Market Overview

Polyamide is a type of polymer consisting of repeated units linked together by amide bonds. Polyamides can occur naturally, such as in proteins like wool and silk, or they can be produced artificially, as in nylons, aramids, and sodium polyaspartate. A polyamide is created by forming an amide function to link two monomer molecules together. Additionally, In 2022 Spain exported $514 million worth of polyamides, making it the 12th largest exporter of polyamides in the world. During the same year, polyamides were the 174th most exported product in Spain. The main destinations for Spain's polyamide exports were Germany ($107 million), Poland ($57.5 million), France ($46.4 million), Italy ($44 million), and Brazil ($28.6 million). Furthermore, advancements in material technology, including bio-based and recyclable polyamides, are driving market expansion. Stringent regulations promoting sustainability are also driving market expansion. Polyamides are used in various applications, including industrial valves, automotive components, electrical and electronic devices, packaging films, textiles, and consumer products.

Report Coverage

This research report categorizes the market for the Spain polyamide based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain polyamide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain polyamide market.

Spain Polyamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 334.9 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.34% |

| 2033 Value Projection: | USD 421.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 162 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Goodfellow Inc,AdvanSix Inc,Domo Chemicals,Ashley Services Group Ltd DR,Lanxess AG,Ascend Performance Materials,Ube Corp,Toyobo Co Ltd and ,Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The automotive, electronics, consumer goods, and packaging industries have a growing demand for polyamides in Spain. The automotive industry requires lightweight materials to improve fuel efficiency and reduce emissions. The electronics industry needs heat-resistant materials for circuit boards and connectors. There is an increasing preference for sustainable and recyclable packaging solutions. Bio-based polyamides are gaining traction due to environmental concerns. Polyamides are being integrated into 3D printing applications. Polyamide composites are being explored for enhanced structural properties.

Restraining Factors

The Spain polyamide market is affected by several factors that limit its growth. For example, the prices of primary raw materials such as adipic acid and hexamethylenediamine are petroleum-based, which makes them susceptible to fluctuations in oil and gas prices. These fluctuations can have an impact on production costs, profitability, and pricing strategies for manufacturers.

Market Segmentation

The Spain polyamide market share is classified into product and application.

- The polyamide 6 segment is expected to hold the largest market share through the forecast period.

The Spain polyamide market is segmented by product into polyamide 6, polyamide 66, bio-based polyamide, and specialty polyamides. Among these, the polyamide 6 segment is expected to hold the largest market share through the forecast period. The use of polyamide 6 in various applications over the past few years has proven its reliability, utility, and cost-effectiveness based on its performance and cost. The product's excellent surface finish, even under reinforced conditions, makes it suitable for applications where aesthetics are important.

- The engineering plastics segment is expected to dominate the Spain polyamide market during the forecast period.

Based on the application, the Spain polyamide market is divided into engineering plastics and fibers. Among these, the engineering plastics segment is expected to dominate the Spain polyamide market during the forecast period. The engineering plastics segment includes automotive, electrical, and electronics, consumer goods and appliances, packaging, and others. The automotive segment is the leading segment. Polyamide is used to manufacture hydraulic clutch lines, headlamp bezels, automotive cooling systems, air intake manifolds, and airbag containers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain polyamide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Goodfellow Inc

- AdvanSix Inc

- Domo Chemicals

- Ashley Services Group Ltd DR

- Lanxess AG

- Ascend Performance Materials

- Ube Corp

- Toyobo Co Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, BASF and Inditex jointly announced a breakthrough in their efforts to boost recyclability in the textile industry. With the launch of loopamid, a polyamide 6 (PA6, also known as nylon 6) made from 100 percent textile waste, BASF provides the first circular solution for nylon apparel made entirely from textile waste.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Polyamide Market based on the below-mentioned segments:

Spain Polyamide Market, By Product

- Polyamide 6

- Polyamide 66

- Bio-based Polyamide

- Specialty Polyamides

Spain Polyamide Market, By Application

- Engineering Plastics

- Fibers

Need help to buy this report?